Apple can't tell you iPhone sales are booming, so it's talking about 'services.' That's a problem.

Apple is boasting about its "services" revenue in Q2. It didn't boast about iPhone sales, which declined.

Which is why Apple has been telling Wall Street "services" are an important growth category for some time.

The problem: Apple's two primary growth drivers for services are at risk from antitrust suits and rules.

Apple had a great second quarter, Apple says: The company hit an "all-time revenue record in Services," the company reported.

But … what about the thing that actually drives Apple — the iPhone?

There's no mention of that in Apple's press release. And if you head over to the company's financials, you can see why: iPhone sales dropped by 10% in the past three months.

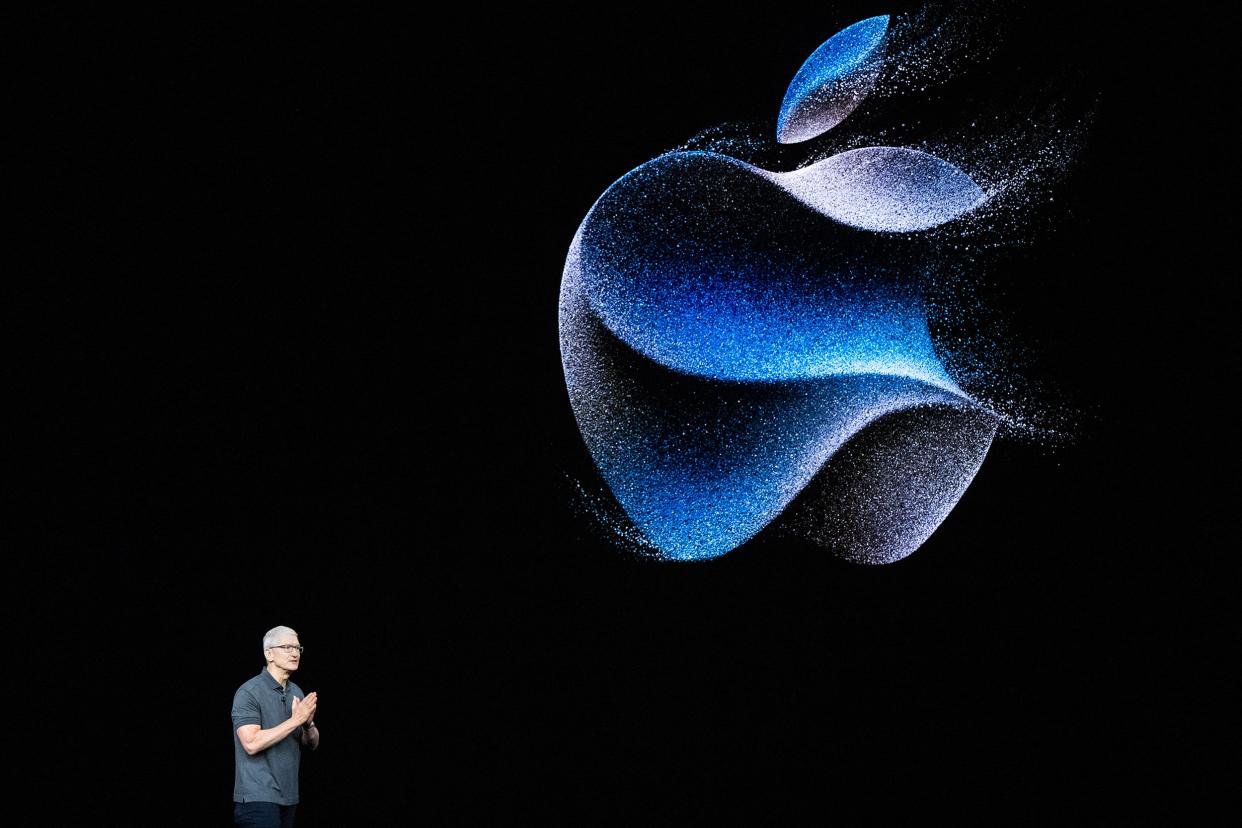

That drop isn't a surprise to Wall Street, though the cause of the decline is up for debate. Before Thursday's earnings, analysts had fretted that Chinese iPhone sales were soft, but on Thursday afternoon, Cook told CNBC that iPhone sales in China were up. "That may come as a surprise to some people," he deadpanned.

Step back, though, and Apple's earnings confirm a story we've been telling you about for some time: Sales of the iPhone, which have been powering the company for a decade-plus, just aren't going to grow like they used to.

If you want an iPhone, you have an iPhone. And iPhones are now so good that there's less reason to replace them every couple of years, despite Apple's efforts to convince you that new features like a better camera or talking-poop emoji are worth the upgrade. I've got an iPhone 13 Max, and it's great. So I've got no interest in moving up to the iPhone 16 Apple will show off this fall.

Why Apple is so focused on 'services'

All of which is why Apple has increasingly been stressing its "services" business, which many people think is about sexy stuff like Apple Music and Apple TV+. But the main driver for services is really two things: the money Google pays Apple to be the default search engine on iPhones and the money that Apple makes from in-app purchases in its App Store.

But both of those revenue streams are facing some degree of risk. The US Justice Department's antitrust suit against Google focuses on moves the company makes to maintain its monopoly on search — like paying Apple $20 billion for its search deal in 2022.

And, as we've been pointing out repeatedly, Apple's App Store rules are under increasing pressure from regulators around the world — in the EU in particular. You can debate whether those rules are built to protect customers, as Apple argues, or whether they are anticompetitive strictures meant to protect Apple, as the company's critics allege.

Regardless, the App Store revenues are a major contributor to "services." And Apple has made it clear that it's going to change the way it runs its App Store only when it's compelled to by regulators. And even when that happens, it's only going to do so kicking and screaming. Thursday's earnings report helps underline why.

Read the original article on Business Insider