The Republican tax bill passes Congress — here's how your tax bracket could change in 2018

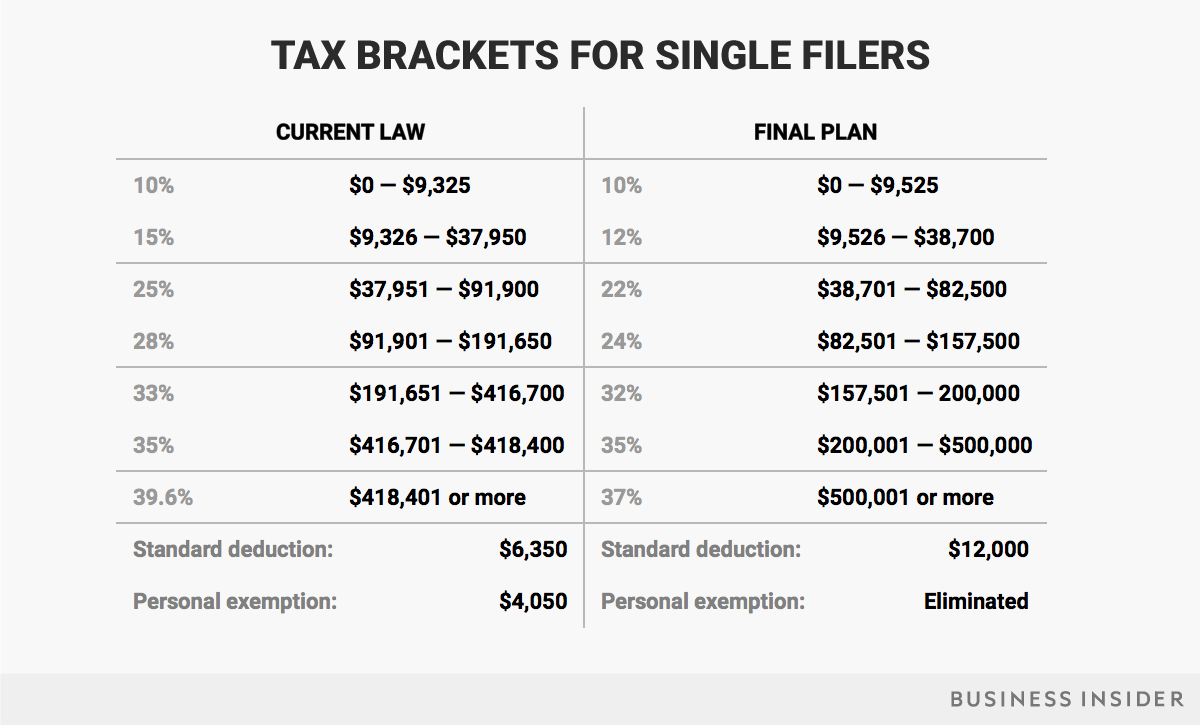

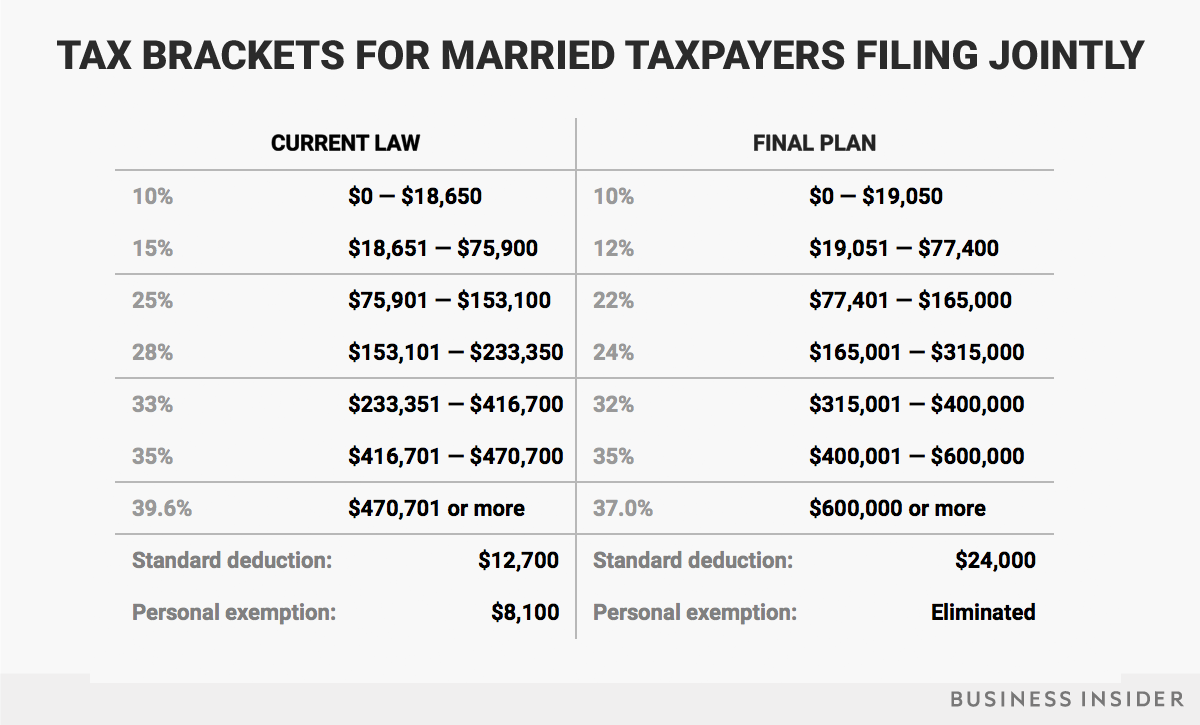

Income tax brackets will change in 2018 if President Donald Trump enacts the GOP tax legislation.

The Republican tax plan proposes keeping seven tax brackets, but it changes the income ranges.

The final bill proposes eliminating the personal exemption and increasing the standard deduction.

Senate Republicans passed their tax bill just after midnight on Wednesday, leaving a technical vote in House as the last remaining obstacle before the bill can be sent to President Donald Trump's desk.

The bill, the Tax Cuts and Jobs Act, is set to make sweeping changes to the tax code for businesses and, on average, American taxpayers.

Here's how this new tax plan could change federal income tax brackets in 2018 compared with those in 2017.

First, for single filers:

Elena Holodny/Business Insider

10%: $0 to $9,525 of taxable income for an individual

12%: $9,526 to $38,700 individual

22%: $38,701 to $82,500 individual

24%: $82,501 to $157,500 individual

32%: $157,501 to $200,000 individual

35%: $200,001 to $500,000 individual

37%: over $500,000 individual

And second, for joint filers:

Elena Holodny/Business Insider

10%: $0 to $19,050 for married joint filers

12%: $19,051 to $77,400 joint

22%: $77,401 to $165,000 joint

24%: $165,001 to $315,000 joint

32%: $315,001 to $400,000 joint

35%: $400,001 to $600,000 joint

37%: Over $600,000 joint

Under the final version of Republican plan, there would still be seven federal income tax brackets — but at slightly lower rates and adjusted income ranges.

RELATED: Check out Republican senators who were on the fence about the GOP tax bill:

About 70% of Americans claim the standard deduction when filing their taxes, and their paychecks will almost certainly increase — albeit slightly — if the tax plan is enacted.

In 2017, the standard deduction for a single taxpayer is $6,350, plus one personal exemption of $4,050.

The GOP proposal would combine those into one larger standard deduction for 2018: $12,000 for single filers and $24,000 for joint filers.

More from Business Insider:

Rich homeowners in blue states are among the biggest losers in the GOP tax bill

Trump's tax plan could bring $250 billion into the US — here are the companies set to benefit most

Here's what America's biggest companies plan to do with all that cash coming back to the US

SEE ALSO: 5 last-minute tax moves to make now before the GOP tax plan goes into effect