The next big stock market shift could come from an unexpected source

In an ironic twist, the most downtrodden part of the stock market could be the main driver of its next leg higher.

Even more surprising: the investor base most responsible for this shift won't be flashy Wall Street types, armed with their sophisticated trading algorithms. It'll be retirees.

The market segment in question is value stocks, or companies seen as trading at a discount to fair value. Retirees are already attracted to value stocks because of the dividend yield the group has historically provided, but the pot just got even sweeter.

Value stocks are now expected to see stronger profit expansion than growth stocks, or companies viewed as having high potential for share appreciation, but not necessarily yield growth.

S&P Dow Jones Indices LLC

Meanwhile, rock-bottom bond yields have left retirees starved for returns, and the Federal Reserve has done little to improve the situation. This only adds to the appeal of value stocks.

"Even as the Fed has continued to slowly raise the Federal Funds rate, fixed income yields have held at historically low levels, leaving few options for retiree investors who need to generate income from their investments," Mike Thompson, chairman of S&P Global Market Intelligence's Investment Advisory Services portfolio strategy committee, wrote in a client note. "Many of these investors are turning to value stocks to fill the void."

Looking beyond the Fed's actions, U.S. economic conditions are also creating an ideal situation for value investing. Thompson at least partially attributes the shift in earnings growth expectations to the continued slow recovery of the U.S. economy — a development seen hindering the further appreciation of growth stocks from current levels.

Political stagnation is also having an effect, with the proposed policies that drove stocks higher after the election seemingly stuck in limbo. Because of that, "investors are adjusting to a slower-growth mindset," Thompson wrote.

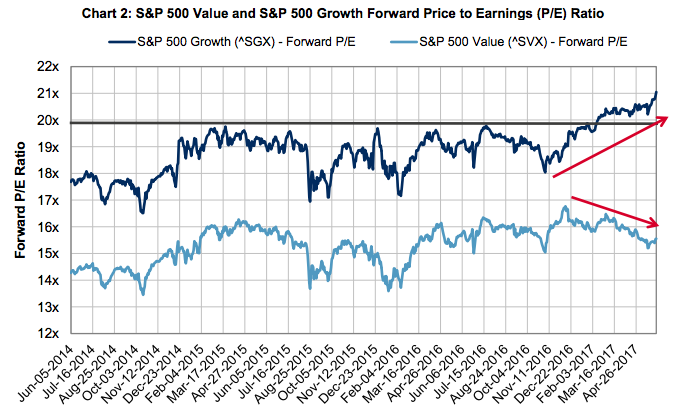

Further, while value stocks are, by definition, cheaper than their growth peers, the price divergence between the two groups in recent months is creating even more of a buying opportunity than usual. Thompson points out that while the S&P 500 Value Index is trading just below historical levels, the S&P 500 Growth Index currently sits well above its three-year average.

This valuation development "may switch investors from momentum stocks and still keep pushing the market higher," he said.

S&P Dow Jones Indices LLC

NOW WATCH: An economist explains the key issues that Trump needs to address to boost the economy

See Also:

The safety net of the stock bull market is vanishing — but it may not matter

The oldest stock market indicator known to man is flashing a big buy sign

There's a creative way to profit from the calmest market in 50 years

SEE ALSO: The safety net of the stock bull market is vanishing — but it may not matter