How to avoid IRS scams during tax season

It's tax season and the stress is high. Filing your taxes is stressful on its own, but these days you also have to worry about cybercriminals trying to steal your money. Those criminals are counting on you being stressed out and confused by all the tax forms coming in the mail and the flood of information the IRS requests from you.

The IRS reports that from January through November last year, it blocked $8 billion in fraudulent tax returns, including when someone uses your ID to claim your tax refund. That doesn't even include other crimes.

At its recent Security Summit, the IRS urged professional tax preparers, and the estimated 120 million people filing electronic returns this year, to ramp up their Internet security efforts, and other security practices. The IRS launched an awareness campaign to "better inform you about the need to protect your personal, tax, and financial data online and at home."

According to the IRS, "People continue to fall prey to clever cybercriminals." These criminals trick you into giving them your Social Security numbers, financial account information and passwords.

Cybercriminals use several methods to steal your information. On the next page, we'll list three ways that cybercriminals steal your identity. But, don't worry, keep reading for three tips to protect yourself this tax season.

How criminals steal your information

1. Phone extortion

If you've been receiving alarming phone calls that are supposedly from the IRS, with scary prerecorded messages about them taking legal action against you, those are very likely cybercriminals. You're not alone in receiving these calls. Since 2013, about 900,000 of these phone calls have made by criminals claiming to be from the IRS, according to our sponsor Kaspersky Lab.

"Given the power of the IRS and the complexity of the code, where mistakes can easily be made, concern about this type of communication from the real IRS makes these calls something to take seriously, and not easy to dismiss," notes Kaspersky Lab. "This fear is exactly what criminals hope to exploit."

2. Phishing

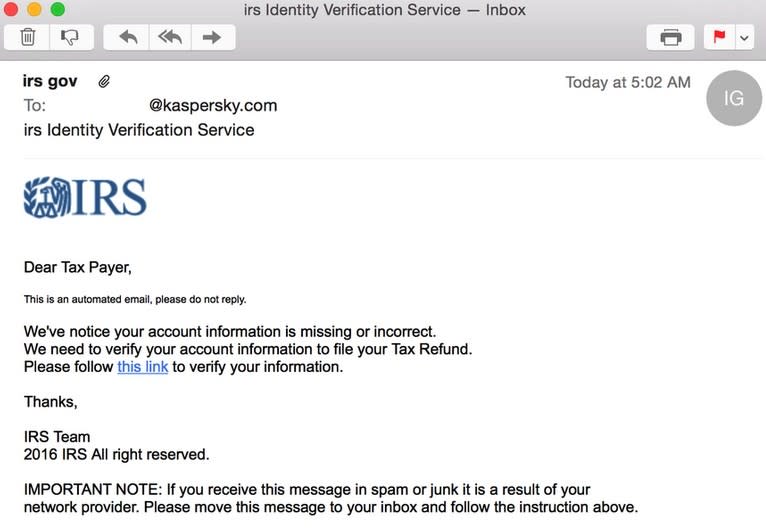

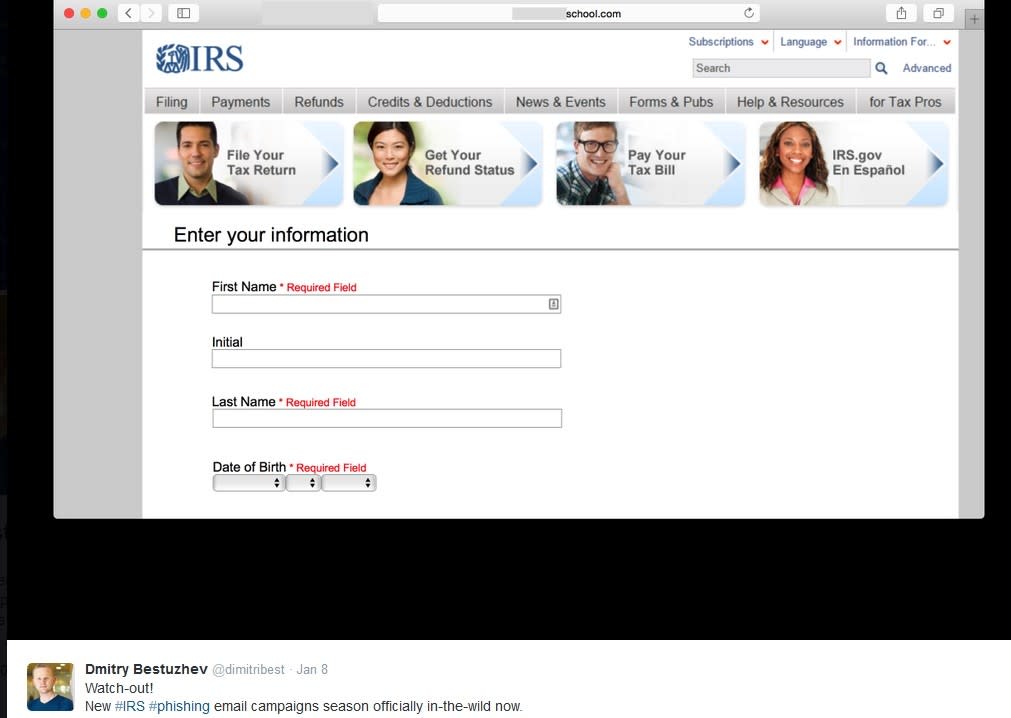

We often tell you about phishing email scams, where you receive an email from a cybercriminal disguised to look like it's from a legitimate company, with official-looking logos and letterhead. Cybercriminals use this technique during tax season, too. (See photos below.)

You'll receive emails, like this one sent to a Kaspersky Lab employee. It appears to be from the IRS, but it's from a cybercriminal. This email takes you to websites where they'll collect your personal information, and may infect your device with malware. "When in doubt, call the IRS," advises Kaspersky Lab.

3. False filings

Cybercriminals will use your information to file your tax return, and take your refund. If you get a rejection letter from the IRS when you file your taxes, saying you've already filed your return, immediately call the IRS.

So, what can you do? Keep reading for tips from Kaspersky Lab to stay safe this tax season.

Protect yourself from criminals

It's always important to be cautious when it comes to giving people your Social Security number, or any identifying information by phone or email. But, during tax season, you need to be extra vigilant.

It's estimated that almost 25% of the scams tracked by the Better Business Bureau last year involved taxes. Here are three ways you can protect yourself, your ID, and your finances this tax season.

1. Verify, then trust

If you are contacted by anyone claiming to be with the IRS, call them back to ensure that the phone call or email came from them. Plus, "if you really owe money to the IRS, it is almost certain that the communication will come by postal mail in order to include a payment form, so any other method of contact should set off alarm bells."

2. ID and credit monitoring

As we often suggest to you, it's important to have strong Internet security software protecting your devices, and strong passwords to keep cybercriminals out. Beyond that, Kaspersky Lab recommends that you think about signing up with a company that "proactively monitors your credit and ID," using either a company that specializes in this, your credit card, or your bank. Click here to learn what monitoring service we recommend for keeping your tax return safe (sponsor).

3. Don't share your identity with anyone

"Unless you can confirm that you are really chatting with an agent of the government for legitimate purposes, there is no need to hand over it over."

The best way to make sure you're talking with a legitimate IRS agent is to be the one making the call. Learn more about spotting and dealing with a scam IRS call.

Get more information on safely filing your taxes this year, and saving money doing it.

More from Komando.com:

3 apps that tell you the best route for multiple stops

5 sites to watch live TV absolutely free

Ways to bring the family together for dinner