American voters increasingly want to tax the rich more

American voters seem relatively united when it comes to taxing ultra-wealthy citizens.

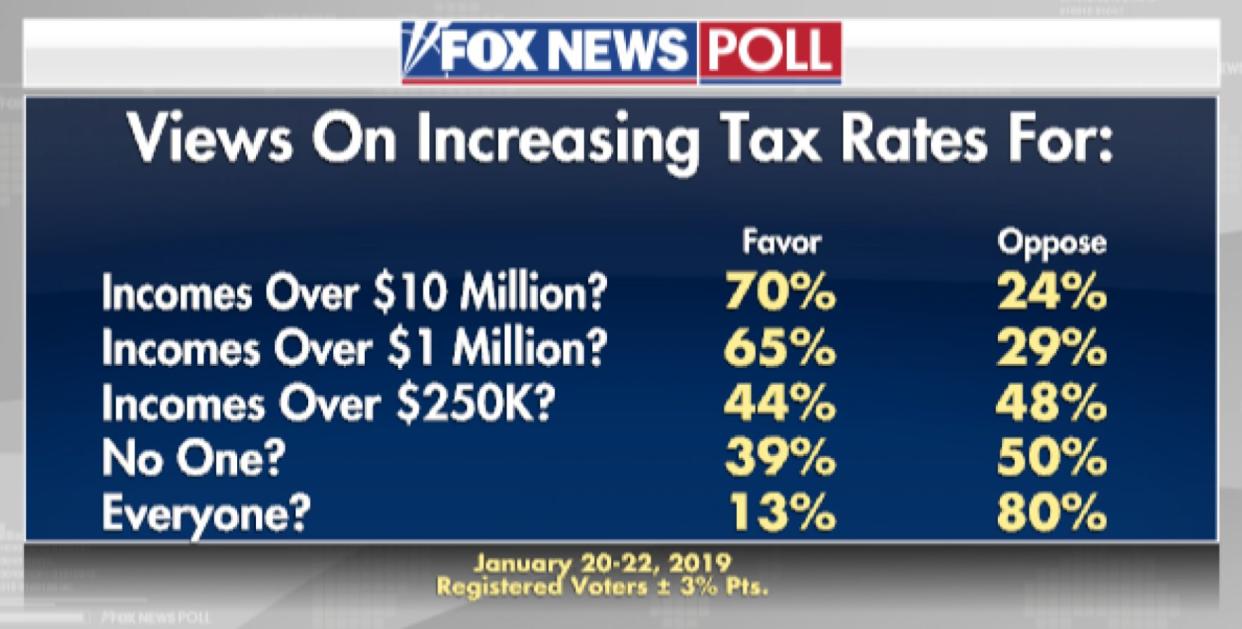

A new poll by Politico and Morning Consult, involving 1,993 people from Feb. 1-2, found that 76% of registered voters surveyed think wealthy Americans should pay more taxes. This comes after a recent Fox News survey of 1,008 registered voters found that 70% of Americans — including 54% of Republicans — are in support of raising taxes on those who earn more than $10 million.

"There is a deep wellspring in terms of perception of unfairness in the economy that’s been tapped into here that either didn’t exist five years ago or existed and had not had a chance to be expressed," Michael Cembalest, chairman of market and investment strategy at JPMorgan Asset Management, told Politico. "This is quite a moment in American economic history where all of a sudden in a matter of months this thing has kind of exploded like this."

Some Democrats call for taxing the rich more

Liberal Democrats and presidential hopefuls recently proposed major tax overhauls that involve high taxes on the wealthy.

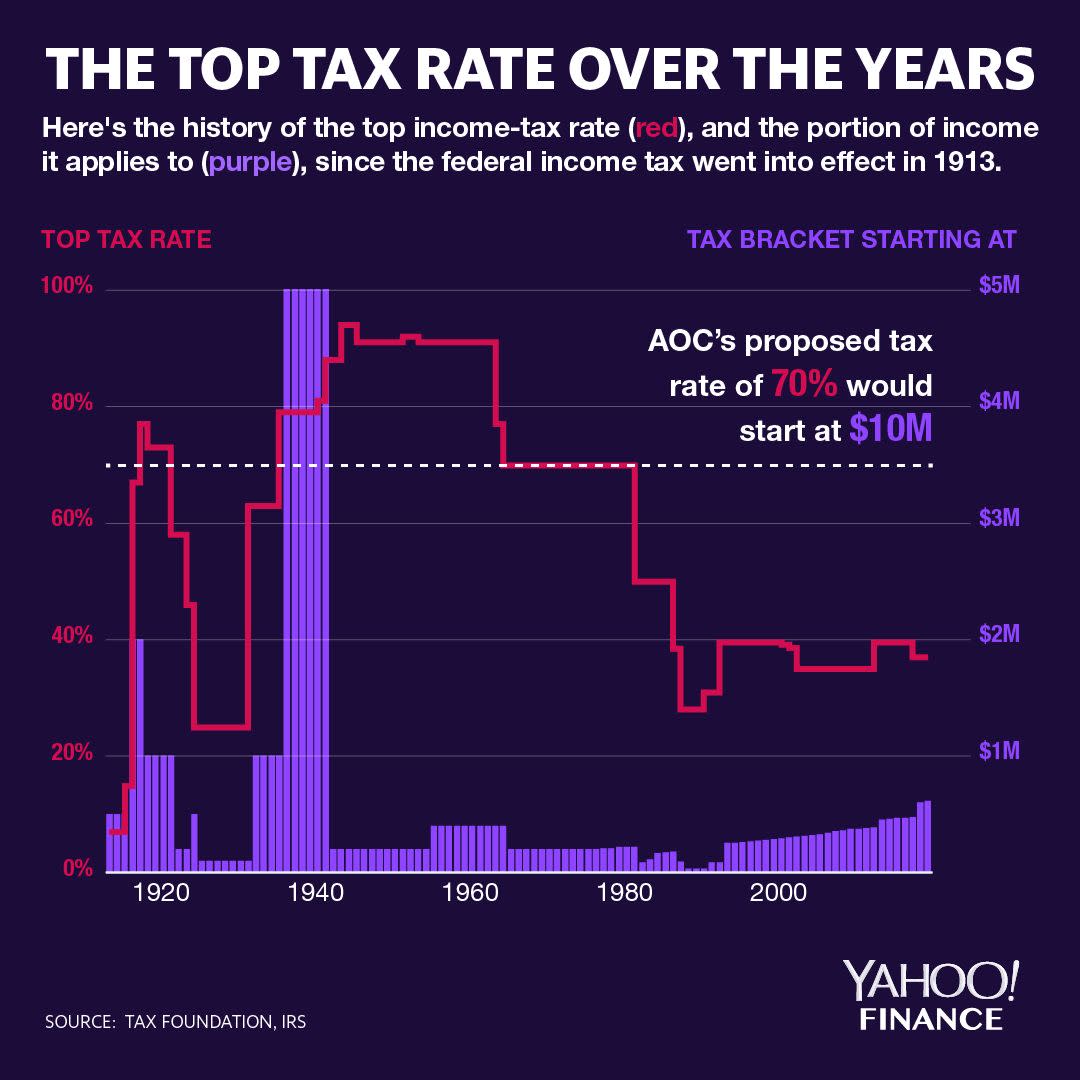

Congresswoman Alexandria Ocasio-Cortez (D-NY) proposed a 70% tax on those who earn more than $10 million. The idea received support from 59% of respondents in a Hill/HarrisX survey (in addition to the Fox News poll). In the new Politico survey, 45% of respondents favored the plan while 32% were against it.

Yahoo Finance’s Rick Newman recently argued why it is unlikely that there will be a 70% tax rate in the near future for two reasons — trust in the government has plunged and the government is bigger than it used to be.

Democratic presidential candidate Elizabeth Warren (D-Mass) has proposed a 2% wealth tax on individuals with a net worth over $50 million and 3% tax on those over $1 billion. In the Politico poll, 61% of respondents supported it while 20% opposed.

Newman noted the obstacles that Warren will face if she tries to pass her tax proposal include the 16th Amendment, which exempts income taxes from the apportion requirement but makes no mention of a wealth tax.

Warren told Politico that she was not surprised that there was large support for tax plans like hers, adding that "Washington has been working so long for the billionaire class that people around here cannot imagine crossing them.”

Research by Yahoo Finance and others previously indicated that many Americans feel Trump-era tax cuts disproportionately benefited corporations and the wealthy. And a recent survey of 106 National Association for Business Economics members found that 84% of respondents said that “the 2017 Tax Cuts and Jobs Act has not caused their firms to change hiring or investment plans.”

Sen. Bernie Sanders (I-VT), a likely Democratic candidate in the 2020 election, “unveiled a proposal that would expand the federal estate tax on the wealthiest 0.2% of Americans, imposing a top rate of 77% on estates worth more than $1 billion,” CNN reported.

‘It’s time for our government to get serious‘

Not everyone agrees with raising taxes on the rich. Larry Kudlow, a top economic adviser for the Trump White House, recently told Fox Business that taxing the rich “never works” and that it blunts innovation.

On the other hand, billionaire and legendary investor Warren Buffett believes that higher taxes would actually help create more people like himself.

“I was lucky enough to be born into a time and place where society values my talent, and gave me a good education to develop that talent, and set up the laws and the financial system to let me do what I love doing—and make a lot of money doing it,” Buffett said according to “The Audacity of Hope” by Barack Obama. “The least I can do is help pay for all that.”

Buffett expressed the same sentiment more bluntly in a 2011 op-ed in the New York Times, writing: “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.