Billions of dollars worth of tax refunds are at risk of being delayed

NOTE: Late on Monday, Jan. 7, acting director of the White House Office of Management and Budget, Russell Vought, told reporters that the IRS will issue refunds to taxpayers even if the U.S. government shutdown persists.

As the Federal government shutdown enters its third week, if it’s not resolved soon, there’s a risk that it could stop tens of billions of dollars worth of income tax refunds.

“This [shutdown] could even extend into months rather than weeks,” Capital Economics’ Chief US Economist Paul Ashworth wrote in a recent note. “Up to now, the economic cost has been limited. But the disruption will increase exponentially for every week the shutdown isn’t resolved, particularly if it delays the payment of tax refunds next month.”

Many taxpayers file much earlier than the April 15th deadline to receive their refund check sooner from the Internal Revenue Service. In the scenario of a prolonged shutdown, those refund checks won’t be mailed on time.

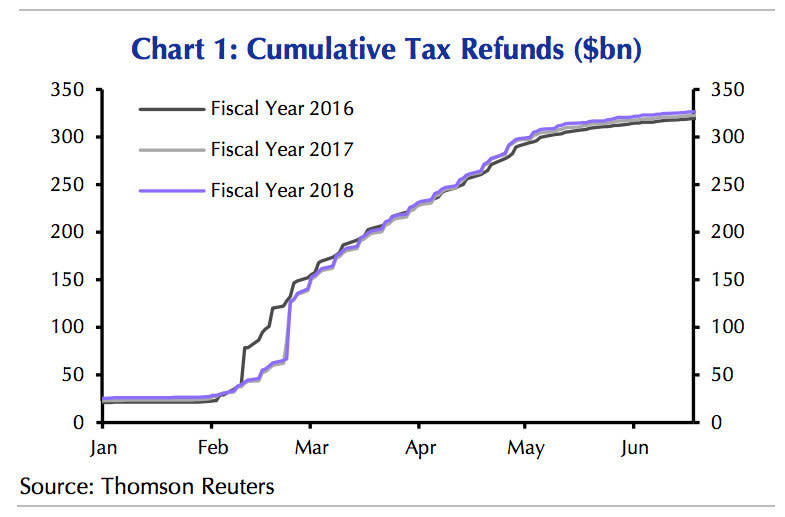

"[The] longer the shutdown lasts, the more government services will grind to a halt. The IRS usually pays around $125 [billion] in tax refunds in February and a further $75 billion in March," Ashworth wrote. "In [annualized] terms, that would be equivalent to an 11% decline in GDP."

The average tax refund is around $2,899 to $3,031. For many Americans, it’s a substantial influx of cash that can be used to pay off debts, add to savings accounts, or spent.

"Of course, once the shutdown ended, Federal salaries would be paid and tax rebates sent out, so the impact on first-quarter GDP should be much smaller than that… as long as the shutdown ends within the next month or two,” Ashworth said. “Unfortunately, there is no guarantee that will happen since both sides appear to be hunkering down for a very long fight.”

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter. Send tips to laroche@oath.com.