How Trump's tax cuts hurt the GOP in America's wealthy suburbs

Republicans are losing their hold on upper-middle-class suburbs, and the tax reform bill may be to blame.

Although a number of races are still too close to call, Democrats have taken 30 seats so far — more than the 23 GOP districts they needed to seize control of the House of Representatives. In swing districts across the country, new Democratic challengers vowed to defy the Trump administration while Republican incumbents touted the benefits of tax reform and a booming economy.

But the GOP’s tax reform bill may have disenfranchised fiscal conservatives in higher-income areas, since the Trump tax cuts capped the amount of deductions that Americans can claim on state and local taxes — abbreviated as SALT — to $10,000. For homeowners facing high property taxes, itemizing their taxes offered more deductions than the standard provision of $12,000.

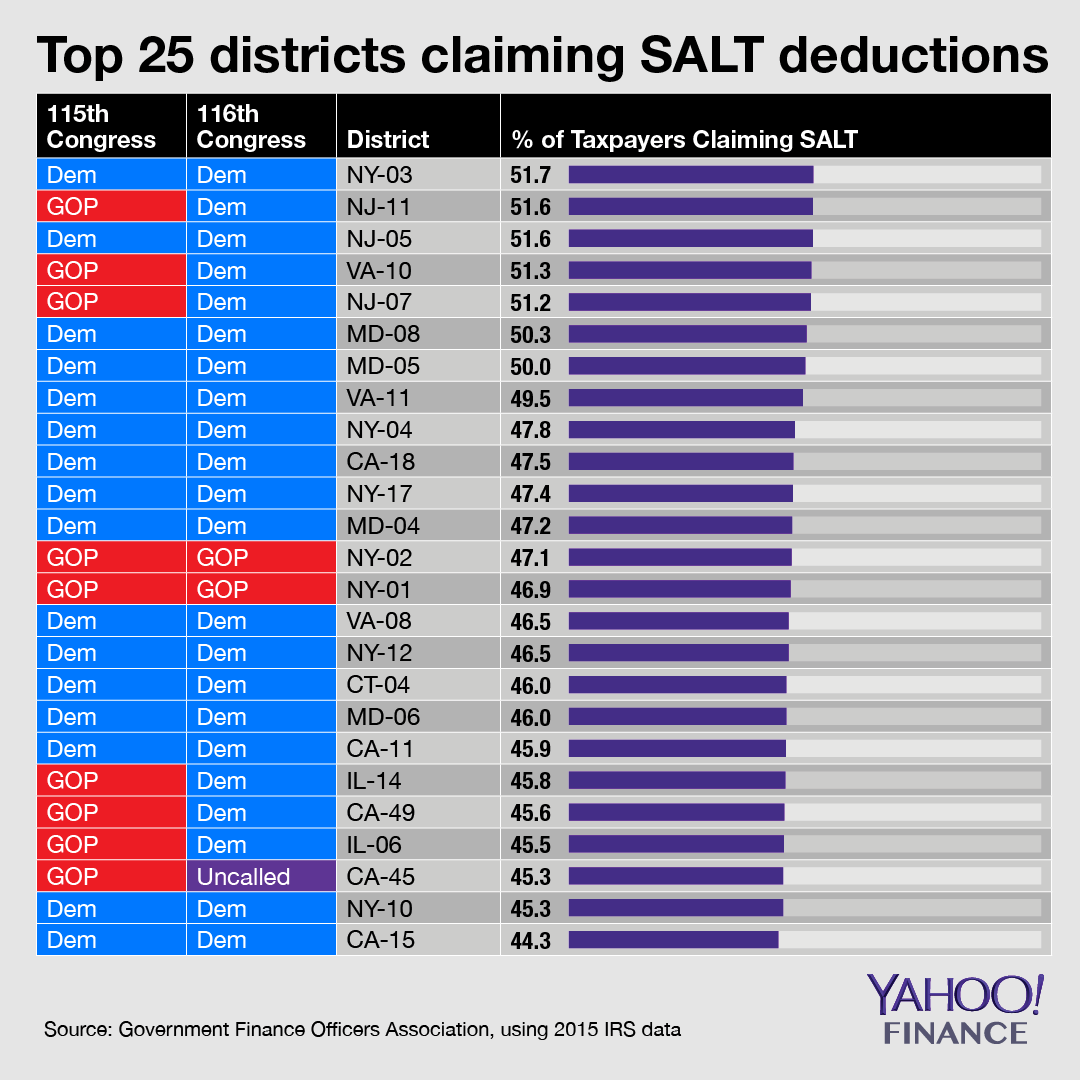

Voters in those districts may have had this in mind when they hit the polls in the midterms. Among the top 25 congressional districts ranked by uptake of SALT deductions, nine are controlled by Republicans in the current Congress.

Six of them flipped blue in the November 6 elections, and one – California’s 45th district – is too close to call.

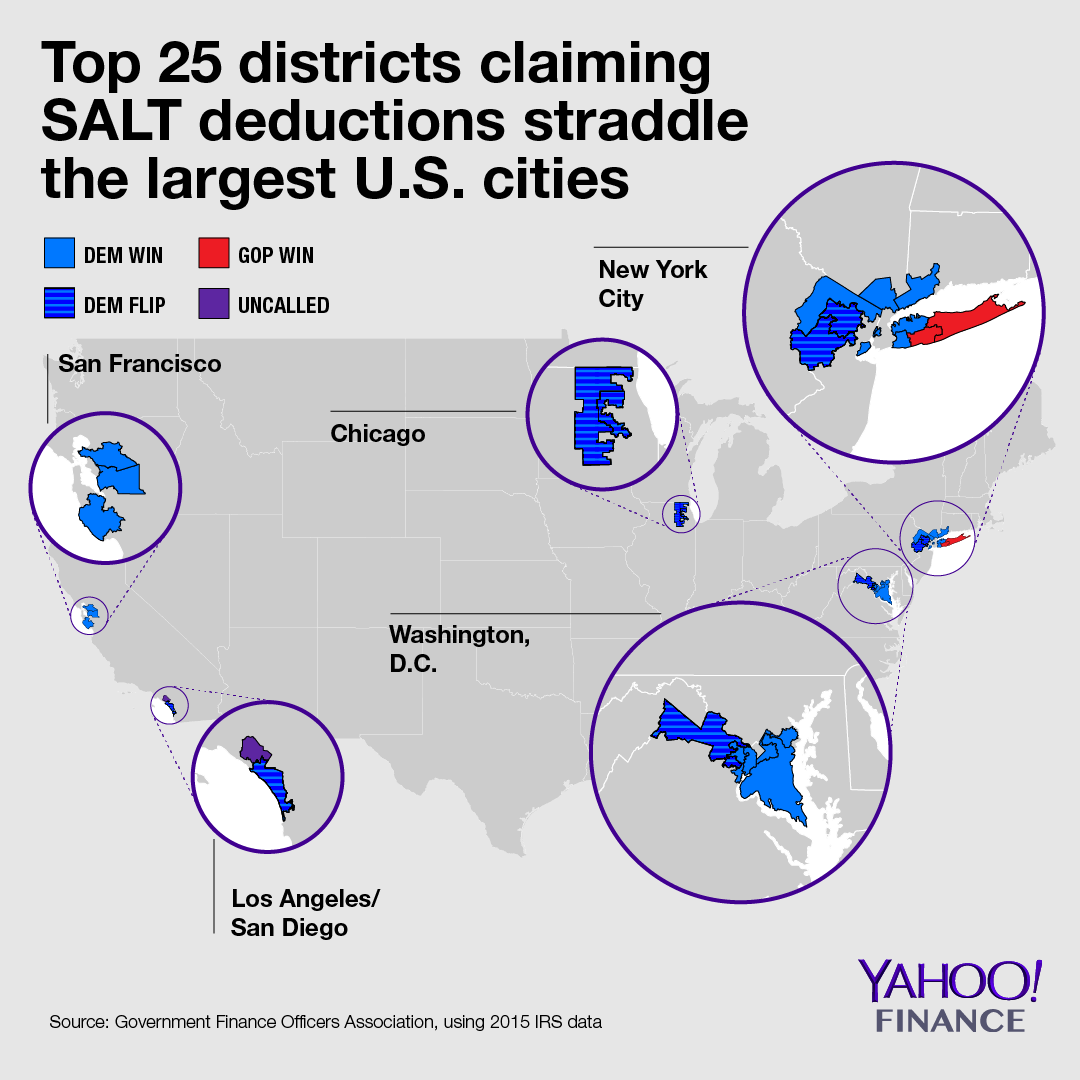

All of the top 25 districts straddle the largest U.S. cities: New York City, Chicago, San Francisco, Los Angeles and Washington, D.C. The common trend: All have expensive housing markets with homeowners who commute to the city for work. In terms of voter priorities, those voters tend to prioritize low taxes and preservation of wealth over social issues like immigration.

The picture on SALT deductions is dramatically different in the rest of the country.

Most Americans do not claim SALT deductions because the standard deduction — even before the Trump bill — offered more deductions than itemizing would. Based on 2015 IRS data compiled by the Government Finance Officers Association, only 30% of Americans in an average U.S. congressional district opted to take SALT deductions.

The average take-up rate for SALT deductions in these top 25 districts was 47.8%.

Across the Hudson River

Head about an hour west of New York City and you’ll arrive in New Jersey’s 11th district, where more than 51.6% of taxpayers take advantage of the SALT deductions — the second highest take-up rate in the country. For 23 years, the district was held by Rodney Frelinghuysen, a Republican who was able to build a following on the promise of low taxes for a constituency that ranks among the highest-income earners in the country.

Frelinghuysen, a rank-and-file GOP leader who chairs the House Appropriations Committee, had to break with his own party in voting against the tax bill. The move drew the ire of Republican leadership, and Frelinghuysen ultimately decided not to run for reelection.

Democrat Mikie Sherrill was able to snatch the seat in the midterms, and frequently hit on how the effects of the tax bill hurt the district.

“This plan has been particularly bad for our state,” Sherrill said in a televised debate in October. She claimed that the average taxpayer in NJ-11 paid $19,000 in property taxes, only about half of which could be deducted under the new tax bill.

Carl Davis, research director at the Institute on Taxation and Economic Policy, told Yahoo Finance that the same story has been playing out across the country.

“I think Californians and New Yorkers are right to feel that they didn’t get an especially good deal out of that tax overhaul,” Davis said. “Their tax cuts, relative to their neighbors all across the country were definitely undersized.”

Proponents of the tax bill say the SALT cap, which tends to benefit the wealthier, will still be offset by a now-doubled standard deduction. Republican Peter Roskam, one of the key members of the tax-writing House Ways and Means Committee, heavily advertised how a larger standard deduction would simplify the tax filing to the size of a postcard.

Roskam ended up losing his seat in Illinois’s 6th congressional district, where Democratic challenger Sean Casten took to Medium.com to attack Roskam and the Trump tax cuts.

“Peter Roskam likes to hype his position on the Ways and Means committee to convince you he knows more about tax policy and you do,” Casten wrote. “It’s all a lie.”

With Roskam gone, the Republican side of the tax-writing House Ways and Means Committee looks thin on members who helped drive the tax reform bill. Three of the six subcommittee members did not run for reelection.

The new Democratic majority in the House likely sets up Richard Neal, a Massachusetts Democrat, to take the committee gavel, with Texas Republican Kevin Brady set up for head of the committee’s minority.

But with a mixed Congress — the Senate still has a GOP majority — it is unclear whether the Democrats can or would do anything about the SALT cap. Goldman Sachs analysts wrote after the midterms that reversing the SALT cap remains a possibility but very unlikely.

“We expect no major tax legislation to become law under a divided Congress,” Goldman wrote.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Trump target Maxine Waters is poised to take a lead on banking regulation

Midterms unlikely to halt Trump administration’s regulatory rollbacks

Bernanke: Fed needs greater ‘lender of last resort’ authority