Billionaires who hate Alexandria Ocasio-Cortez's 70% tax on the super-rich are adamant it will hurt the economy — but history suggests otherwise

Rep. Alexandria Ocasio-Cortez of New York has touted a plan that would tax Americans earning more than $10 million at a marginal rate of roughly 70%.

The proposal was immediately met with consternation from the billionaire class, which argued that it would hurt the economy overall.

However, historical evidence shows the US economy has been strong during past periods when the ultra-wealthy marginal tax rate was at or above 70%.

Peter Diamond — Nobel laureate in economics and one of the world's most respected public-finance experts — crunched the numbers and found that the optimal tax rate for top earners is 73%.

When New York Rep. Alexandria Ocasio-Cortez first unveiled a plan to hike taxes for the super-wealthy, the outrage was harsh and swift.

The proposal — which calls for the marginal tax rate on income above $10 million to be significantly increased to 70% — faced immediate opposition from high-ranking GOP officials. Other pundits took to social media and went to extreme means to discredit her proposition.

Meanwhile, at Davos — an annual gathering for the world's wealthiest and most powerful elite — the backlash came in droves. Business Insider spoke to three industry-leading finance professionals who all balked at the idea of a 70% marginal tax and expressed concern over a negative economic impact.

But underlying all of that fervor was one undeniable truth: The US has taxed the ultra-wealthy to a similarly high degree throughout history, and the economy has hung in there just fine.

In fact, it's thrived.

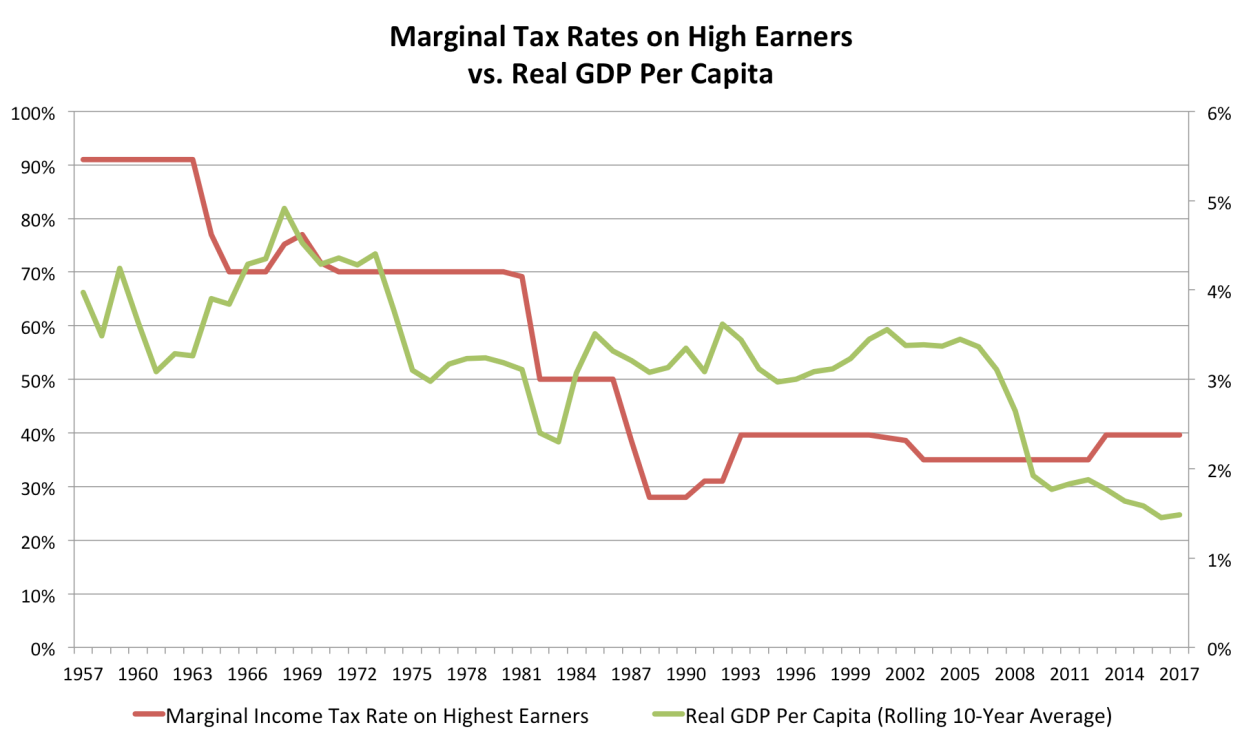

The chart below shows this dynamic in action. There are several key observations to be gleaned:

The US economic growth rate has hovered near record lows over the past decade, even though ultra-rich tax rates have also been historically low.

From 1957 through the 1970s, the tax rate was at 70% or above. Yet the economy was markedly stronger during that period than it is now.

In fact, the 35 years following World War II were the most economically prosperous in US history — and the tax rate was at or above the 70% region proposed by Ocasio-Cortez.

Business Insider / Joe Ciolli, data from Tax Policy Center / BEA

Not convinced yet? Perhaps findings from Peter Diamond — Nobel laureate in economics and one of the world's most respected public-finance experts — will do the trick.

Along with inequality expert Emmanuel Sez, he co-authored an academic study in 2011 entitled "The Case for a Progressive Tax: From Basic Research to Policy Recommendations." And while the findings were quite complex, one number stuck out: 73% — the figure they arrived at when calculating the optimal tax rate for top earners.

That's right in line with Ocasio-Cortez's proposal.

If you haven't yet had your fill of expert commentary from the genius class, consider the fact that Nobel Prize-winning economist Paul Krugman penned an op-ed for the New York Times on this very subject, citing many of the same arguments.

There remains staunch opposition to the tax hike

Despite the Nobel-level credentials possessed by the aforementioned experts, there are still serious questions around what the ideal tax rate is for Americans who make more than $10 million a year. While Diamond's 2011 report has long stood as the benchmark, new research has come out to challenge its findings.

Perhaps the most notable example of this is a 2018 study conducted by Prof. Alejandro Badel of Georgetown University and his two colleagues, Mark Huggett and Wenlan Luo. They ran what they describe as a "quantitative human capital model" and arrived at 49% as the optimal top tax rate.

There's also the matter of what the world's high-earning financial elite thinks about the Ocasio-Cortez's proposal. Sure, they're more inclined to care about this since it directly affects them, but they also make some compelling arguments around how detrimental the economic impact could be.

Moelis & Co. founder and CEO Ken Moelis is a good example. Business Insider spoke to him at Davos last month, and he didn't mince words.

"If you impose a 70% tax rate on that type of wage earner, you're going to crush the economy," Moelis said.

Scott Minerd, the chief investment officer at $265 billion Guggenheim Partners, adopted a similarly skeptical tone. In his Davos interview, he harped specifically on the impact higher taxes will have on productivity.

"The frightening thing about high marginal tax rates is that it leads us into a low productivity economy," he said. "And we have a lot of headwinds already in this country."

He continued: "For instance, the growth in the working age population is declining dramatically. If you layer on top of that high marginal tax rates, you could actually build an economy that has zero growth potential."

Meanwhile, Bob Prince, the billionaire co-CIO at Bridgewater Associates — the world's biggest hedge fund — is less concerned about the damage an ultra-wealthy tax increase will have. His view is more agnostic and centered around the idea that a tax hike won't be enough to spur any change.

"I don't think it would solve any problems," he told Business Insider at Davos. "The reason this is emerging as a topic is because of populism, income inequality. And they're really rooted in much deeper issues that a 70% tax rate is not going to address."

In the end, if this recap of the various arguments surrounding Ocasio-Cortez's proposed tax is any indication, it's clear the road to reform will be arduous. There are smart, analysis-driven arguments on either side, which makes the situation that much more unpredictable.

The only certainty is that will be a hot-button topic for months, even years, to come. And as a citizen, the best you can do is be fully informed.

See Also: