Amazon will pay $0 in taxes on $11,200,000,000 in profit for 2018

While some people have received some surprise tax bills when filing their returns, corporations continue to avoid paying tax — thanks to a cocktail of tax credits, loopholes, and exemptions.

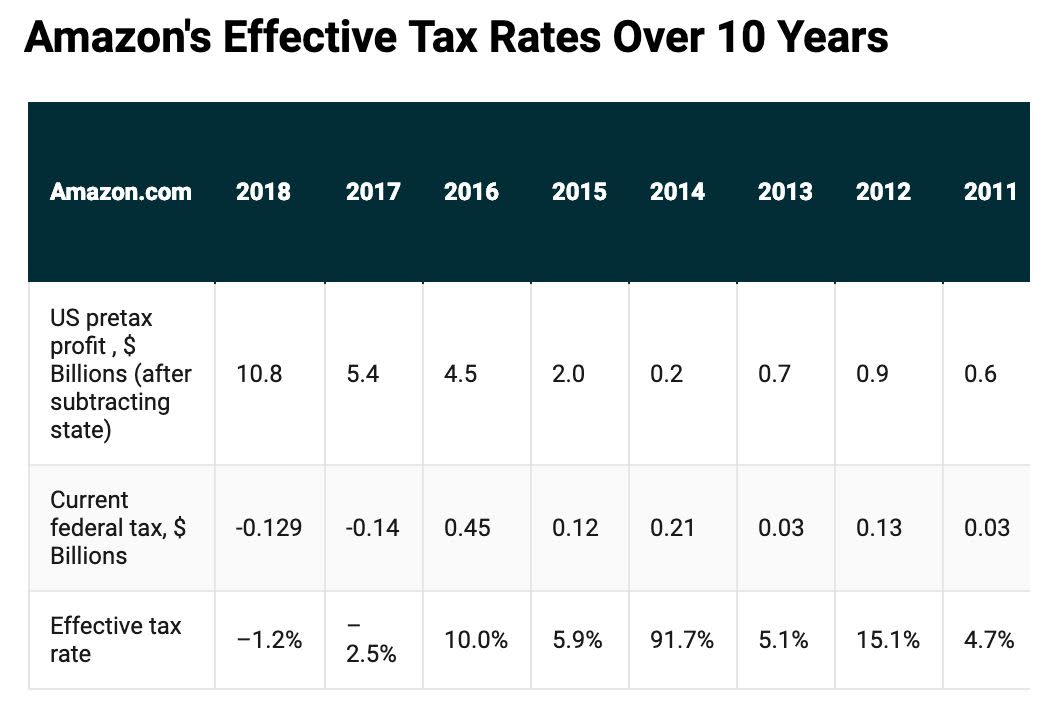

According to a report from the Institute on Taxation and Economic Policy (ITEP), Amazon (AMZN) will pay nothing in federal income taxes for the second year in a row.

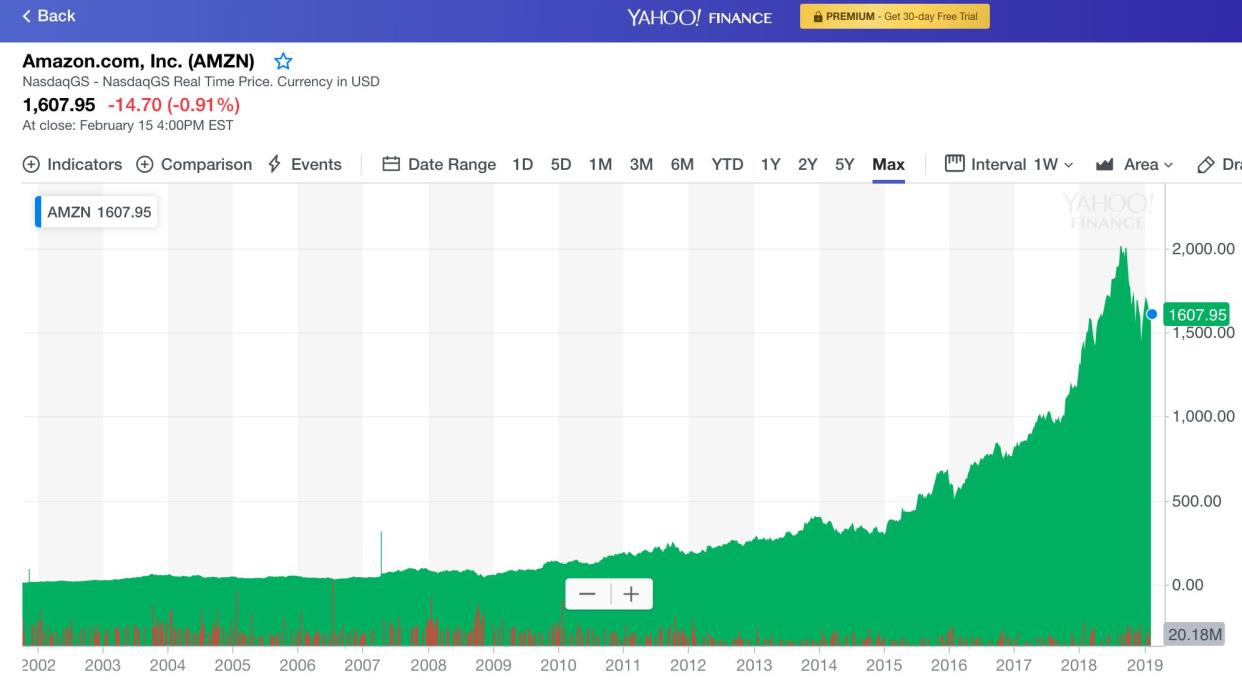

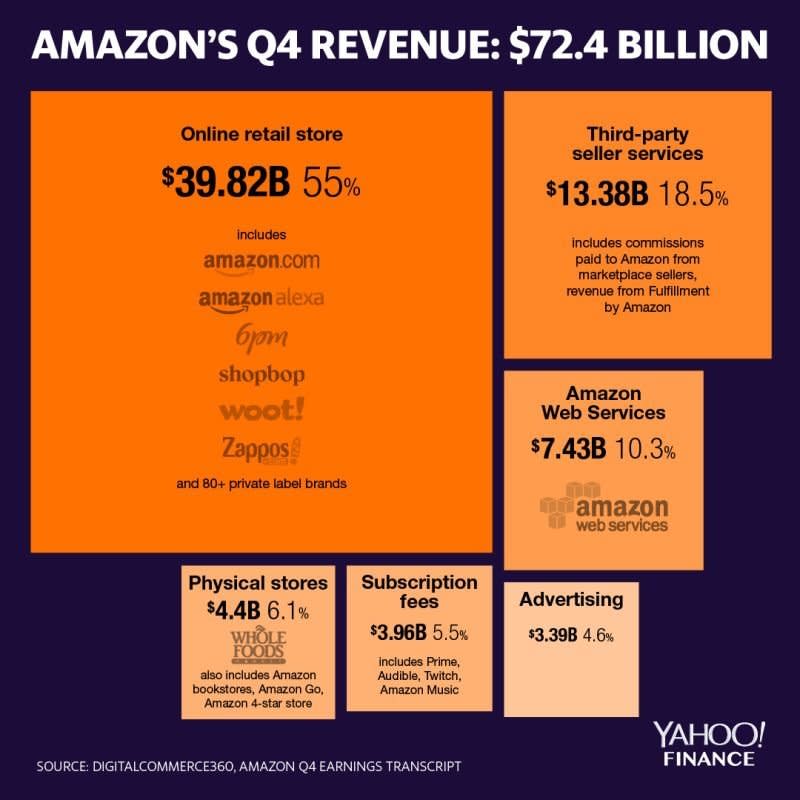

Thanks to the new Tax Cuts and Jobs Act (TCJA), Amazon’s federal tax responsibility is 21% (down from 35% in previous years). But with the help of tax breaks, according to corporate filings, Amazon won’t be paying a dime to Uncle Sam despite posting more than $11.2 billion in profits in 2018.

How is that possible?

“It’s hard to know exactly what they’re doing,” said Steve Wamhoff, ITEP’s Director of Federal Tax Policy. “In their public documents they don’t lay out their tax strategy. So it’s unclear exactly which breaks [the company is taking advantage of]. They vaguely say tax credits. One could think of many different ways a corporation could do this, like the depreciation breaks which were expanded under TCJA.”

‘It’s hard to tell’

Though Amazon might have taken advantage of new breaks and loopholes available under TCJA, this isn’t the first year that Amazon has avoided paying federal tax. The company reported $5.6 billion in U.S. profits in 2017 and paid $0 last year as well.

"Amazon pays all the taxes we are required to pay in the U.S. and every country where we operate, including paying $2.6 billion in corporate tax and reporting $3.4 billion in tax expense over the last three years," an Amazon spokesperson said in a statement.

According to Wamhoff, the company’s apparently nonexistent tax bill highlights that there have always been issues with corporate tax liability.

“The thing we would need to know is would they have had positive corporate income tax liability were it not for TCJA?” Wamhoff asked. “Maybe. It’s hard to tell.”

Revelations about Amazon’s tax liability come despite President Trump’s very public criticisms of Amazon and Bezos for not paying enough tax. The president had promised his new tax law would end special interest breaks and close loopholes, but it’s clear that isn’t the case, says Wamhoff.

“This is another situation where the rhetoric from President Trump is completely divorced from what he does and what his policies do,” explained Wamhoff. “The part about cutting corporate tax rate was true. And they eliminated some corporate tax rates but not all.”

He added: “The corporate tax revenue was a big loser. We aren’t going to see corporations suddenly paying more. We see that in the case of Amazon.”

Declining tax revenue has only widened deficits, as national debt has ballooned up and over $22 trillion.

Amazon not alone

TCJA had been criticized in large part due to the benefits it provided the wealthiest Americans and big corporations. Wamhoff says it’s ironic that the corporate tax rate was slashed to 21% (from its previous 35%) because the effective corporate tax rate under previous tax law was 21%, after accounting for tax breaks and loopholes.

Therefore, Wamhoff says, we’ll likely see the effective tax rate fall even lower.

But if anyone thinks that Amazon is alone, they would be wrong. Last week, Netflix also did not pay American federal or state income taxes according to a separate ITEP report, despite posting record profits. Netflix has disputed those findings, while ITEP claims that the $131 million paid by Netflix is taxes on foreign income.

And historically Wamhoff says, this story is nothing new. Several corporations have avoided paying federal income tax throughout the years, he says.

“These companies have been consistently profitable,” he explained. “And they should really be paying taxes.”

READ MORE:

Source: Institute on Taxation and Economic Policy analysis of SEC filings

Amazon abandoning NYC headquarters is a cautionary tale for big tech

Amazon bailing won't reverse Long Island City's soaring rents

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.