Wall Street is loading up on bets against Snapchat

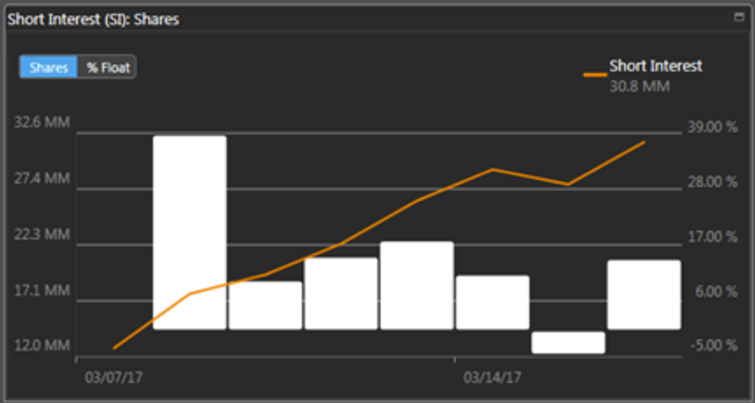

Traders are loading up on short bets against Snapchat. Short interest in the stock has surged to more than 30 million shares, making up about 15.4% of the shares available for trading, according to Data provided by the Wall Street analytics firm S3 Partners.

S3 Partners

Snapchat priced its initial public offering at $17 a share and made its Wall Street debut at $24. Shares climbed as high as $28.84 on March 3, its second day of trading, but have been retreating ever since.

The price has tumbled by nearly a third as analysts across Wall Street have come out against the stock. At least five Wall Street analysts have the stock rated as "Sell," with another two calling it a "Hold."

Anthony DiClemente of Nomura Instinet wrote that four reasons were limiting Snapchat's upside:

"Already slowing growth in daily active users (DAUs)."

"Slowing monetization (ARPU) growth."

"Fierce competition from larger rivals such as Facebook, Instagram, and WhatsApp."

"Rich valuation relative to current and future growth."

Others are pointing to the fact that common shareholders don't have voting rights as a reason to be downbeat on the stock.

STOCK PRICE FOR SNAP

Brian Wieser, an analyst at Pivotal Research Group, might be the most bearish analyst on Wall Street when it comes to Snapchat. Back when the stock debuted, he assigned a $10 target, saying the stock was "significantly overvalued given the likely scale of its long-term opportunity and the risks associated with executing against that opportunity."

NOW WATCH: 7 mega-billionaires who made a fortune last year

See Also:

SEE ALSO: GoPro finally realizes that smartphones can do exactly what its cameras can