Payless has filed for bankruptcy and will immediately close 400 stores

Payless ShoeSource said Tuesday that it has filed for bankruptcy and will immediately close 400 stores in the US and Puerto Rico.

The discount shoe chain has filed for Chapter 11 protection on less than $1 billion in assets and $10 billion in liabilities.

Payless has been in talks with its lenders for months over a restructuring plan that at one point included closing as many as 1,000 stores, or a quarter of the company's locations.

Additional store closures are likely. The company said it planned to "work to aggressively manage the remaining" stores through additional closures — beyond the initial 400 — or modified lease terms.

Payless has 4,400 stores in 30 countries and employs nearly 22,000 people.

It was bought in 2012 by private equity firms Golden Gate Capital and Blum Capital partners.

Payless CEO W. Paul Jones cited a challenging retail environment in announcing the bankrupcty proceedings.

RELATED: Payless Inc.

"This is a difficult, but necessary, decision driven by the continued challenges of the retail environment, which will only intensify," he said in a news release. "We will build a stronger Payless for our customers, vendors and suppliers, associates, business partners and other stakeholders through this process."

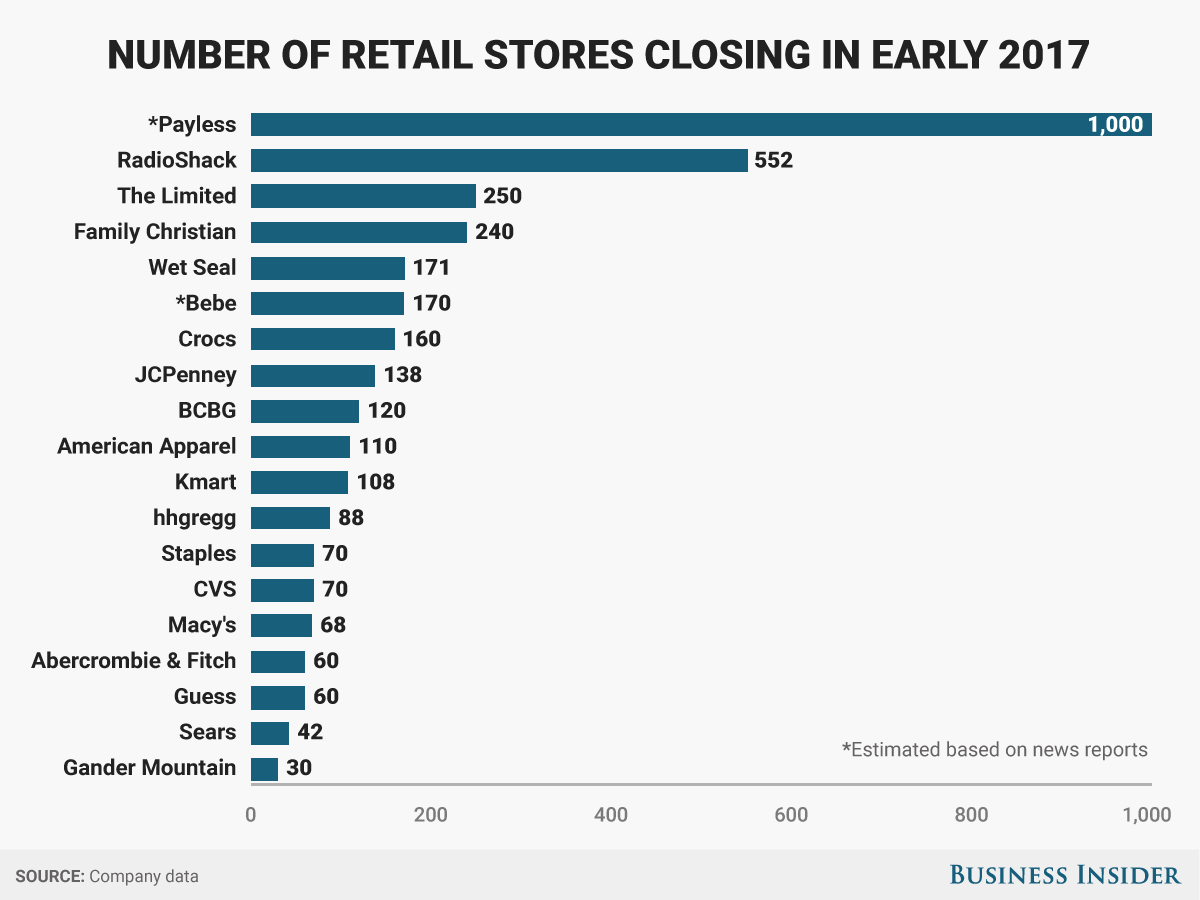

By closing stores, Payless joins a long list of other retailers cutting back on their physical presence.

Department stores like JCPenney, Macy's, Sears, and Kmart have all announced store closures this year, along with middle-of-the-mall chains like Crocs, BCBG, Abercrombie & Fitch, and Guess.

Mike Nudelman

Some retailers are exiting the brick-and-mortar business altogether and trying to shift to an all-online model.

For example, Bebe is closing all its stores — about 170 — to focus on increasing its online sales, according to a Bloomberg report.

Others are going out of business altogether, like The Limited which recently shut down all 250 of its stores.

NOW WATCH: Subway is suing the CBC for claiming its oven-roasted chicken is only 53.6% chicken

See Also:

We compared prices at Whole Foods to those at Trader Joe's — and the results were surprising

I've tried nearly every fast-food burger out there — here's who does it best

SEE ALSO: The retail apocalypse has officially descended on America