Cyber Monday shoppers in many states should be ready to pay taxes

Cyber Monday is expected to be a record-breaker, with forecasts calling for $7.8 billion in sales, or a 17.6% increase over last year’s shopping holiday, according to Adobe Analytics.

While shoppers will spend more this Cyber Monday on the hottest electronics and toys, many will also shell out more in taxes thanks to a recent Supreme Court ruling.

“[If] you were taking advantage of online shopping as a means of potentially avoiding having to pay sales taxes on their purchases, depending on where you live you may find that is no longer the case since the Wayfair [Supreme Court] decision,” said Chuck Maniace, director of regulatory analysis at Wilmington-based Sovos, a tax compliance software provider.

In late June, the U.S. Supreme court ruled in South Dakota v. Wayfair that states can collect sales tax from online sellers even if the retailers don’t have a physical presence in that state. That decision essentially overturned a 26-year-old ruling (Quill Corp. v. North Dakota) that previously found that states could not force mail-order catalog companies to collect sales taxes unless they had a physical presence in the state.

Of course, the Quill decision was in 1992, and the retail world has since changed with the rise of e-commerce, which is why South Dakota and 36 other states had pushed for the change. States also estimated that they were losing billions annually. South Dakota, which has no state income tax, estimated that it was losing between $48 and $58 million in revenues each year.

Most states will require internet retailers to collect sales taxes

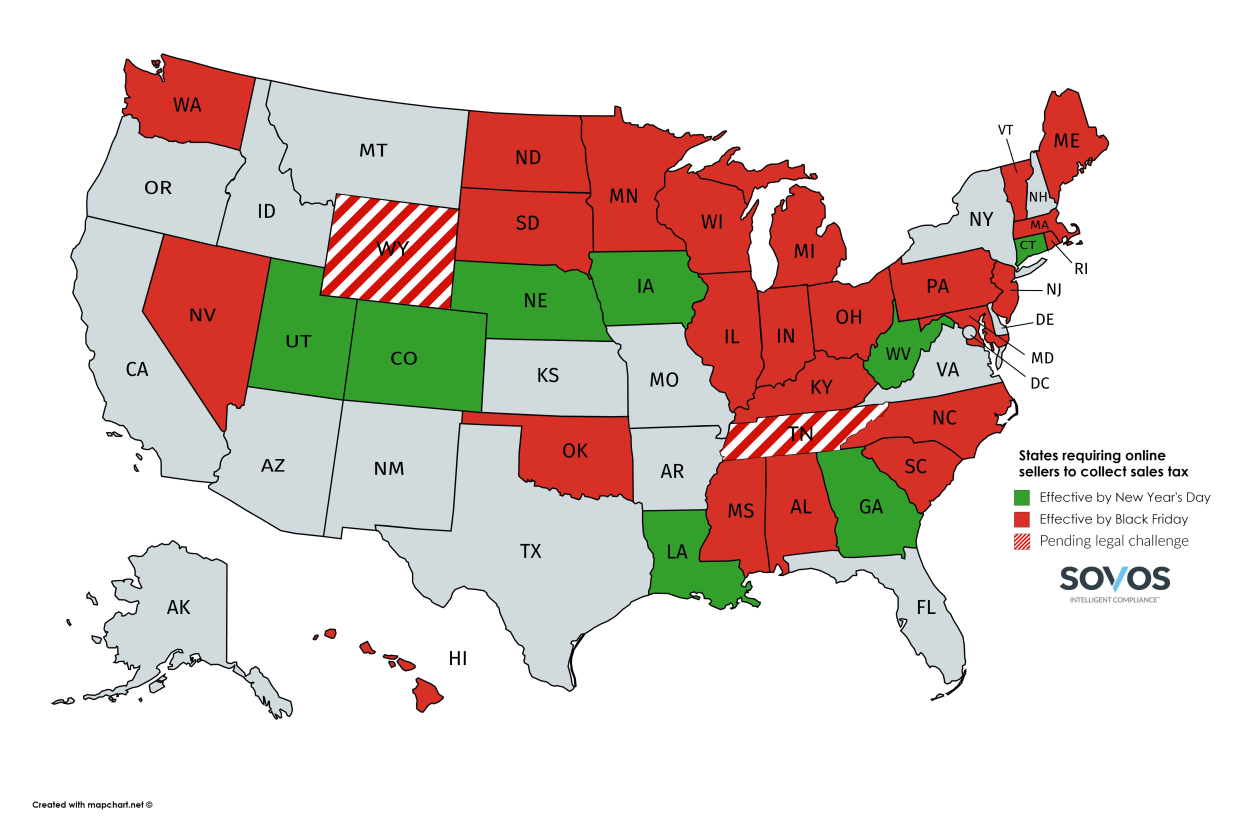

Since the Wayfair (W) decision, a substantial swath of the country has moved or is moving to apply their sales tax rules to internet sellers.

“The Supreme Court’s decision in South Dakota v. Wayfair essentially amounted to a green light for state governments to apply their sales tax rules to sellers beyond their physical borders, meaning sellers who are not necessarily located in their state but sell to their in-state customers so long as the requirements that they apply aren’t an undue burden,” said Maniace.

Generally, a new requirement would meet that standard if it didn’t apply retroactively and if there were an exception for the smallest of sellers, Maniace explained. Since June, a bunch of states adopted the standard that South Dakota won with at the Supreme Court.

By the end of the year, over 30 states will require internet retailers to collect sales taxes regardless of physical presence. On Oct. 1, 11 states went live with the so-called economic nexus collection requirements, and 11 more are planning to take action by January. By this time next year, Maniace expects that it will be almost every state.

“Expect to pay approximately 8% more”

What all this means is some U.S. shoppers should expect a larger e-commerce bill ahead of the holidays.

“On balance, if you live in a state that has enacted a remote seller collection rule and you buy online from sellers that historically don’t charge tax, expect to pay approximately 8% more for your purchases. So, if you plan on spending $600 online this holiday season, reserve at least an additional $48 for tax,” said Maniace

What’s more, some places will be more expensive than others. For example, shoppers in Boley, Oklahoma will be the most impacted.

“If they purchased an item online last Black Friday/Cyber Monday from an online retailer without a sales tax obligation, they can expect to pay 11.5% more on that same purchase this year,” said Maniace.

Ski resort areas can also expect to be hit especially hard as they often have some of the highest tax rates, according to Maniace. For example, those living in Bachelor’s Gulch, Colorado on Beaver Creek Mountain will be paying 9.4% more than last year for their online purchases. Colorado’s requirement will go live on Dec. 1.

Elsewhere, the rate in Raleigh, North Carolina is 7.25% so a shopper there purchasing a $20 toy from an online vendor can expect to pay $1.45 in additional tax this year. The rate in Reno, Nevada is 8.265% so a consumer there can expect to pay an additional $8.27 on a $100 electronics purchase, according to Maniace.

Those living in Pennsylvania can expect to pay 6% more, while residents of Illinois will pay 6.25% more.

Residents in Myrtle Beach, South Carolina, can expect to shell out an additional 9%, while residents of Sioux Falls, South Dakota will pay an additional 6.5%.

Residents of Alabama will pay 8% more for many online purchases this Cyber Monday. After the New Year, Louisiana residents can expect to pay 8.45% more.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter. Send tips to laroche@oath.com.