MORGAN STANLEY: The stock market's meltdown was just an 'appetizer' — here's how to protect against the next selloff

The US stock market correction from earlier in February may have been painful for investors, but it also gave them a dry run to prepare for another major market event.

Morgan Stanley has learned from the experience, and provides four hedging recommendations in the event of another meltdown.

Sure, the 10% correction that rocked US equity markets earlier this month was jarring and painful, but it also gave investors a dry run for a major market meltdown.

As a result, traders now have a good idea what tactics will work when defending against sharp losses. And that's a major positive, considering Morgan Stanley thinks the worst is yet to come.

Floor reactions to the stock market plunge:

The selloff was an "appetizer, not the main course," Andrew Sheets, Morgan Stanley's chief cross-asset strategist, wrote in a client note. We "remain in the late stages of a late-cycle environment," he said.

With that in mind, Morgan Stanley makes the important distinction the headwinds currently facing the market — increasing valuations, rising inflation, tightening policy, higher commodity prices, and more volatility — are all normal hallmarks of a late-cycle environment.

As such, the firm thinks there's ample opportunity to identify downside protection in the event of further turbulence. And since the traditional inverse relationship between stocks and bonds has disintegrated, depriving the equity market of a tried and true hedge, investors would be wise to seek diversification.

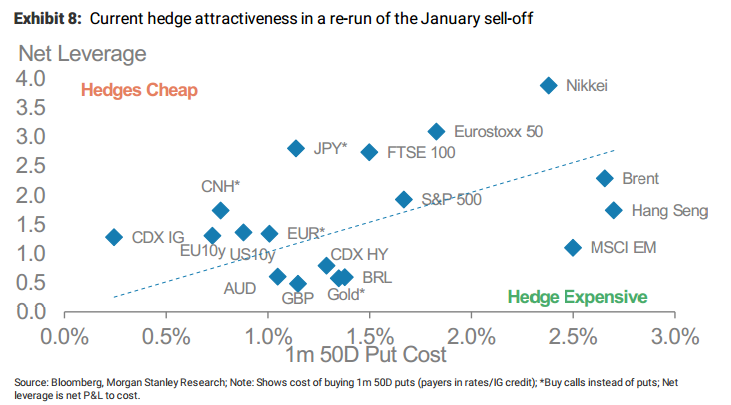

Morgan Stanley has crunched the numbers and identified four asset classes that could be a safe haven for traders if another stock selloff takes hold:

Japanese yen (JPY) — "After initial sluggishness, JPY did move materially and proved to be a good offset for portfolios. JPY also stands out as the one asset class where implied vols are still low to hedge for a repeat of last month."

Nikkei— "Nikkei has been the most volatile index, underperforming other regions far more than even current implied vols would suggest."

European equities— "Both Eurostoxx and FTSE 100, suffered sharp declines relative to what the option market implies today. That said, Europe's material underperformance since mid-2016 means we see value in being long instead."

Brent crude— "Brent did decline much more than what is in the price for options volatility currently, but this is more a reflection of still low implied vols on Brent rather than the magnitude of the decline (relative to previous sell-offs). As with European equities, we see better value in being long instead."

Don't feel like taking Morgan Stanley's word for it? The chart below shows the hedging costs for each of them, relative to their expected performance in a market event similar to the one seen between January 24 and February 14. As you'll note, the asset classes listed above are situated the highest on the y-axis.

Morgan Stanley

NOW WATCH: Microsoft President Brad Smith says the US shouldn't get 'too isolationist'

See Also:

Warren Buffett just made life miserable for one group of investors

GOLDMAN SACHS: These 17 stocks offer the best bargains in the market right now

SEE ALSO: A new part of the market is melting down as panicked investors get another 'wake-up call'