Here's how the new US tax brackets for 2019 affect every American taxpayer

Shayanne Gal/Business Insider

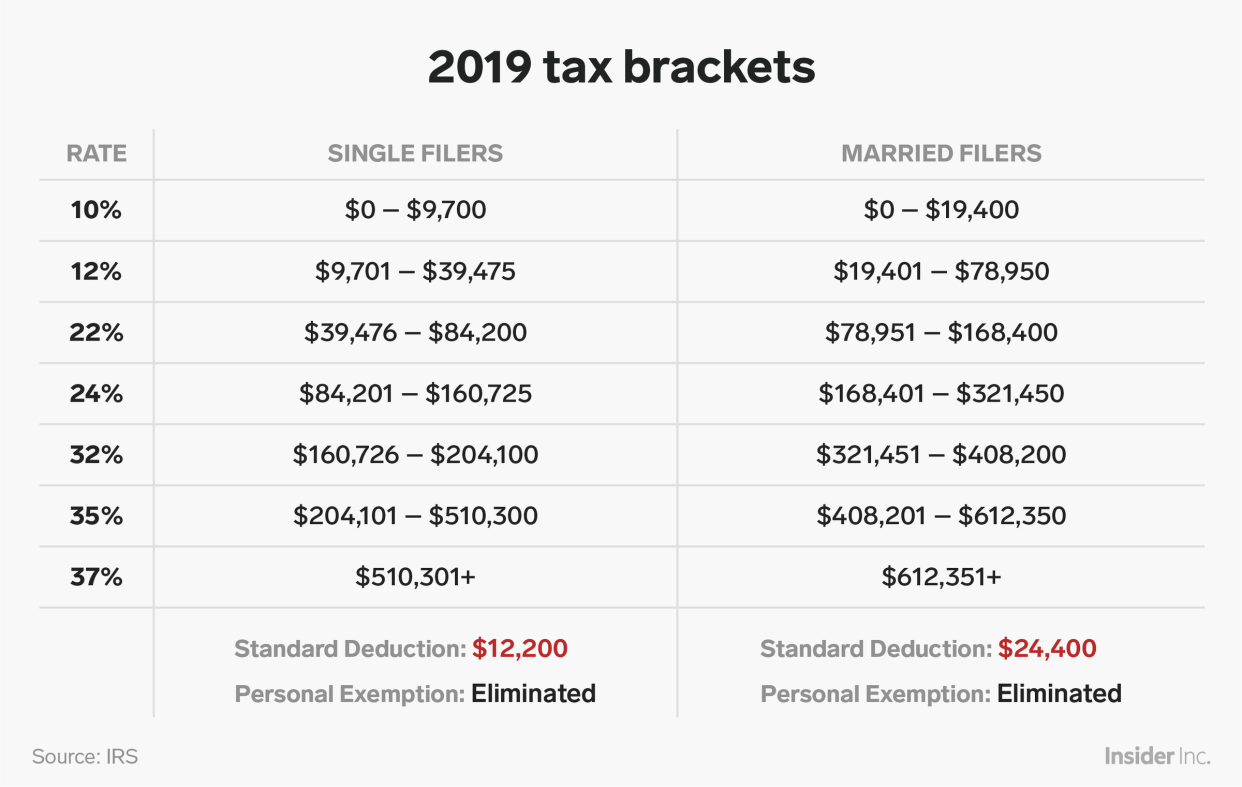

The IRS has taken inflation into account and released new tax brackets for 2019, which will apply to income earned this year.

Tax Day 2019 — when taxes are due for income earned in 2018 — is Monday, April 15.

The federal income tax ranges have shifted slightly and the standard deduction is now $12,200 for single filers and $24,400 for married filers.

Tax Day 2019 is April 15. That means taxes are due for income earned in 2018, the first tax season under the 2017 GOP tax law.

The IRS has updated the seven federal income tax brackets for 2019 to reflect inflation, which went into effect on January 1. Any income earned in 2019 is subject to the new tax brackets.

The standard deduction is now $12,200 for single filers and $24,400 for married filers, up $200 and $400, respectively.

Here's how the brackets have changed for the new year compared to 2018.

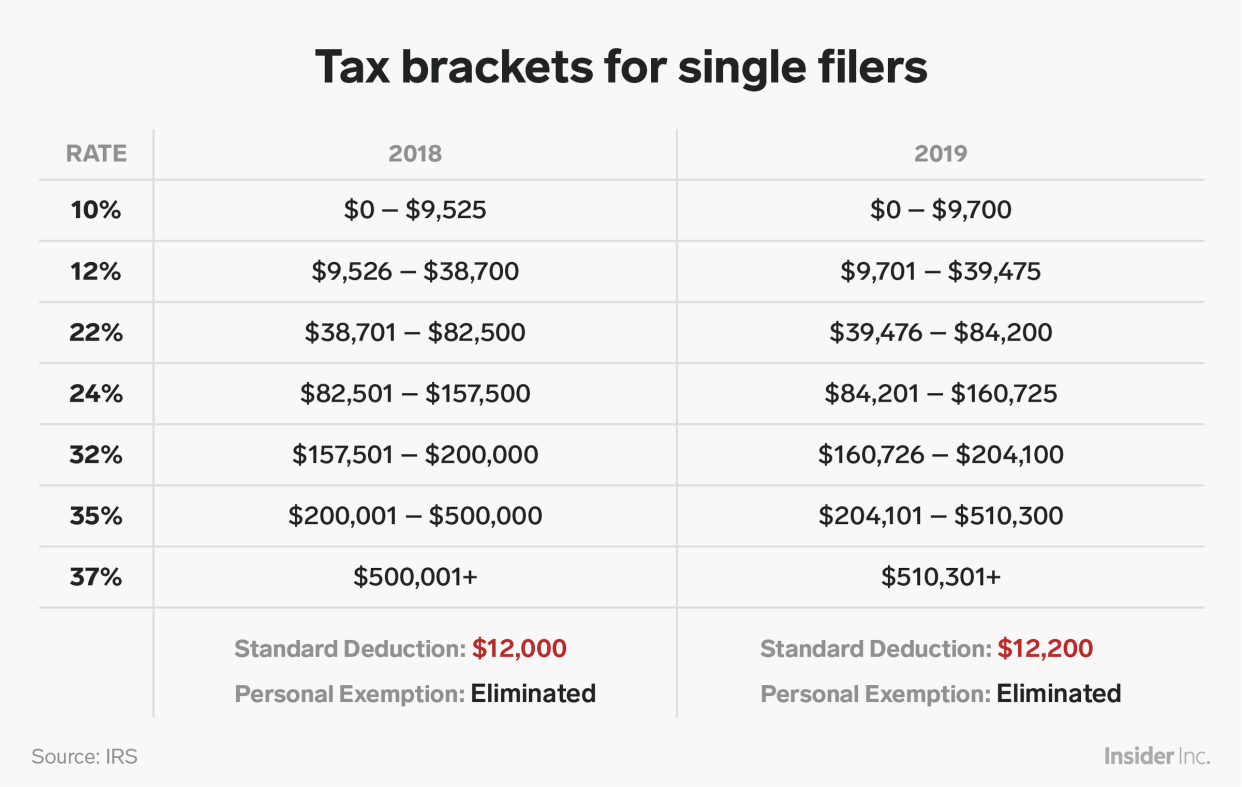

For single filers:

Shayanne Gal/Business Insider

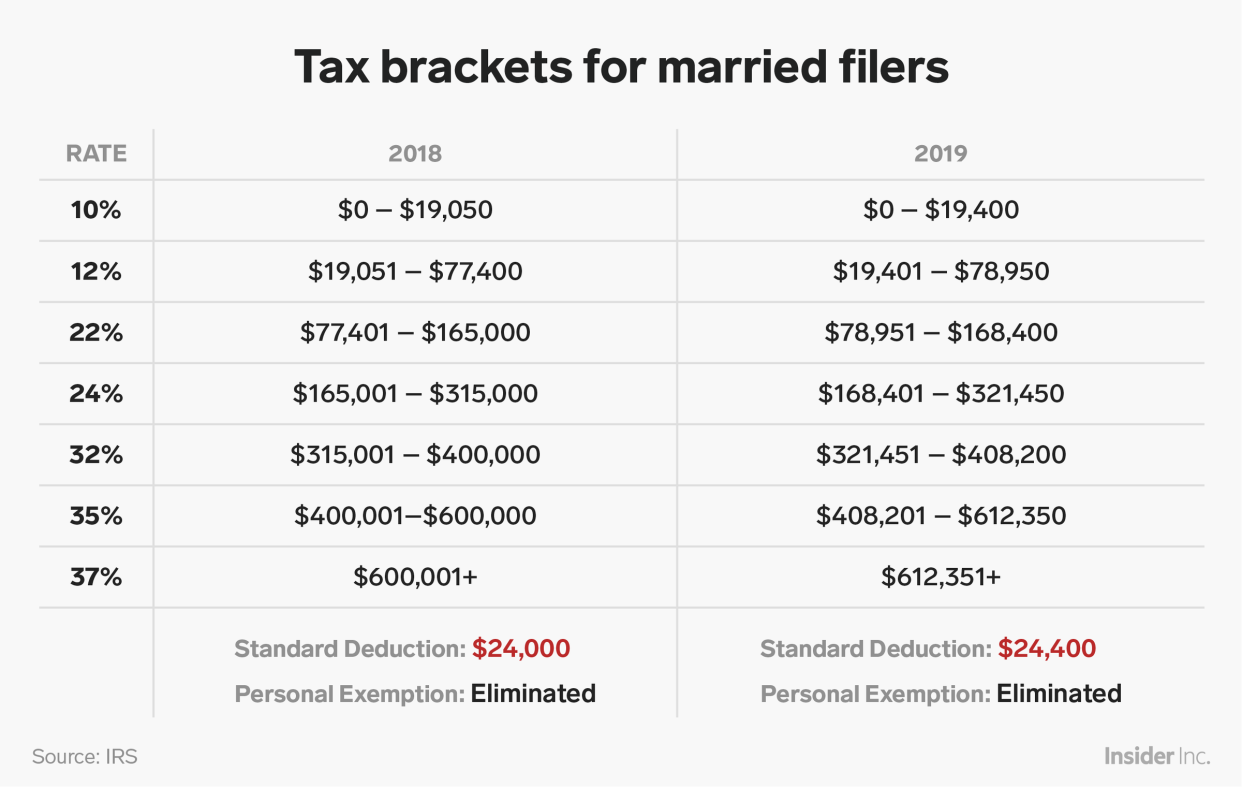

For married filers:

Shayanne Gal/Business Insider

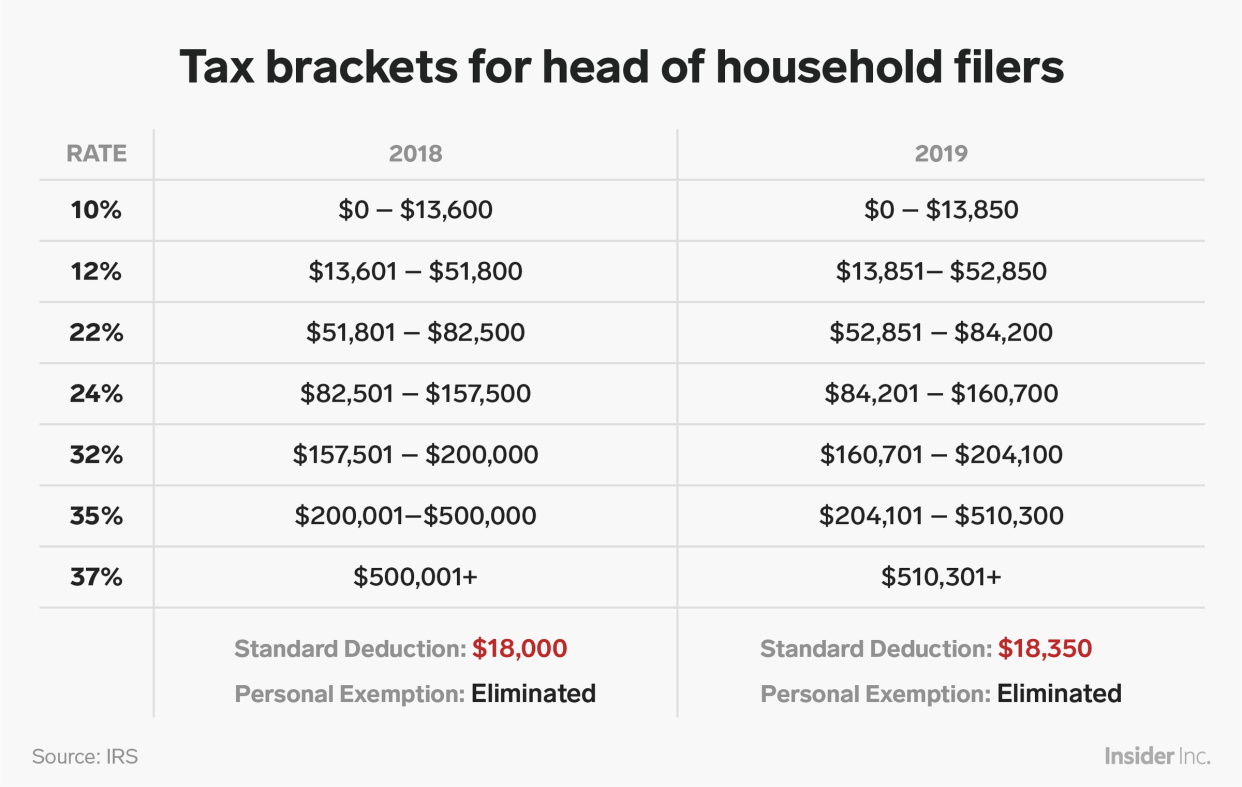

For head of household filers:

Shayanne Gal/Business Insider

Other tax changes for 2019 include increased limits for retirement contributions:

$19,000 limit for 401(k), 403(b) and most 457 plans (if you're 50 or older, you can put away an additional $6,000)

$6,000 limit for IRAs (if you're 50 or older, you can put away an additional $1,000)

And higher exemptions for gifts and estate taxes:

$11.4 million limit for lifetime gift and estate tax exemption

$15,000 limit for annual gift and estate tax exemption (same as 2018)

Read more:

Tax Day is April 15. Here's what you can expect when filing under the new tax law

Here's when you can expect your employer to send the form you need to file your taxes for 2018

NOW WATCH: Tim Cook's estimated net worth is $625 million — here's how he makes and spends his money

More from Business Insider:

Alexandria Ocasio-Cortez has a plan to tax the wealthiest Americans 60% to 70%, and it highlights a detail about taxes most people get wrong

The minimum wage is set to increase in 21 states and DC in 2019 — here's what it will be in every state

Here's when you can expect your employer to send the form you need to file your taxes for 2018