Americans are facing a $50 billion headwind

Confidence among middle-income households has risen more than 30 points since President Trump's election, according to a note published by Morgan Stanley Research on Thursday.

Middle-income Americans are feeling more optimistic on the back of many of Trump's policies, like anticipated tax cuts, but this hasn't translated into a higher pace of spending and "not everyone is happy," according to the team led by Morgan Stanley Economist Ellen Zentner.

To understand the reason, Morgan Stanley points to the headwinds consumers are currently facing — notably the burden of rising gas prices.

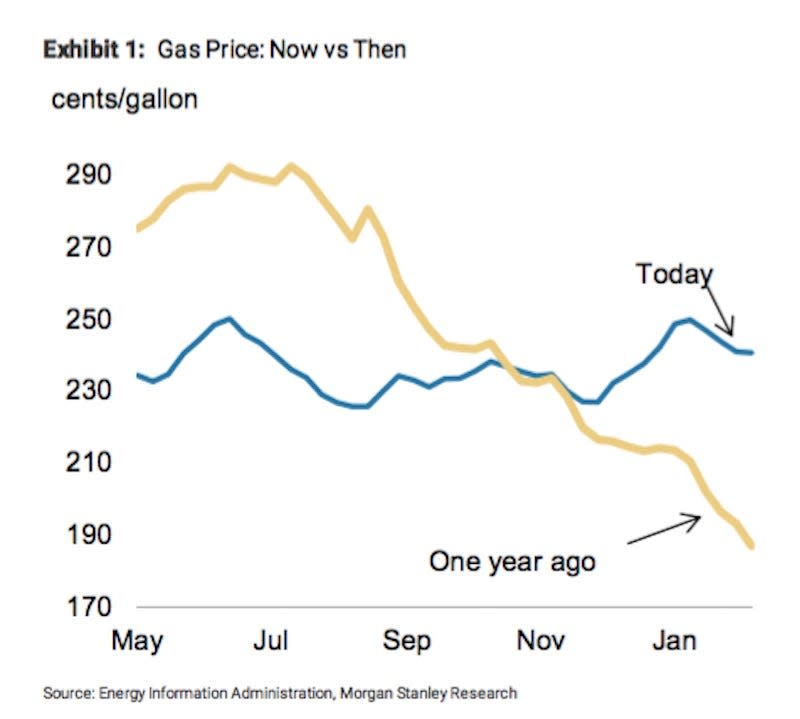

Data provided by AAA shows the average gallon regular of gasoline costs $2.284 a gallon, up from $1.698 a year ago. According to Zentner, "Annualized that is about a $50 billion headwind to the consumer wallet." She continued, "Data from the Energy Information Administration show that gas prices rose by more than 30% year-over-year in the latest week. Seasonally adjusted they increased by 8% month-over-month in December and an additional 4% in January."

Energy Information Administration, Morgan Stanley Research

The main reason for the increase in gas prices is low supplies from refineries.

The first quarter of the year also marks "refinery maintenance" season. During the maintenance period, also known as "turnaround," a refinery process unit or plant experiences a periodic shut down to perform maintenance, overhaul and repair operations and to inspect, test and replace materials and equipment. The refinery maintenance period is usually accompanied by a further spike in prices due to the decreased supply.

RELATED: Take a look at the market before Trump was elected:

In other consumer headwinds, Morgan Stanley cites the pace of wage growth not fully offsetting the slowing trend in job growth, leading to a slowdown in real disposable personal income.

The team does not expect this to be a long-lasting trend, however, and thinks that the delivery of proposed tax cuts later this year will stem the slowdown in income. The Tax Policy Center says Trump's tax plan would reduce the average American's tax bill by $2,940.

See Also: One of Wall Street's top equity analysts reveals his biggest fear for 2017

NOW WATCH: Here's how to use one of the many apps to buy and trade bitcoin

More from Business Insider:

10 must-have travel tech accessories

Goldman Sachs climbs to a record high

This simple Wi-Fi range extender eliminated dead zones and saved me from buying a more expensive router