How much will I pay in 2017 income taxes?

With the election of Donald Trump as the country's president, many Americans are looking forward to promised tax reform that could lead to dramatic changes in how their income taxes are calculated. Some could pay more, some less. However, many tax experts believe that any changes to personal income taxes will likely take effect after 2017, and so the current laws will continue to apply this year.

One thing that is vitally important to point out is that no single article -- this one included -- will be able to do as thorough a job of evaluating your income tax liability as a certified tax professional. There are simply too many variables at play to create a one-size-fits-all template.

That being said, if you consider the following, you'll get a ballpark idea of how much you'll owe in income taxes in 2017.

Step One: How much will you earn?

If you're self-employed, or an entrepreneur trying to get your business off the ground, this will be impossible to estimate. But most salaried Americans have a pretty good idea how much they'll get paid in 2017.

This is your starting point. Take out a pad of paper and a pencil, and write down this number. If you're married and filing jointly, be sure to include your spouse's income, as well as your own.

To highlight how this can work, I'll be calculating the income taxes owed by a family with a husband, wife, and two children, with an income of $85,000 per year -- well above the median of about $56,000 per household.

Author calculation

Step Two: Deductions and credits

Currently, almost every filer can count on two deductions: the standard deduction and personal exemptions. For 2017, every person that you claim on your tax filing will garner you a personal exemption of $4,050.

Standard deductions will break down as follows:

Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|

$6,350 | $12,700 | $6,350 | $9,350 |

Data source: IRS.

But that's hardly the end of the list for the deductions you can take. While I can't provide an exhaustive list here, the most popular deductions include:

Contributions to your 401(k) or 403(b) plan -- up to $18,000 for those under 50, $24,000 for those 50 and older.

Contributions to a Traditional IRA -- up to $5,500 for those under 50, $6,500 for those age 50 and older.

Any contributions to a Health Savings Plan (HSA), up to $3,400 for individuals, $6,750 for families.

Any charitable contributions -- up to 50% of your adjusted gross income, though some restrictions apply. Note that if you claim this, you'll forgo the standard deduction in favor of an itemized deduction.

Mortgage interest deduction on a home you own -- generally up to a principal balance of $1 million on the home. As with charitable donations, if you claim this, you cannot also claim the standard deduction.

And then, there are tax credits. For our purposes, we'll point out the two most popular. The child tax credit is $1,000 per qualifying child, the child and dependent care credit comes in at $3,000 for one child and $6,000 for two or more children. However, there are limits on how much and under what circumstances you can claim.

All of that can sound like a lot to compute -- and it is. No one said our tax code was simple! Take a moment, subtract out any deductions you see, and save any tax credits you might qualify for, and set them aside.

Here's how our example family's tax sheet looks now:

Author calculation.

Step Three: Find your bracket

We're almost to the end! Next, take your taxable income and your filing status, and find out where your household sits on the tax-bracket chart below. The numbers present are the upper limit for each bracket.

Single | Married Jointly | Married Separate | Head of Household | |

|---|---|---|---|---|

10% | $9,325 | $18,650 | $9,325 | $13,350 |

15% | $37,950 | $75,900 | $37,950 | $50,800 |

25% | $91,900 | $153,100 | $76,550 | $131,200 |

28% | $191,650 | $233,350 | $116,675 | $212,500 |

33% | $416,700 | $416,700 | $208,350 | $416,700 |

35% | $418,400 | $470,700 | $235,350 | $444,550 |

39.6% | $418,401+ | $470,701+ | $235,351+ | $444,551+ |

Data source: IRS.

It's important to note that, just because your taxable income places you in, say, the 25% bracket, that doesn't mean that all of your income is taxed at 25%. Instead, the first portion is taxed at 10%, the second portion at 15%, and so on.

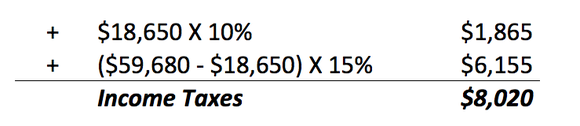

Here's how it works for our example family:

Author's calculation.

But wait, there's one last step

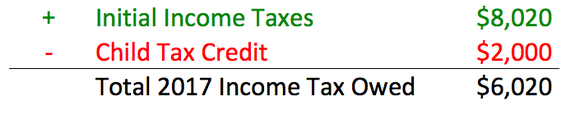

Remember those tax credits we talked about in Step Two? Now is the time that they can be applied. As I said, there are far more tax credits available than the two that I mentioned. But credits are different than deductions -- they reduce the tax burden, not the taxable income.

Since our example family included two children, they were able to claim $2,000 in tax credits. So this is what their final income tax bill looked like.

Author's calculation.

There you have it. While on the surface, you might think that this family will need to pay 25% of their income on taxes -- because that's the bracket they fall in before deductions -- that's hardly the truth. Their effective income tax rate comes out to just 7.1% of gross income.

Everyone's situation will be different, but by following the four steps above, you should be able to get a ballpark figure for what your income taxes will be in 2017.

The $15,834 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.