A Trump trade war victory over China could be disastrous for the US

U.S. President Donald Trump appears to be winning the trade war. China is reeling from the effects of trade tariffs imposed by the United States and may be facing a major slowdown in its growth that could be worsened by additional tariffs, analysts say.

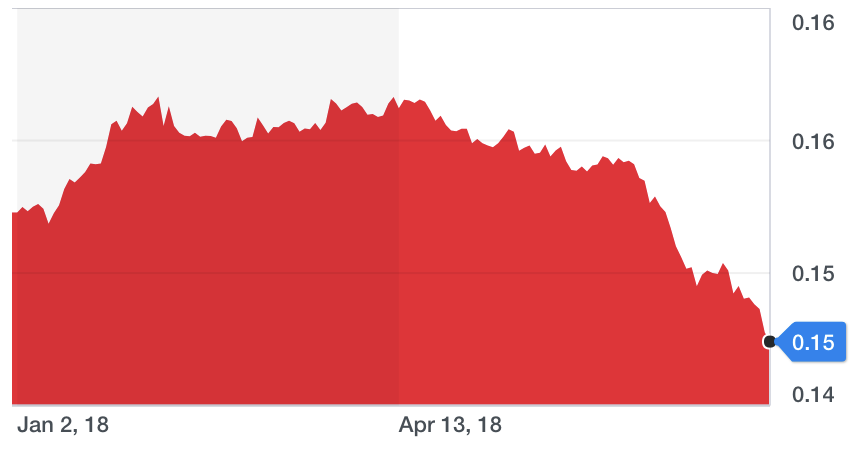

China’s rock solid economy has already started showing cracks. Growth in its manufacturing sector has slowed, its stock market has tumbled and the country has faced “extremely complicated and severe” domestic and external conditions in the first half of the year, statistics authority spokesman Mao Shengyong said in a statement earlier this month. The country’s political leaders are also trying to roll back massive credit and debt expansion.

But that’s not just bad news for China. It could also spell disaster for American workers, U.S.-based companies and economies around the world.

James Barrineau, head of emerging markets debt at Schroders, argues that a slowdown in China carries global contagion risks. China is not only the world’s second largest economy — and the world’s largest measured by purchasing power parity — it’s also a top trading partner with almost every country on the planet and a major focus of U.S. policy making.

“If the market were to conclude that trade wars were causing significant stress in an economy of that size I think risk appetite globally would dry up pretty quickly,” Barrineau told Yahoo Finance in a phone interview.

The U.S. is ‘especially vulnerable’

That would be a major risk to U.S. markets, particularly stocks and other financial assets, as the benchmark S&P 500 index already is trading at historically high levels. Further, because Trump has antagonized and threatened tariffs not just on China but the European Union, Japan, Canada, Mexico and many of the world’s largest economies, the United States would be hit harder than other nations, the International Monetary Fund said last week.

“As the focus of global retaliation, the United States finds a relatively high share of its exports taxed in global markets in such a broader trade conflict, and it is therefore especially vulnerable,” IMF chief economist Maury Obstfeld said in a statement.

Trump has threatened to increase tariffs on more than $500 billion worth of Chinese imports to the United States — nearly the totality of what the Asian nation sends — which would far exceed the tariffs China can place on U.S. imports, simply because they import far less. But that doesn’t mean that China can’t retaliate.

Chinese officials said this week that they would not intentionally devalue their currency, which has fallen 5% since June to its weakest level against the dollar (USDCNY=X) in more than a year.

Even if that’s true, Chinese policy makers still have a number of options.

Liz Young, senior investment strategist at BNY Mellon Investment Management, says that there are more “hidden risks” than possible benefits for the United States and the rest of the world “if things start to really blow up in China with the trade war.”

“They can put on some qualitative measures: They can delay [mergers between U.S. and Chinese companies], they can encourage their consumers not to buy U.S. products,” Young said via phone. “But those aren’t quantifiable, they would probably affect sentiment more than anything else.”

The danger of sentiment

Worsening sentiment could be a silent killer for the U.S. economy because many American companies are deriving significant revenue from their operations in China, said Linda Zhang, founder and CEO of Purview Investments, who grew up in China.

While import/export statistics show significantly more products coming from China into the United States than in the opposite direction, that total doesn’t account for much of the haul from U.S. enterprises that have set up shop in China and sell products locally. If Chinese customers were to turn against those companies – whether on their own or at the direction of the Chinese Communist Party – the hit could be substantial, she said.

A recent survey from financial research firm FactSet shows that the 20 U.S. companies in the S&P 500 with the highest level of sales in China totaled $158.4 billion during the most recently reported full fiscal year. Apple, the world’s largest company, reported $44.8 billion in Chinese sales that year and five U.S. companies, including Broadcom Ltd. and Qualcomm Inc., reported that more than half of their sales came from China. FactSet identified 62 companies with major sales in the country.

Anti-American sentiment in China could mean significantly reduced sales for these companies, which represent a major share of the U.S. stock market, potentially leading to a drop in stock prices and a bear market or a recession.

Seeking to get out ahead of these negative effects, companies would likely move more operations to China, Zhang said. More companies moving to China or to other countries outside the United States that aren’t involved in a trade war likely means more job losses in the U.S.

“Trade statistics often distort the global economic reality today,” Zhang told Yahoo Finance in an email following a meeting in Manhattan. “As China has become the most important overseas market for many American firms setting up operations there … such distortion of the trade reality becomes even more severe.”

—

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

Global debt jumped by $8 trillion in Q1, rising to record $247 trillion

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.