Analyst: Apple stock is a Buy ahead of the inflationary iPhone 14 release

Optimism on Apple's next suite of products is running high ahead of the company's Sept. 7 event.

Apple stock is up over 15% in the last two months as investors bank on higher prices for the iPhone 14 family and speculate on new augmented reality glasses from the tech giant.

"In our opinion, iPhone pricing is the main focus item for investors followed by timing and cadence of the launch and any news on pricing/bundling," Bank of America analyst Wamsi Mohan wrote in a new note to clients.

Mohan is staying bullish on Apple's stock into the event next month. Here's what Mohan had to say about Apple.

Price Target: $185

Rating: Buy (reiterated)

Stock Price movement assumed: +16%

Mohan's call on iPhone pricing:

"In our Apple model we assume iPhone 14 is launched at the same launch prices as iPhone 13," Mohan wrote. "However, with an inflationary backdrop, Apple could choose to increase the price of the Pro models (high end consumer less sensitive to price) and leave the lower end models unchanged."

"If Apple were to raise pro-model prices by $50," Mohan added, "we estimate a $0.20 EPS tailwind. We look at a scenario where Apple raises iPhone 14 Pro/Pro Max prices by $50 each, while lowering prices for iPhone 14/14 Max by $50. We estimate about $0.10 benefit if 10 million incremental iPhone units are sold."

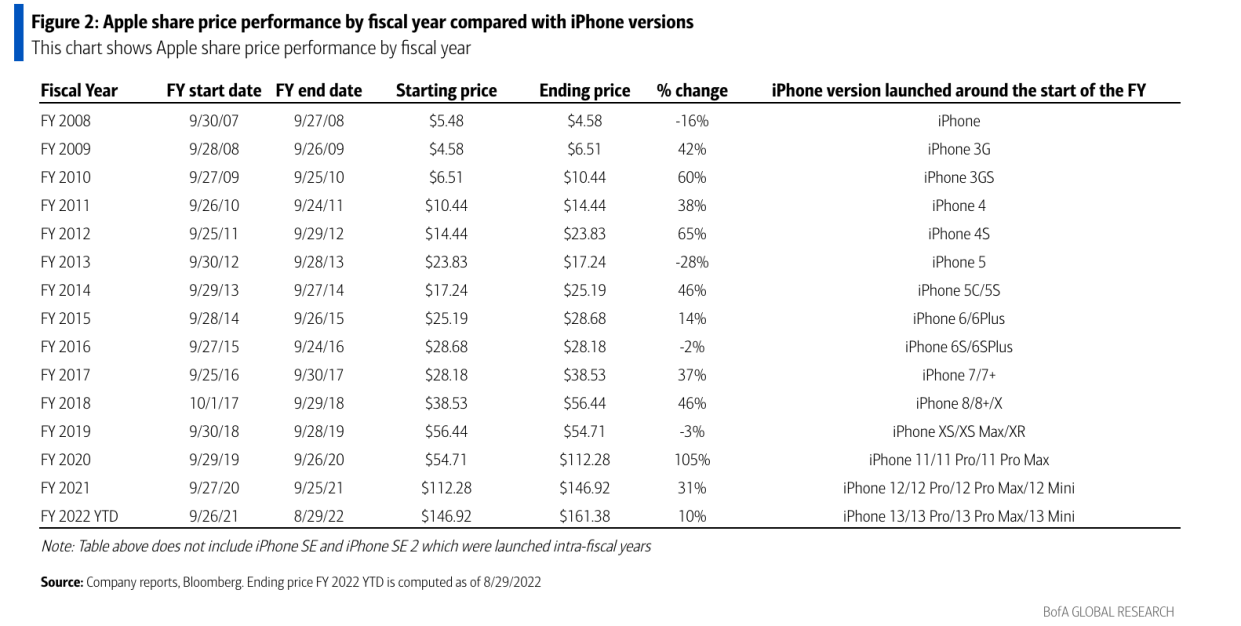

What Apple's stock does around iPhone releases:

Apple has launched a new version of the iPhone around the start of its fiscal year for the past 14 years. The stock has seen double-digit growth for many of those years and even saw triple-digit growth in fiscal year 2020.

Mohan's long-term thesis on Apple:

Mohan's Buy rating on Apple is based on a number of factors: "1) strong iPhone upgrade cycle in fiscal year 2023 driven by the need for higher connectivity which will enable new AR/VR applications, 2) higher growth in services revenues, 3) expectation that the multiple will re-rate higher as has been the case before major product launches, 4) continuing strong capital returns, 5) Apple likely to charge for App and in-App purchases outside the App store, and 6) shares likely to outperform in a broader market down cycle."

The tech industry vibe:

Second-quarter earnings season for a large chunk of large-cap tech companies has been mixed, at best.

Companies such as HP have warned about slowing growth in PCs as consumers pull back on spending.

Meanwhile, Salesforce recently warned about cooling sales for enterprise clients. And companies like Snap are laying off workers in droves to combat a slowdown in the advertising market.

From the Yahoo Finance Live archives: HP CEO Enrique Lores weighs in on demand for PCs

"So this is something that we were expecting, a slowdown in consumer, but clearly the slowdown was bigger than we were expecting," HP CEO Enrique Lorestold Yahoo Finance Live following a sales miss late Tuesday.

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube