A daily cup of coffee ends up costing a lot more than you think

As a young man, Warren Buffett estimated he could save $300,000 over his lifetime by adjusting his haircut schedule.

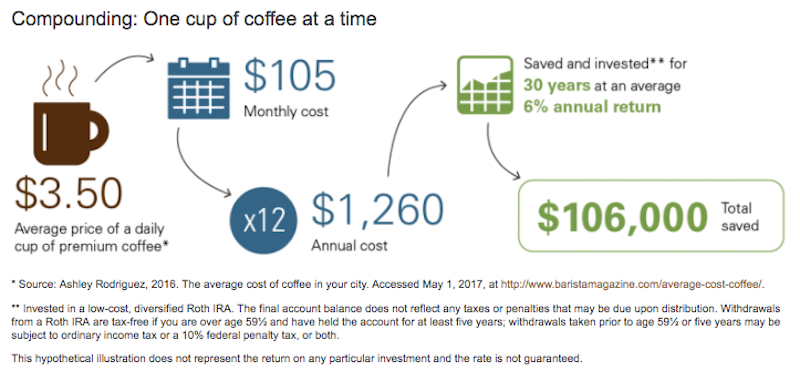

Americans looking for ways to contribute to retirement funds can similarly look to their daily purchases — such as their morning cup of coffee — for potential savings, according to a Vanguard Blog for Advisors post by Frank Kinniry.

"By pocketing the $3.50 for coffee each day and investing it instead in a low-cost, diversified Roth IRA, you'd have an estimated $106,000 after 30 years," writes Kinniry. "I don't think anyone would pay $106,000 for coffee!"

Vanguard Blog for Advisors

This type of incremental savings plan is also endorsed by David Bach, author of "Smart Couples Finish Rich."

"Becoming rich is nothing more than a matter of committing and sticking to a systematic savings and investment plan," he writes. "You don't need to have money to make money. You just need to make the right decisions — and act on them."

RELATED: 31 clever money hacks that can make you richer:

Bach estimates the amount of daily savings needed to reach $1 million by age 65 in the the chart below. While it makes certain assumptions about how those savings will grow through investment — such as a 12% annual return rate — it illustrates the impact even a modest savings plan can have in the long run.

Business Insider

But Americans, particularly millennials, have struggled to meet recommended savings goals. Kinniry notes that while Vanguard recommends saving enough so that retirees can spend 75% their annual income from when they were working, the median account balance among Vanguard retirement plan investors fell by 11% from 2014 to 2015.

But that trend is not irreversible, especially for younger investors.

"The best way to change that trend is to continue to encourage your clients to look at their spending through a compounding lens and to calculate how much their regular purchases would equate to over time," writes Kinniry. "Time is the biggest advantage young investors have."

NOW WATCH: Former Navy SEAL commanders explain why they still wake up at 4:30 a.m. — and why you should, too

More from Business Insider:

This upgrade will extend the life of your MacBook Air for years

Here's how LeBron James reacted when he learned Kevin Durant was joining the Warriors

'Do you even understand what you're asking?': Putin and Megyn Kelly have a heated exchange over Trump-Russia ties

SEE ALSO: Millennials are still spooked by the 2008 financial crisis