America's hottest investment product is about to go global

Passive investments, including exchange-traded funds (ETFs) and index funds, currently account for $6 trillion of global assets.

And, according to a report by Moody's Investor Services published on Thursday, that's just the beginning.

Current penetration in US financial markets is only 28.5%, a number that Moody's forecasts will reach over 50% by 2024 at the latest.

RELATED: Take a look at the New York Stock Exchange before the election:

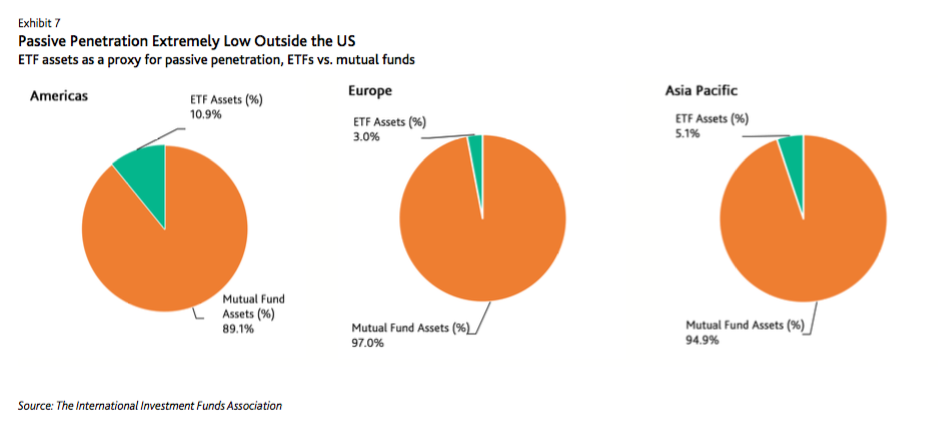

In the Europe and Asia, passive market share is only about 5-15%. The penetration rate is lower in these areas because markets are overall less developed than in the US. Investors are less aware of passive products, sales practices don't necessarily favor the best interest of investors, and corporate governance practices are less shareholder-friendly, according to Moody's.

As global and emerging markets evolve however and corporate governance improves to developed market standards, the potential for global growth in passive funds is huge.

Reuters

"Although we believe that US passive market share has much room for potential growth, the potential overseas is even greater," according to the Moody's team led by Stephen Tu. "We expect passive adoption in the EU and Asia to follow a pattern similar to the US, provided that global transparency and communication improves and that global financial markets continue to mature and become more investor friendly." Initiatives such as

Initiatives such as MiFid II in Europe aim to promote transparency of fees, which will lead to greater usage of lower-cost passive options.

Over time, Moody's expects active management to underperform passive across all major geographies, developed and emerging.

NOW WATCH: Here's how to use one of the many apps to buy and trade bitcoin

More from Business Insider:

Guys, these are some of the most comfortable jeans you'll ever wear

Nordstrom has officially cut ties with Ivanka Trump's brand

Steve Bannon's obsession with a dark theory of history should be worrisome

SEE ALSO: This chart should terrify stock pickers everywhere