The Trump tax-cut stimulus still isn’t here

The economy is doing well, but 10 months after a steep Republican tax cut went into effect, there remains scant evidence the cuts are boosting business investment as Republicans promised.

The tax cuts, which passed Congress with no Democratic support last December, slashed the corporate tax rate from 35% to 21%, and also cut the tax burden for most individual payers. Yet the tax cuts remain unpopular, with slightly more people disapproving than approving. Research by Yahoo Finance and others shows that many Americans feel the tax cuts disproportionately benefited corporations and the wealthy, with less help for the middle class. That could hurt Republicans in the midterm elections on Nov. 6.

Trump and other Republicans argued that cutting corporate taxes would lead to a surge of investment that would ultimately benefit workers, as companies bought more stuff, built new facilities, hired more workers and raised pay. Yet the data so far for 2018 show no such surge. “There are still few signs that the recent tax cuts have boosted the economy’s supply side,” economist Paul Ashworth of Capital Economics wrote in a November 1 research note. “With business investment softening, the chances of an eventual pick-up appear to be fading.”

Here are some of the latest numbers:

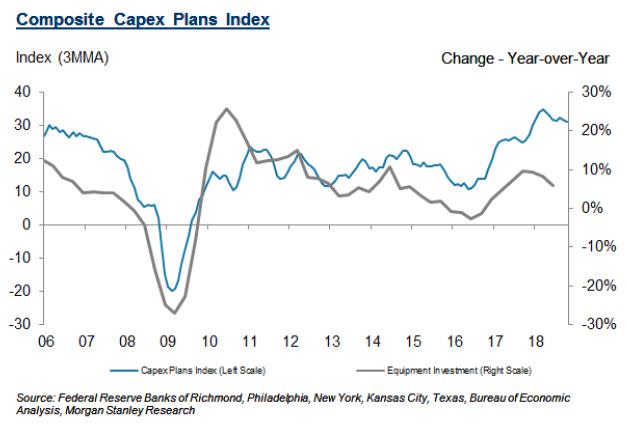

Morgan Stanley’s capital-expenditure index, which tracks the change in business spending, fell 0.6 points in October. The index rose sharply in 2017 and peaked in mid-March. It’s still close to a record high. But it has fallen 6 of the past 7 months, which is the opposite of what you’d expect if there were a surge of business investment.

Business economists say the tax cuts have done little to change corporate plans for hiring or investing. The latest monthly survey conducted by the National Association of Business Economists included a question on whether the firm changed hiring or investment plans on account of the Trump tax cuts. Eighty-one percent of business economists said there was no change. Six percent said their firms had accelerated hiring, and 12% said investment was up, on account of the tax cuts. Three percent said they had delayed hiring, with 1% saying their firms had delayed investment.

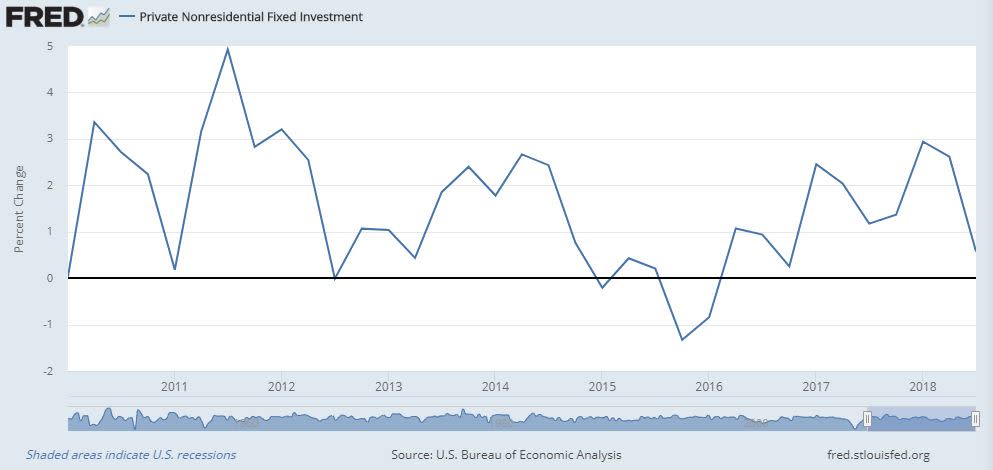

Business spending was weak in the third-quarter GDP report released on Oct. 26. Nonresidential fixed investment, which measures business spending, rose just 0.8% from the second quarter to the third, which was the weakest number since the fourth quarter of 2016. The overall pattern looks like a slowdown. Nonresidential fixed investment rose by a robust 11.5% in the first quarter, followed by 8.7% growth in the second quarter, and 0.8% in the third.

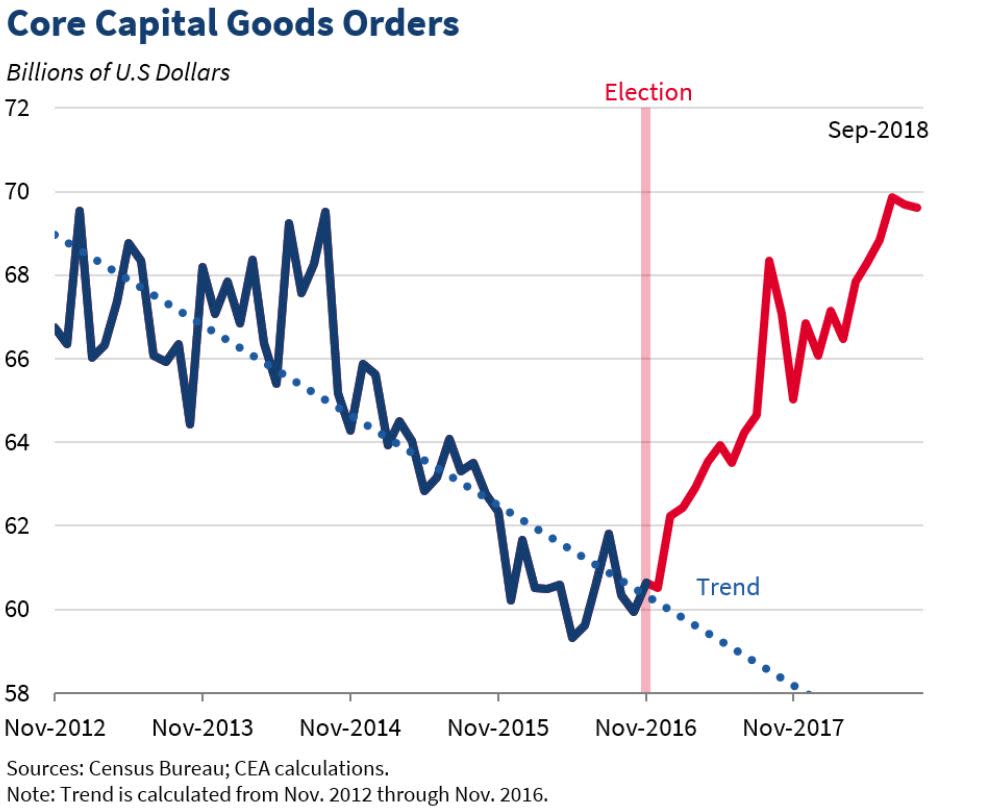

White House economists acknowledge that it could take years for the tax cuts to fully work their way through the economy and trigger the kind of growth they’re aiming for. And Trump’s Council of Economic Advisers points to other data showing capital goods orders and other measures of business spending have spiked during Trump’s time in office. But even those numbers show a trend line in 2018 that’s similar to 2017, with no unusual spike—along with a tapering of activity in the last month or two. Here’s an example:

There are countervailing forces that might be offsetting the stimulative effect of the tax cuts. Interest rates have been rising—as they should, late in an economic expansion—which makes borrowing for investments more expensive. Business leaders have also been expressing increasing concern over Trump’s trade policies, including tariffs, which are raising costs and shutting off some foreign markets. Some are also concerned about an aging business-cycle expansion that might be in the late innings. Businesses are unlikely to invest if they think a recession is looming or policy mistakes might cut into economic growth.

The economy will still be strong when voters head to the polls on Nov. 6. But Republicans can’t credibly claim their tax cuts have caused a business boom. Maybe by the next election.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman