Warren Buffett just made life miserable for one group of investors

Warren Buffett and Berkshire Hathaway disclosed an almost $400 million stake in Teva Pharmaceutical after the market close on Thursday, sending the shares soaring.

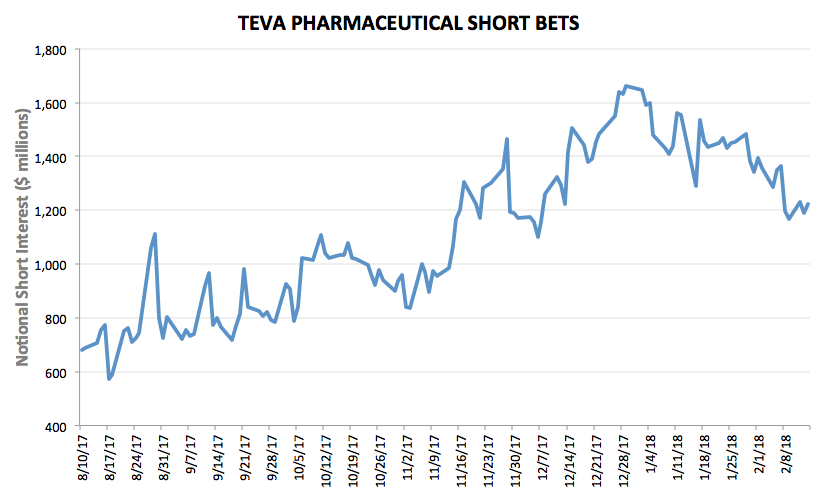

The big stock increase crushed short sellers, who were sitting on a more than $1.2 billion position when the news hit.

Warren Buffett's almost $400 million investment in Teva Pharmaceutical made a lot of investors quite a bit of money as the company's American deposit receipts (ADRs) surged 11% in after-market trading on Thursday.

Another group, however, wasn't quite so fortunate.

We're talking about short sellers — or investors betting on a Teva stock decline. As of Thursday's close, prior to Berkshire Hathaway's disclosure, they held a roughly $1.2 billion short position on the company — one that proved to be a sitting duck once Teva shares started surging.

It's a cruel twist of fate for Teva skeptics, considering they've nearly doubled their short position over the past six months, according to data compiled by financial analytics firm S3 Partners.

Business Insider / Joe Ciolli, data from S3 Partners

It's likely the unwinding of these positions — also known as a short squeeze — is exacerbating the move in Teva's share price as traders are forced to close their positions by buying the stock.

So why was there so much money riding on a Teva stock collapse? One possible explanation for the increase in short interest is that traders saw Teva's 66% decline over the past two years and viewed the stock as a sinking ship. Short interest normally falls as a stock price does, so it's interesting that investors continued to pile into those bets.

RELATED: Check out Warren Buffett through the years:

It's also possible that traders have become wary of mounting competition. In October 2017, Teva's blockbuster multiple sclerosis treatment Copaxone suffered through a rough patch as US regulators approved discounted pricing for generic competitors, while two European companies received approval for their own generic version of the drug.

Buffett's investment in Teva is just one entry into what many expect will be a busy year for the legendary billionaire. UBS recently speculated the company could make an enormous acquisition of up to $160 billion, considering how much cash Berkshire Hathaway has on hand, and how much cash flow it generates.

Teva climbed 9.2% in US pre-market trading on Thursday.

Markets Insider

NOW WATCH: Microsoft President Brad Smith says the US shouldn't get 'too isolationist'

More from Business Insider:

GOLDMAN SACHS: These 17 stocks offer the best bargains in the market right now

Morgan Stanley's US equity chief explains why the recent meltdown signaled the 'final stage' of the bull market

The stock market's safety net went missing when it was needed most — here's what that means for the future