How your tax bracket could change under the Senate's tax plan, in two charts

Income tax brackets could change in 2018 if tax reform legislation is enacted under President Donald Trump.

The Senate's tax plan proposes keeping seven tax brackets but changes the income ranges.

The bill proposes eliminating the personal exemption and increasing the standard deduction.

Senate Republicans appear to be inching closer to passing their huge tax overhaul.

The most concrete sign that Republicans were making progress came in the Senate Budget Committee on Tuesday, where the bill passed on a party-line vote of 12 to 11. Two GOP senators on the committee, Ron Johnson and Bob Corker, ended up voting for the bill after saying on Monday they would vote against it.

But political and procedural stumbling blocks remain as Republicans try to clear their bill through the full Senate.

In the meantime, Business Insider put together two charts showing how the Senate's tax plan could change federal income-tax brackets in 2018 compared with those in 2017.

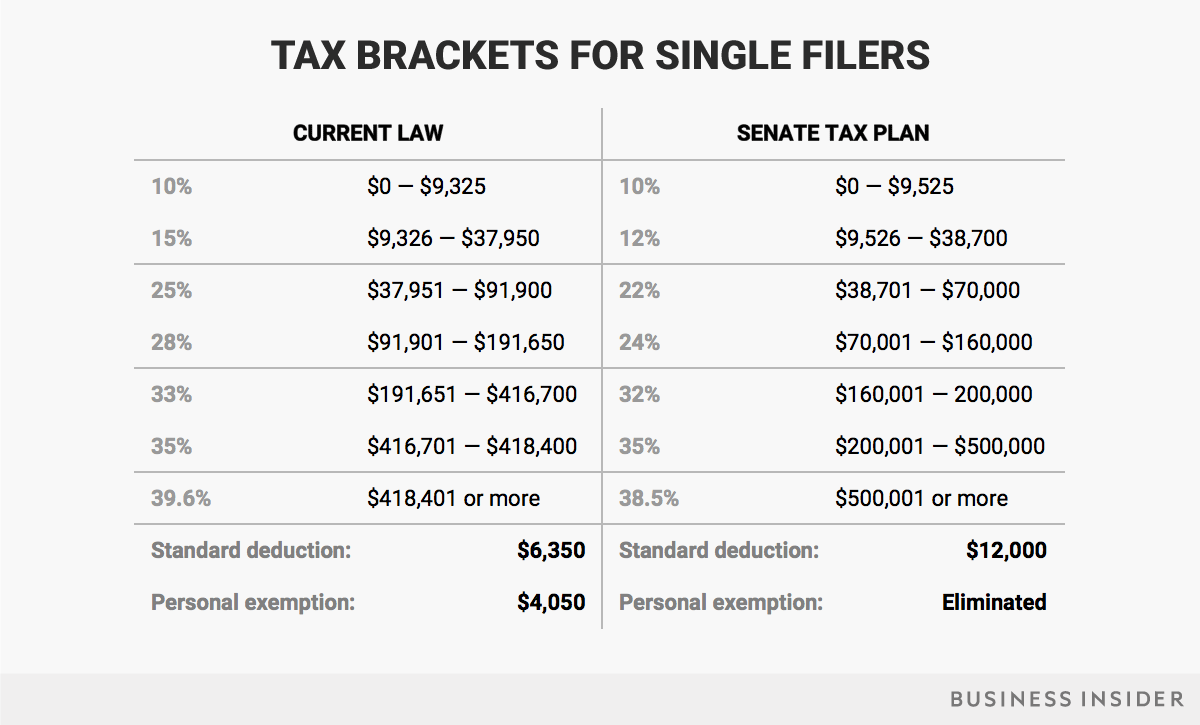

First, for single filers:

(Andy Kiersz/Business Insider)

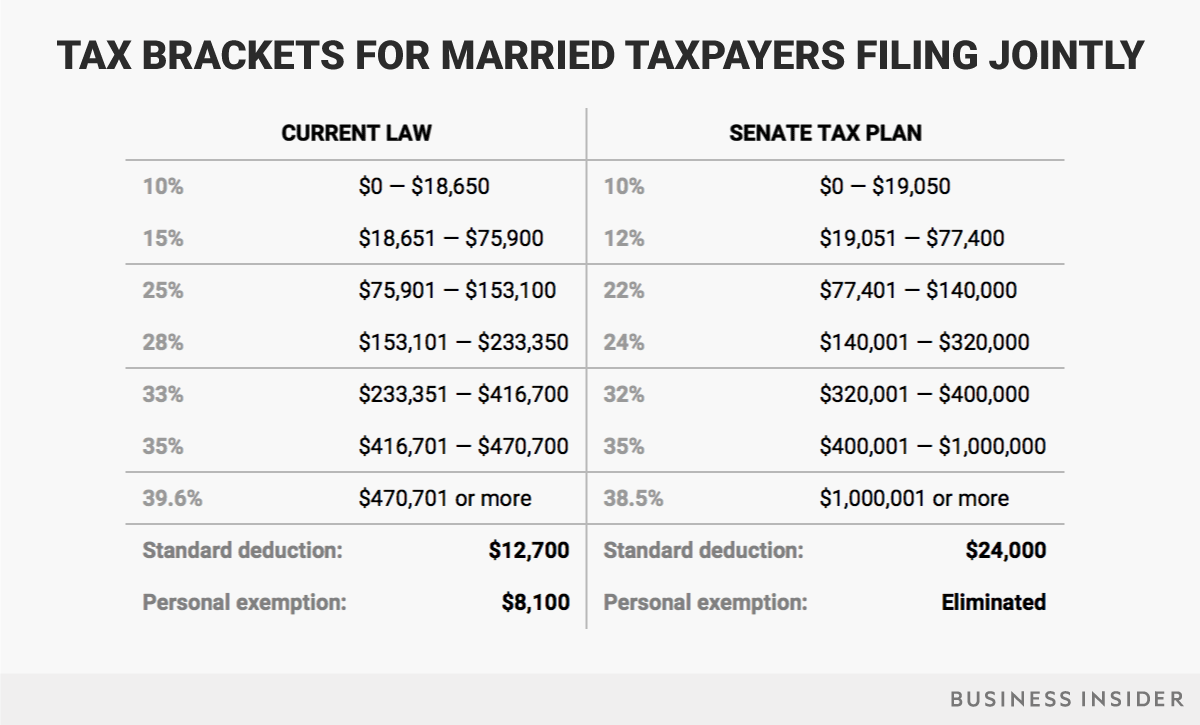

And second, for joint filers:

(Andy Kiersz/Business Insider)

Under the Senate's plan, there would still be seven federal income brackets but at slightly lower rates and adjusted income ranges. The brackets proposed are 10%, 12%, 22%, 24%, 32%, 35%, and 38.5%.

About 70% of Americans claim the standard deduction when filing their taxes, and their paychecks will almost certainly increase — albeit slightly — if tax reform passes.

In 2017, the standard deduction for a single taxpayer is $6,350, plus one personal exemption of $4,050.

The Senate proposal would combine those into one larger standard deduction for 2018: $12,000 for single filers and $24,000 for joint filers.

More from Business Insider: