Stocks rally, ending 6-day losing streak

Stocks edged higher after a six-day streak of losses.

The S&P 500 (^GSPC) rose 1.42%, or 38.76 points at market close Friday, snapping six days of losses. Technology stocks that had pulled indices down the past two days rebounded, and each of the FANG names ended the day in the green. The Nasdaq (^IXIC) advanced 2.29%, or 167.93 points.

After dipping into the red earlier in the day, the Dow (^DJI) rose 1.15%, or 287.16 points at the end of trading Friday. This follows 1300 lost points over the two days prior.

It was a wild week for stocks, and experts’ explanations for the factors contributing to the sell-off included higher rates, a more hawkish Federal Reserve, midterm elections and trade tensions. Regardless of the catalyst, at least some strategists argue that market volatility is nothing to fear – especially at this time of year.

“October should be known for volatility, as no month has seen more 1% changes (up or down) for the S&P 500 Index going back to 1950,” Ryan Detrick, senior market strategist at LPL Financial, said in a note on Thursday. Between 1950 and 2017, the S&P 500 saw 362 instances of at least 1% changes in October.

For some experts, volatility presents a unique opportunity to buy.

“Historically, investing on volatility spikes leads to above average returns in subsequent months,” Jonathan Golub, an analyst with Credit Suisse, wrote in a note Thursday. “[We] believe that investors should opportunistically extend risk against this higher volatility.”

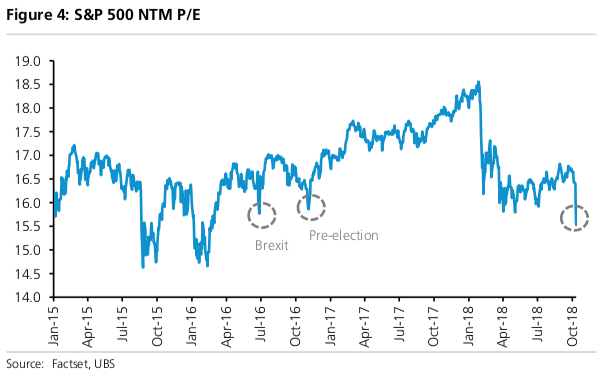

UBS’s Keith Parker observed that valuations have gotten much more attractive, and he believes we should see a rebound. The S&P 500’s 12-month price-earnings ratio is “now at 15.5x, over 1.5x below average levels prior to the onset of trade concerns and near the lows of 2016,” Parker said.

STOCKS: Big banks kick off earnings season

Earnings season unofficially began Friday, and major banks were among the first to report their quarterly results.

JPMorgan Chase (JPM) reported earnings that largely exceeded Wall Street expectations. However, the stock fell 1.1% to $106.94 per share at the end of trading Friday, after advancing earlier in the day. The biggest U.S. bank by assets delivered earnings of $2.34 per share on adjusted revenue of $27.82 billion, versus expectations of $2.26 per share in adjusted earnings and $27.44 billion in revenue. CEO Jamie Dimon also said in a statement that the bank just opened its first branch in Washington, D.C.

“The U.S. and the global economy continue to show strength, despite increasing economic and geopolitical uncertainties, which at some point in the future may have negative effects on the economy,” Dimon said in the statement. “We are extremely excited to be expanding again, as smart regulatory policy and a competitive corporate tax system help us to deliver on our commitment to invest in our customers and communities.”

Wells Fargo’s (WFC) stock advanced 1.32% to $52.12 per share after the company reported revenues topping expectations and signaled it would continue boosting its digital banking offerings. The company’s profits rose 32% in the third quarter on account of higher net interest income and lower expenses. The bank posted earnings of $1.13 for the quarter ending September 30, versus estimates of $1.17. This is the first time this year that revenue grew for the bank, with its third-quarter results of $21.9 billion slightly beating average analyst estimates of $21.89 billion.

Citigroup (C) posted a surprise surge in quarterly profits as the bank benefited from fixed-income trading in the third quarter following interest-rate increases. Net income for the quarter increased 12% to $4.6 billion, reflecting a lower effective tax rate and lower expenses and cost of credit, the bank said in a statement Friday. The company posted earnings of $1.73 per share on revenue of $18.4 billion, flat from the year-before period. Shares of Citigroup rose 2.05% to $69.78 each at market close Friday.

NEWS: Eyes on the yuan

Treasury Secretary Steven Mnuchin said he is “carefully monitoring” the Chinese yuan’s decline against the dollar in the wake of the escalating trade war, CNN reported Thursday. But the U.S. Treasury Department’s staff reportedly advised Mnuchin that China isn’t manipulating its currency, according to reports from Bloomberg citing two people familiar. The International Monetary Fund also said the yuan is fairly valued, Bloomberg reported Friday. A decline in the value of the yuan would help to offset some of the impact of tariffs by making Chinese goods less expensive for Americans to purchase. President Donald Trump has previously accused China of currency manipulation. The yuan has fallen more than 6% against the dollar this year.

Meanwhile, China’s trade surplus with the U.S. widened to a record $34.1 billion in September, at least temporarily contradicting expectations that increasing tariffs would hamper Chinese exports to the United States. Exports to the American market rose 13% year-over-year. The Chinese monthly trade surplus with the United States last hit a record after August’s reading registered at $31 billion.

ECONOMY: Import prices increased in September

U.S. import prices ticked up 0.5% month-over-month in September, the Labor Department said in a release Friday. The results outpaced average economists estimates of 0.2% and revised August results of a 0.4% decrease in prices. This marks the first monthly increase in prices since a 0.9% rise in May. Import prices year over year advanced 3.5%, versus average expectations of a 3.1% increase. Fuel imports posted the largest price increases, rising 3.8% in September after falling 2.2% in August. Excluding fuel, import prices were unchanged after falling 0.2% in August.

The University of Michigan sentiment index for consumer comfort fell to 99.0 in early October from 100.1 in September, coming in short of the average forecast of 100.5. The five to 10-year inflation expectations series fell to 2.3%, beneath expectations of 2.5%.

“Confidence hasn’t been a particularly useful guide to spending in recent years but, along with the continued strength of the labour market, it provides another reason to expect consumer spending growth to remain solid in the near term,” Andrew Hunter, an economist with Capital Economics, wrote in a note.

However, given that expectations are sensitive to the stock market, “if the recent drop in prices is sustained, reported confidence will take a hit in the next month or two,” Ian Shepherdson, chief economist of Pantheon Macroeconomics, wrote in a note. The preliminary survey for the University of Michigan’s sentiment index ended before the sharpest equity declines over the past couple days.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Trump doesn’t like how the Fed is conducting monetary policy

Weed stock Tilray is sending investors on an incredible ride

Tilray shares jump as company says it’s exporting cannabis to sick children in Australia

A trade war won’t rattle the ‘white hot’ US economy

White House economist: Tariffs are hurting China much more than the US