Coke and Pepsi are facing a terrifying reality

Americans cut their soda intake yet again in 2015.

The total volume of soda consumed in the US dropped 1.2% in 2015, compared to a drop of 0.9% in 2014, according to Beverage Digest's annual report.

The amount of Coke consumed by Americans dropped by 1% by volume, while Pepsi Cola dropped 3.2%.

The slide in soda consumption is a continuation of a multi-year slump. In total, Americans consumed 8.7 billion 192-oz cases of carbonated soft drinks in 2015. That's 1.5 billion cases fewer than peak volume, which was 10.2 billion cases back in 2004.

Americans turning away from landmark soda brands is an obvious negative for PepsiCo and Coca-Cola. However, the companies are working hard to solve the problem — and to convince others declining soda consumption may not be such a huge issue after all.

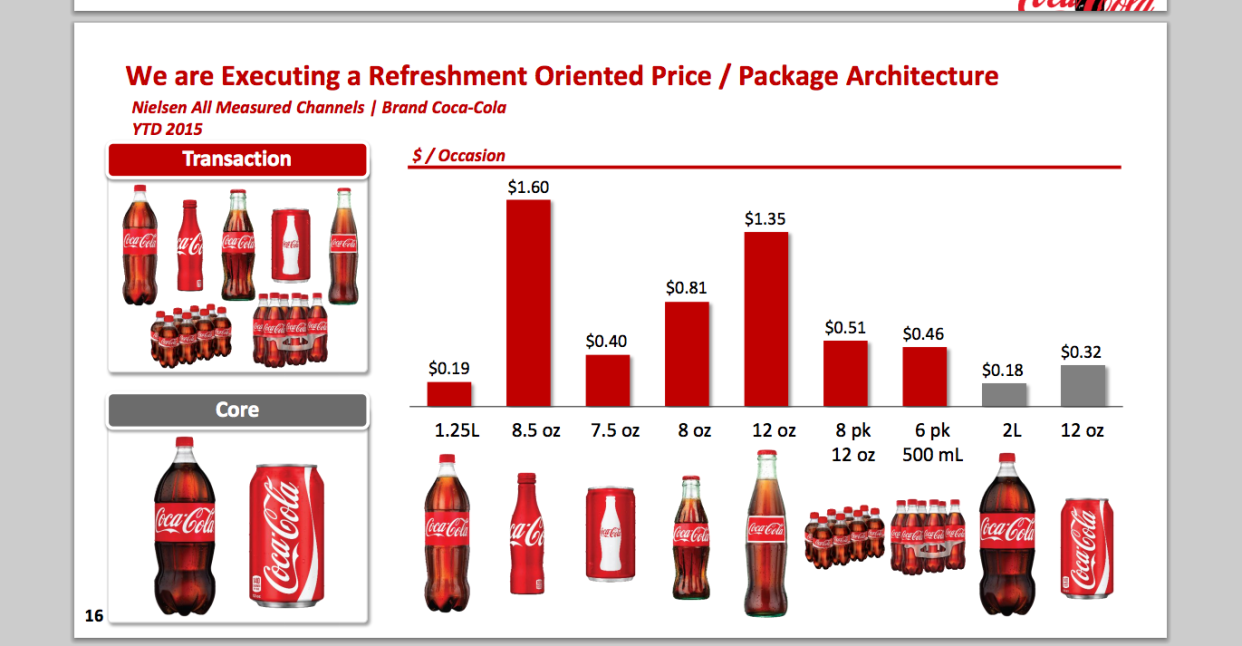

One major way companies are trying to reframe the fact that Americans are drinking less soda is by emphasizing sales of packages, instead of by gallonage.

"People ask me, 'When do you think the carbonated soft drink categories going to stop declining?'" Sandy Douglas, president of Coca-Cola North America, said in a Morgan Stanley Global Consumer and Retail Conference in November. "That question is born of measuring volume, a gallonage, not packages."

Indeed, while the sheer volume of soda that Americans drink is decreasing, soda giants are quick to emphasize that the number of bottles and cans that consumers are buying is increasing. Companies like Coke can make more money selling a smaller bottle than they can selling a larger bottle.

Thomson Reuters

"The consumer is moving to smaller packages," Douglas said. "A 12-ounce can traded to a 7-ounce can is a 30% reduction in volume, but it's an increase in revenue."

Still, even if soda companies are pushing the narrative that Americans drinking less soda is, in fact, a good thing for business, that doesn't mean Pepsi and Coke aren't looking for other solutions. Coca-Cola and Pepsi are increasingly diversifying outside of their namesake sodas to sell drinks that consumers perceive as healthier — and customers are responding positively.

While volume across cola brands decreased, non-carbonated options grew in 2015. Gatorade's volume increased 6.1% in the liquid refreshment beverage category in 2015, while consumption of water brands Dasani, Aquafina, and Poland Springs increased in volume from 6.5% to 11.4%.

Related: The evolution of Coca-Cola through the years:

NOW WATCH: Here's how much sugar is in your favorite drinks

See Also:

SEE ALSO: Coca-Cola figured out how to make more money by selling less soda