The 'death rate' of America's biggest companies is surging

Savor the time you have with the companies in the S&P 500, because in 10 years, half of them will be replaced.

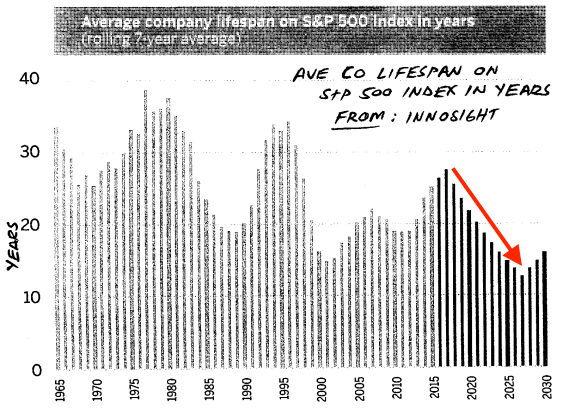

The length of time large-cap stocks have spent in the benchmark index has been declining, from 33 years on average in 1985, to 20 years as of 1990. And their window is forecast to get even smaller in the future, shrinking to 14 years by 2026, CLSA wrote in a client note, citing data from Innosight.

Those dwindling S&P 500 shelf lives are being driven by record merger and acquisition activity, as well as the rapid growth of startups that are achieving multi-billion dollar valuations faster than ever, said CLSA investment strategist Damien Kestel.

"A period of relative stability is ending," Kestel wrote in a client note. "An increasing number of corporate leaders will lose control of their firm's future."

CLSA / Innosight

While getting the boot from a major index like the S&P 500 isn't the end of a world for a company, it can certainly have some adverse effects. After a stock is no longer included in various index funds and exchange-traded products tracking the gauge — some of which are among the most heavily-traded in the world — it can see a large drop in trading volume and overall investor interest.

Still, it's also important to note that increased turnover in major indexes isn't directly negative for the market as a whole. Each company that's removed from the S&P 500 is replaced by another, in what amounts to a simple rotation.

Here's a look at which stocks have shuttled in and out of the benchmark during the eight-year bull market, according to CLSA:

Companies that have entered the S&P 500 over the past eight years: Dollar General, Facebook, Regeneron, Accenture, Fossil, Level 3 Communications, Activision Blizzard, Trip Advisor, PayPal, Universal Health Services, Altera, Under Armour, Illumina, Seagate Technology, NRG Energy, Netflix

Companies that have exited the S&P 500 over the past eight years: Family Dollar, Eastman Kodak, Covidien, Computer Sciences, Abercrombie & Fitch, Sprint, International Game Tech, JC Penney, National Semiconductor, Safeway, HJ Heinz, US Steel, Radio Shack, Dell Computer, Avon, The New York Times

NOW WATCH: Amazon's transformation of Whole Foods puts the entire grocery industry on notice

See Also:

SEE ALSO: One of the market's hottest trades is riskier than ever