There are signs Trump's trade friction is killing jobs in big manufacturing states

There are some signs that President Donald Trump's tariffs on steel, aluminum, and other imports are slowing hiring in manufacturing-heavy states, according to Deutsche Bank.

Warnings that Trump's trade policies could produce this kind of result have been pouring in from economists.

It’s still early days, but there are some signs that the Trump administration’s approach to trade is hurting jobs in the most affected states.

Since announcing tariffs on steel and aluminum in March, the US has rolled out import taxes on $50 billion worth of Chinese goods, and threatened an additional $100 billion in tariffs. In response, China announced plans to impose tariffs on more than 100 American products worth $50 billion annually, including important exports like soybeans and autos.

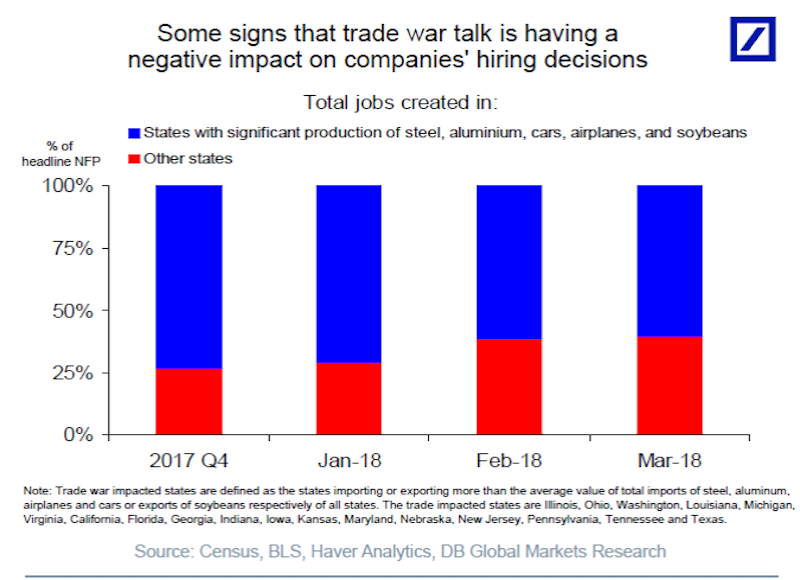

The chart below shows employment growth in states that have a higher-than-average volume of trade in steel, aluminum, airplanes, cars, and soybeans — all products that are impacted by tariffs. In recent months, they've accounted for a smaller share of total job growth, according to Torsten Sløk, Deutsche Bank's chief international economist.

"The bottom line is that continued corporate uncertainty about input costs and output demand is likely to weigh on job growth going forward," Sløk said.

Warnings that Trump's trade policies could have this kind of outcome have been pouring in from economists. The World Trade Organization and the International Monetary Fund are among the major institutions that have warned a trade war between China and the US would hurt the global economy.

Also, the Federal Reserve's latest Beige Book of feedback from businesses across America released last week mentioned the word "tariff" 36 times. There were no mentions in the March document.

This is what a Fed contact in Boston said:

"In general, respondents were optimistic in their outlook. However, two contacts brought up the proposed China tariffs and said they represent a major risk. One was a toy manufacturer who sources 75 percent of their production from China. The second said that punitive tariffs on Chinese aluminum had already had a big effect: "Thin gauge foil" is produced only in China and tariffs raised the price three-fold; the contact argued that "these tariffs are now killing high-paying American manufacturing jobs and businesses."

Deutsche Bank

NOW WATCH: Wall Street's biggest bull explains why trade war fears are way overblown

See Also:

Vintage photos taken by the EPA reveal what America looked like before pollution was regulated

FED'S KASHKARI: Wall Street is 'forgetting the lessons of the 2008 financial crisis'

SEE ALSO: One of Trump's biggest accomplishments could make the next recession worse

DON'T MISS: Trump's trade fight is getting blasted by some of the most powerful economic groups in the world