Experts dismiss talk of a 'housing collapse'

The entire housing space — from homebuilders, to mortgage lenders, to economic data — has fallen under significant pressure over the last year as rising interest rates have posed a major headwind.

While it's worth noting a slowdown in a crucial part of the market and the economy, some strategists and economists say concerns are overblown.

Economists at Bank of America Merrill Lynch recently told clients that while demand has slowed down, a full-on housing collapse is nowhere to be seen.

There's no doubt that housing in the US has come under significant pressure over the past year. A lethal combination of rising interest rates and home prices — at a late phase in the economic cycle — has given way to weak mortgage-lending, climbing inventory, and a bear market in housing stocks.

Still, a handful of market strategists and economists taking the sector's pulse are throwing cold water on fears of a severe downturn.

"Don't believe the narratives of a housing collapse," Bank of America Merrill Lynch economists led by Michelle Meyer told clients last week. "The sector is challenged but should only be a slight drag on growth.

"In the very near term, we think we could see a brief period of stronger housing data. The decline in mortgage rates is very well timed ahead of the spring selling season. We suspect that potential homebuyers who may have been scared from the market during the period of rising rates in the fall could see it as an opportunity to jump back in."

Slowing demand has been the main driver of excess inventory in new homes, Meyer wrote. She pointed specifically to the monthly supply of houses in the United States — a gauge of how many months it would take to clear inventory given the current pace of sales — rising above the historical average.

RELATED: Strangest Real Estate Finds

The culprit behind Americans' waning appetite for new home-buying?

"The rapid run-up in rates last year was likely the catalyst, causing a major shock to affordability."

Still, Bank of America contends the data is "quite volatile and we can't be sure that the recent move up is a start of a new trend." The firm also asserted its confidence in healthy levels of employment and wage growth ticking higher.

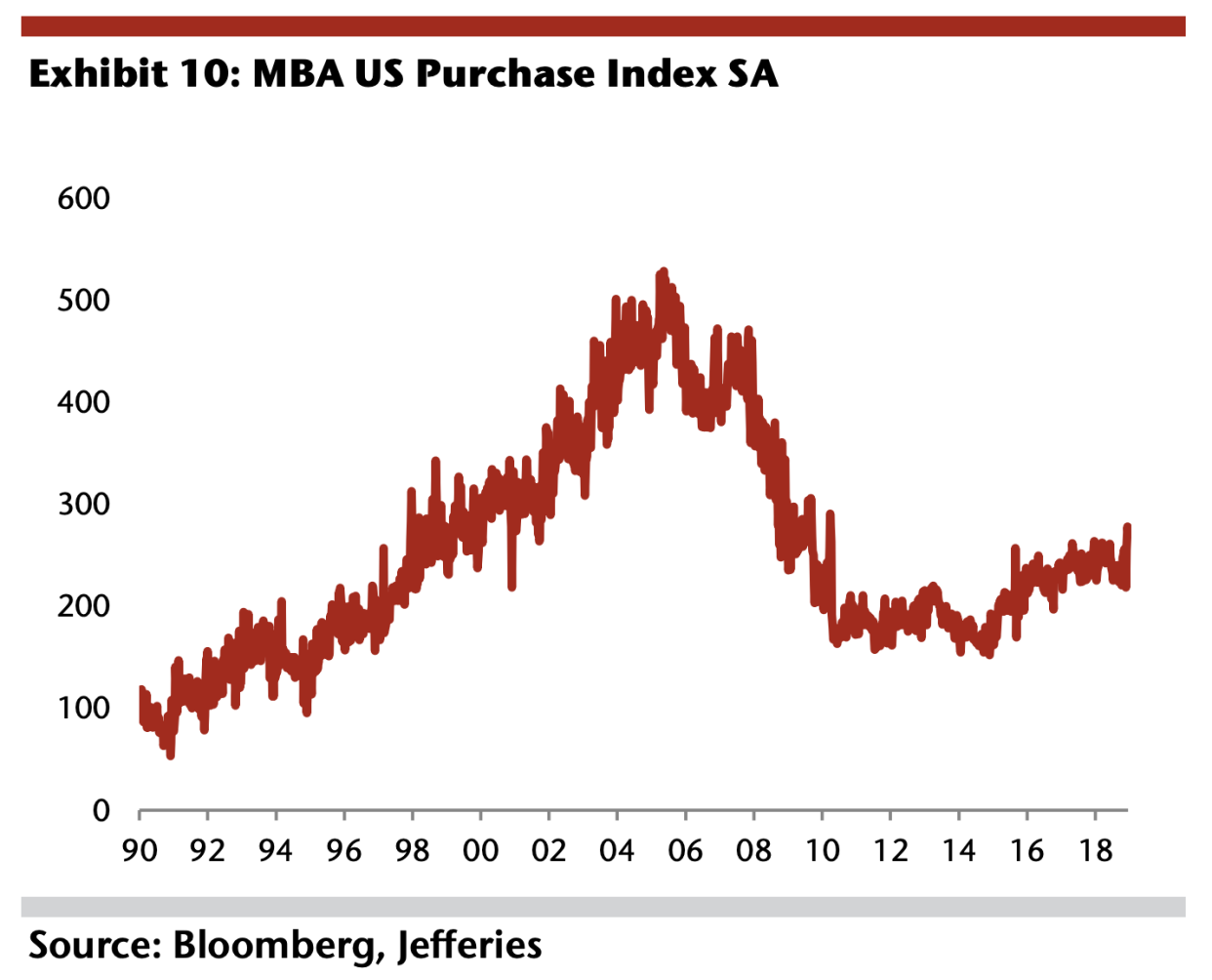

Fears over housing affordability have proved "unfounded," Jefferies equity strategists led by Sean Darby told clients in a note out Monday. They said before investors dismiss the sector, they ought to consider the latest Mortgage Bankers Association purchase index data, which "hints at a rebound in sales."

Jefferies

"At a time when the markets are fretting over global growth and trade, the domestic homebuilders appear to be in a much better position than investors have priced in," the Jefferies team added.

The chart of a popular home construction stock-tracking exchange-traded fund paints a dismal picture, but seems to be improving, said Matt Maley, equity strategist at Miller Tabak. Indeed, the ITB has plunged 27% below its 52-week high, placing the group in a technical bear market.

"The news we're seeing on this group is not overly comforting, but there is no question that mortgage rates have stabilized at a level that is well below last year's highs... and this seems to be helping the group bounce back," Maley wrote in a weekend note to clients.

"No, the fundamental back-drop for housing is not particularly good, but the group rolled over before the data on housing turned down last year. Thus if (repeat, IF) the ITB can rally further over the coming days and weeks, it just might be telling us that the industry is not going to decline to the degree that some of the housing bears think it will (especially if mortgage rates hold steady)."

Some housing industry executives have sounded the alarm on a slowdown in the industry — but insist growth has not come to a screeching halt.

Earlier this month, US homebuilder Lennar reported lower-than-expected quarterly home sales and orders, compounding fears of weakness in the market. Still, Stuart Miller, the company's executive chairman, attempted to assuage investors' concerns.

"With recent pressure on both volume and margin, many have become concerned that the housing market has completely stalled," Miller said on the quarterly earnings conference call. "We still do not agree. As rates have started to ease, we have seen traffic pickup. Therefore, we continue to believe the market has taken a natural pause. It will adjust and recalibrate and demand, driven by fundamental economic strength, will resume."

Now read:

NOW WATCH: 7 science-backed ways to a happier and healthier 2019 that you can do the first week of the new year

See Also: