America's love for home remodeling cools off amid higher interest rates

During the pandemic, Demi Fox, a homeowner and Realtor, was ultra-focused on upgrading her home, taking on remodeling and DIY projects. But now Fox has put on the brakes and is less willing to dole out money for upgrades for her Simi Valley, Calif., home.

"We were going to do the kitchen but we’re holding back right now. Looking at the numbers, I said ‘nah,’” Fox told Yahoo Finance. "I like using my own money when I remodel. I don’t like to use any kind of loan."

Fox is among many homeowners who are rethinking their remodeling plans following the boom during the pandemic. Less savings, higher interest rates, and the lack of housing activity in the resale market are among the reasons the industry is bracing for a slowdown.

Total spending on home improvement and repairs is projected to drop 7.7% over the next four quarters to $452 billion, researchers from Harvard University’s Joint Center for Housing Studies’ latest Leading Indicator of Remodeling Activity showed.

"The decline [expected] in 2024, if that comes to pass, would be the first decline in more than a decade," Abbe Will, associate project director of the Remodeling Futures Program, told Yahoo Finance in an interview.

A second measure of remodeling activity also captured the slowdown.

Data from the National Association of Home Builders showed remodeler confidence slipped in the third quarter of this year, with the index measuring current conditions falling for projects of all sizes and the index gauging future activity — rate at which leads and inquiries are coming in and the backlog of jobs — also declining. Still, the overall index signals that more remodelers view remodeling market conditions as good than poor.

"While there is still demand for remodeling, we are seeing some customers pull back a bit, especially for larger projects, due to higher prices and increased interest rates," said NAHB Remodelers Chair Alan Archuleta, a remodeler from Morristown, N.J.

‘It was really easy to take cash out’

The pandemic unleashed home improvement demand in 2020 and 2021. The unique circumstances of the time made people rethink their relationship with their homes.

"They thought we're going to be spending a lot of time at home for the next few years or for the foreseeable future," Eric Finnigan, vice president, research and demographics at John Burns Research & Consulting told Yahoo Finance. "We need to make this comfortable. We need to make this livable and functional with not just us working at home, but also our kids doing school at home."

Financing those projects got easier, too. Three rounds of stimulus checks fattened checking accounts. Historically low interest rates made borrowing cheap. And home equity was soaring because the housing market took off.

"It was really easy to take cash out or equity out of the home," Finnigan said. "We saw a huge spike in cash out refinance activity, which then showed up in account balances for people's checking accounts and savings accounts."

‘People are getting really cost sensitive’

But things are shaping up differently now.

"It is just a matter of money was really cheap [then] and now money's really expensive," Finnigan said. "People are getting really cost sensitive and they're feeling a lot more conservative about putting money in their home."

While many Americans are sitting on valuable homes still, the average rate on a 30-year fixed mortgage is more than double what it was in 2020 and 2021, sitting at 7.63% this week, according to Freddie Mac. As a result, cash-out refinances have shrunk.

Read more: Mortgage rates at 20-year high: Is 2023 a good time to buy a house?

During the first half of this year, cash-refinances totaled $24 billion, down from $141 billion in the first half of 2022, per Freddie Mac data. As a share of total home equity, aggregate equity cashed out represented only 0.04% in the first and second quarter of this year, down from 0.28% and 0.17% in the first and second quarters of 2021, respectively.

Credit cards are also an expensive option to finance projects. The average annual percentage rate on a credit card is more than 20%, the highest level in at least 38 years, according to Bankrate.

Read more: Can I use a credit card to pay my mortgage?

The pullback in the homebuying market also is driving the slowdown. Homeowners are reluctant to sell their properties because they’ll lose the historically low mortgage rate they secured during the pandemic. So there’s no reason for these owners to fix up their homes to sell.

Buyers, on the other hand, have to shell out more money to just buy a home these days with home prices still at record highs and borrowing costs more expensive. That doesn’t leave a lot for renovations after move-in. And more buyers are turning to new homes this year, because builders can offer incentives on mortgage rates.

Read more: Types of mortgage loans: Buying a house in 2023

"The impact on home sales, existing home sales in particular, has been very meaningful," Will said. "A lot of remodeling does tend to happen around the time of a sale. That's certainly not conducive this year if we don't have the sales, and people won't be remodeling their newly purchased homes next year."

‘More maintenance on older homes’

Still, remodeling activity hasn’t totally dried up — and the long-term outlook points to continued demand.

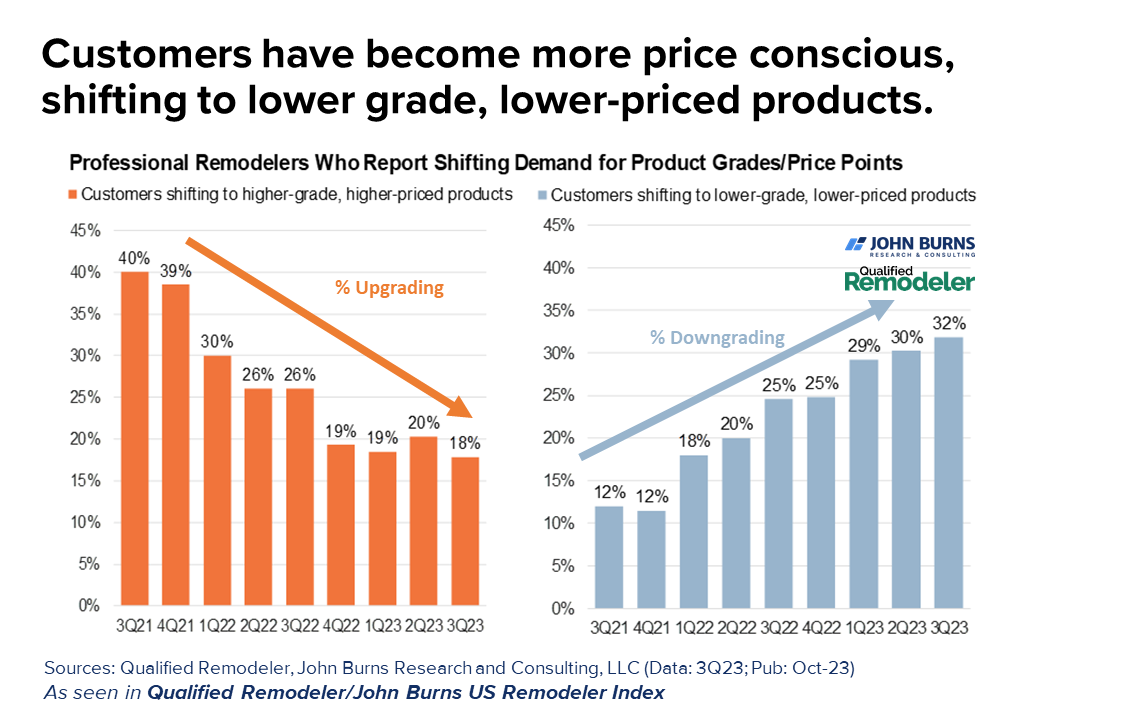

A quarterly survey from John Burns Research & Consulting found one-third of customers say they are focusing on smaller projects, and reducing project scopes, while 32% are shifting to cheaper materials — all to save on upfront costs.

That’s what Fox is doing. "We are changing appliances and doing touch-ups," she said.

"Homeowners are saying costs have gotten so out of control – on materials, labor, and interest rates – that many homeowners are saying those big, nice-to-have home improvement projects can wait, for now," Finnigan said.

Overall, homeowners may have no choice but to finance home improvements down the road because the housing stock is aging. About 50% of homeowners live in a home that was built before the 1980s, which means lots of kitchens, bathrooms, and roofs will need upgrades.

"The average age of our homes has been steadily going up over the last couple decades. That certainly will provide some lift to remodeling activity just in terms of needing to do more maintenance on older homes," Will said.

Spending on renovations and repairs is expected to grow 2% by the end of the year, according to Harvard University’s Joint Center for Housing Studies’ research.

"There is still a solid base of long-term homeowners that are moving forward with remodeling projects. These homeowners – think older, with a solid nest egg, and looking to stay in their home for another 20 years – want a home that accommodates their own changing needs," Finnigan said.

Since "there are so few homes available to purchase, these homeowners are choosing to remodel instead of move. This "trade-up-in-place" phenomenon is keeping the home improvement and remodeling industry afloat," he added.

—

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter @daniromerotv.