Walmart is beating Amazon at its own game (WMT)

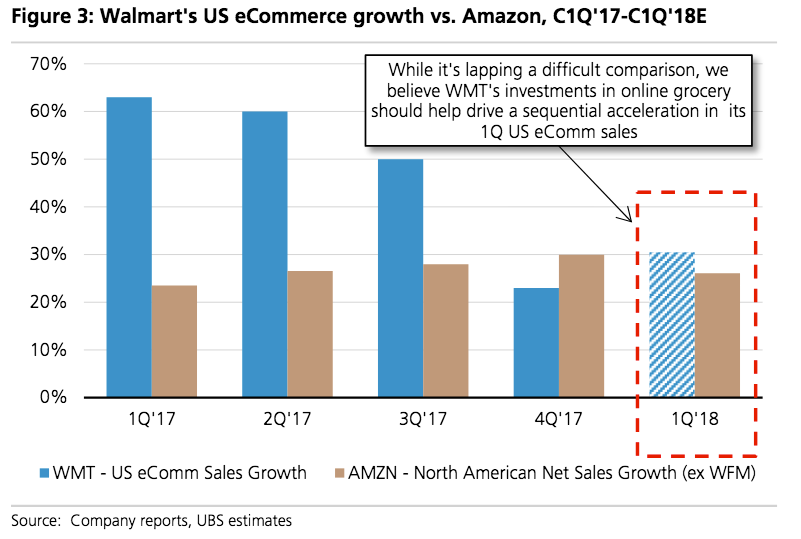

Walmart's US e-commerce business has been growing faster than Amazon's.

That trend briefly halted, but UBS analyst Michael Lasser estimates it has already resumed.

Walmart's online grocery agenda is a key driver of its US e-commerce sales.

Walmart's US e-commerce growth has outpaced Amazon's, and that trend likely continued in the first-quarter of 2018.

"After reporting three consecutive quarters with 50%+ sales improvements, its growth slowed to just 23% in 4Q," UBS analyst Michael Lasser wrote in a note to clients sent out on Monday. He says Walmart's sales growth likely accelerated to 30% in the first quarter, which would outpace that Amazon's 26% US e-commerce growth. Walmart is set to report its first-quarter results on Thursday.

Markets Insider

Although the big-box retailer saw a brief dip in its e-commerce growth during the fourth-quarter, Lasser sees online grocery sales leading it past Amazon in terms of e-commerce growth in the first quarter.

"As of March 14, Walmart noted it operated grocery delivery out of 800-odd stores," Lasser wrote. "This compares to just a handful last year. Thus, we think it likely had more than enough tailwinds to see a reacceleration in digital sales over the course of the period."

RELATED: Walmart's top-selling items in every state

Walmart has been notably responsive to Amazon's acquisition of Whole Foods, which sent shockwaves through the grocery industry last August. Amazon is bringing tech to groceries, causing the entire industry to adapt in order to survive.

Walmart increased its number of US stores that have online capabilities to 1,100 by the end of 2017, according to UBS analyst Eric Sheridan in an April note to clients. That's 600 more than it had at the end of 2016. It wants to have more than 2,000 such stores by the end of 2018 and also wants to boost its third-party grocery delivery abilities, through partnerships with Postmates, the note added.

Walmart also may utilize Uber and Lyft for its "delivery to fridge" agenda. These plans, Walmart hopes, will enable it to reach 40% or more of US households by the end of 2018.

Lasser has a $103 price target on Walmart, about 23% above its current level.

Walmart is down 14.35% on the year.

More from Business Insider: