Americans — particularly millennials — are alarmingly late on car payments

A record seven million Americans are more than 90 days late on their auto loan payments, and millennials are clearly leading delinquency rates, according to a report by the New York Fed.

The NY Fed found that the number of new auto loans and leases appearing on credit reports in 2018 reached a new peak — the highest level in the 19 years they have monitored the data — at $584 billion.

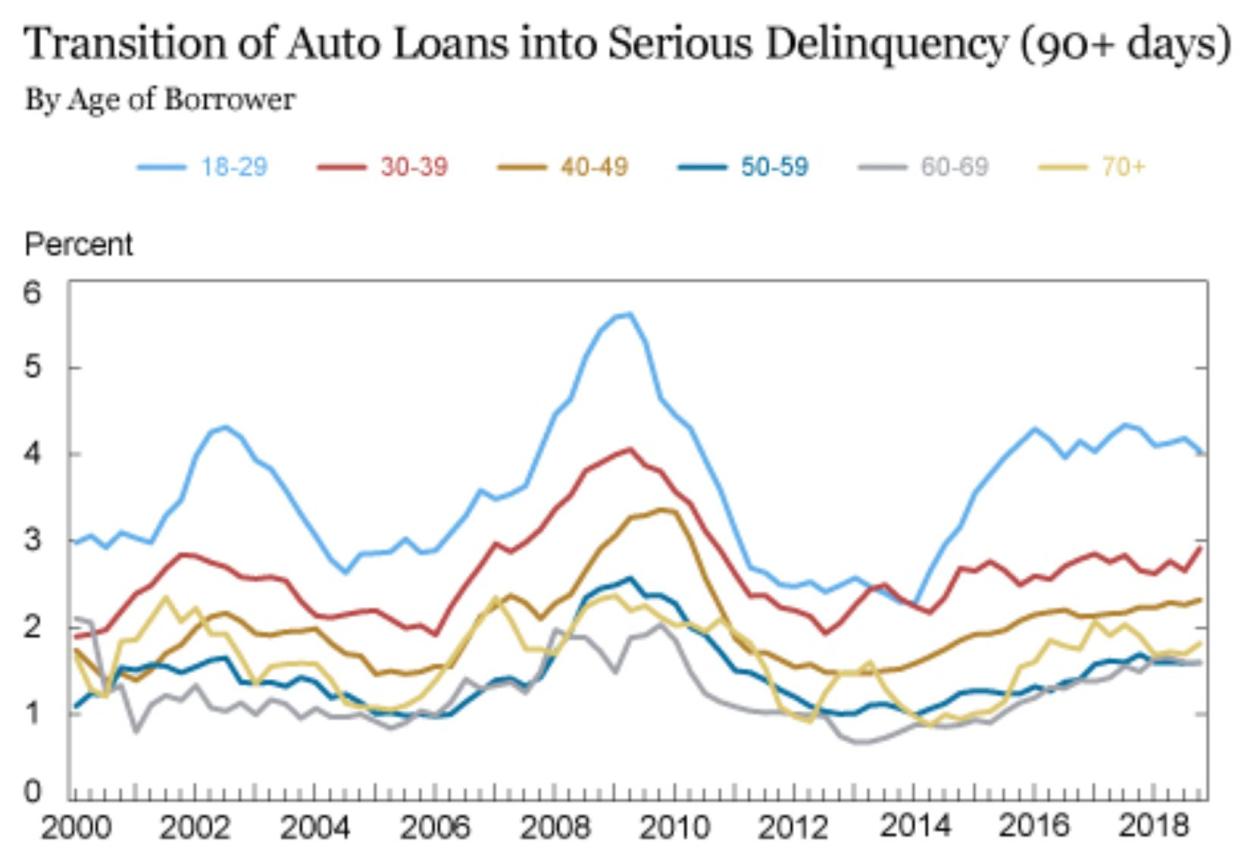

Looking at the number of auto loans in serious delinquency, the researchers noted that there was a “sharp worsening in the performance of the loans held by borrowers under 30 years old between 2014 and 2016.”

And as seen in the graph below, borrowers between the ages of 18 and 39 — Pew Research identifies millennials as anyone born between 1981 and 1996 (ages 23 to 38 in 2019) — have the worst delinquency rates as compared to other demographics.

The researchers said that overall, the end of 2018 saw “more than a million more troubled borrowers than there had been at the end of 2010,” when the overall delinquency rates were at their worst on record. Auto loans have also surged by almost 35 percent since the Great Recession according to additional data.

“The substantial and growing number of distressed borrowers suggests that not all Americans have benefitted from the strong labor market and warrants continued monitoring and analysis of this sector,” the report concluded.

Delinquencies concentrated in the southeast

A Yahoo Finance analysis of the NY Fed data revealed that many of the higher delinquency rates are concentrated in the southeast, with states like Alabama, Georgia and Mississippi looking at the highest levels.

Vicious cycle of low credit ratings

Millennials with poor credit may be a key contributor to the trend.

“The strongest correlation is credit rating,” Bankrate.com’s chief financial analyst Greg McBride told Yahoo Finance. “Those with poor credit ratings have much higher delinquencies. It’s much more a function of credit rating than age.”

McBride explained that younger people don’t have a long and established credit history, which results in them being classified as non-prime borrowers in addition to depriving them of access to financing options from credit unions or banks.

“Borrowers with credit scores less than 620 saw their transitions into delinquency exceed 8 percent in the fourth quarter,” the NY Fed report stated, “a development that is surprising during a strong economy and labor market.”

McBride downplayed the idea that millennials’ student loan debt burden created the need to delay payments to reallocate funds: “If you run into financial difficulty, you have more flexibility on that than any other form of payment… with car payments in particular, you have absolutely no wiggle room.”

He pointed out that while auto loan delinquencies alone didn’t warrant alarm, the situation was still worrying when looking at overall household debt — which includes mortgages, credit cards and auto loans. (Auto debt makes up about 9.4% of the total household debt, according to the NY Fed.)

Auto loans ‘not a smoking gun’

Other economists strongly rejected the idea that the rapidly increasing number of delinquencies represented a threat to the economy.

“Auto delinquencies have never been the smoking gun that flashes warning signs that the economy is stretched to its limits and in danger of crashing,” MUFG’s chief economist Chris Rupkey told Yahoo Finance. “It is a false comparison to say subprime auto loans are similar to subprime, no-doc home loans made over a decade ago that brought about the deepest downturn in the economy since the Great Depression.”

He added that unlike homes, “cars can be resold with less of a haircut and less of a financial loss.”

However, the effects could be cumulative. Heritage Capital president Paul Schatz told Yahoo Finance that overall, the loan delinquencies are just “one nail in the coffin for the expansion but nowhere near the final nail.”

Schatz added that the current situation does not resemble the 2008 crisis because “today, the consumer has a much better balance sheet and is not committing mistakes as egregiously as they did from 2003 to 2007.”

Nevertheless, the combination of other areas of the economy weakening — alongside auto loan delinquencies — could create enough momentum such that “an exogenous event will tip us into recession after the landscape has been properly fertilized for it.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

The 35-day government shutdown created long-term affordable housing concerns

Judge denies Equifax's request to dismiss class action lawsuit

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.