America deserves its downgrade

The United States is the world’s most overprivileged nation. We get away with crap nobody else does, rarely paying a price for ineptitude or malfeasance.

The Fitch ratings agency is like a scolding parent calling out an undisciplined child. Fitch downgraded the US credit rating by one notch on Aug. 1, from the highest level, AAA, to AA+. It’s the second downgrade of America’s once-sterling credit, following a similar action by S&P Global Ratings in 2011.

Fitch’s action drew a lot of criticism from President Biden's deputies and allies and from members of Congress copping a how-dare-they attitude. Some economists argue that a downgrade makes no sense at this particular moment, given that the US economy is growing, unemployment is close to record lows, and no other advanced nation emerged from the COVID pandemic as strongly as the United States.

Bah. Fitch is spot-on with its downgrade and its rationale. Fitch cited “a steady deterioration in standards of governance over the last 20 years" along with "the expected fiscal deterioration over the next three years.” The firm argued that “repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

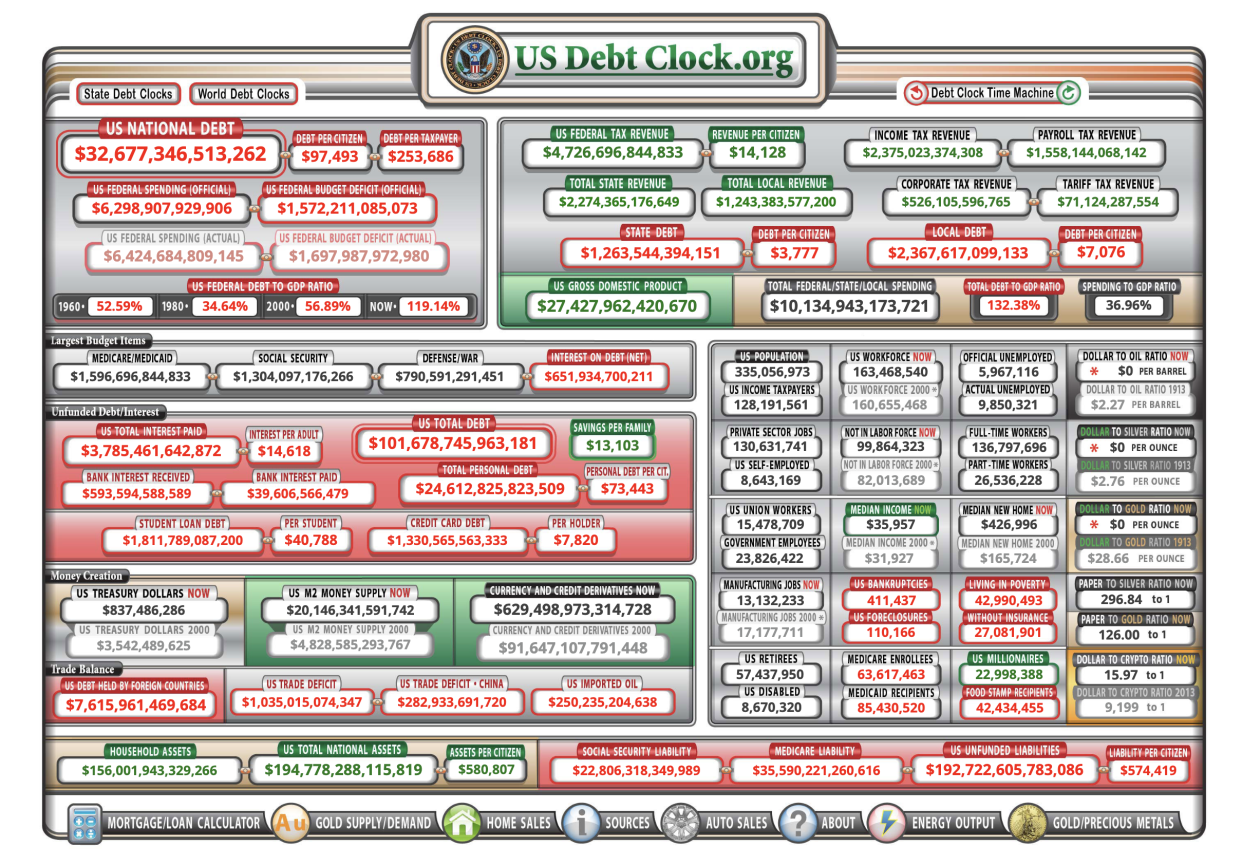

Who could possibly argue with this? Politicians of both parties have grown accustomed to playing games with the nation’s finances and completely disregarding a mushrooming debt bomb. Financial markets are complicit. The dollar’s status as the world’s reserve currency keeps US interest rates far lower than they’d be otherwise. Investors everywhere demand dollars because there’s no better alternative. The Federal Reserve is the world’s most powerful financial institution, with incredibly powerful tools for averting financial pain.

All of this enables abject behavior by America’s fiscal stewards, who would get fired and sued if they ran a bank or an ordinary company the way they run the United States of America. The worst offenses, as Fitch points out, are routine threats to default on US debt by refusing to allow any further borrowing every time the Treasury hits the federal borrowing limit.

This only happens because long ago, Congress established a total limit on federal debt as a way of keeping the federal budget under control. It worked for a while. But starting around the time of the Great Recession in 2008, the US debt burden exploded, due to fiscal stimulus, the growing cost of federal healthcare programs, the retirement of baby boomers, tax cuts that failed to pay for themselves, and other factors. The debt limit has done absolutely nothing to control debt levels during the last 15 years.

Congress could repeal this now-pointless law, and we’d have no more standoffs over whether the Treasury can continue borrowing to finance spending Congress has already approved. But Republicans in particular find the periodic need to raise the borrowing limit useful because it provides a regular hostage-holding opportunity. We all know the plot: For a few weeks, Republicans pretend they care about the nation’s mounting debt and threaten default unless Congress slashes funding for the poor and a few other causes deemed unworthy.

[Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.]

There’s always a last second deal, as there was in May, when we hit the borrowing limit, again. But if you continually threaten not to pay your debts, why in the world should you have a top credit rating? If there are enough Republicans to interrupt regular government operations when they control just one of two houses of Congress, then it stands to reason they could blow the whole thing up if they controlled both houses of Congress and the White House — especially if Capt. Chaos, Donald Trump, earns another term in the White House. Fitch is treating deadbeats the way deadbeats deserve to be treated.

Democrats aren’t blameless. Biden is going around bragging about how he “reduced” a deficit that will hit around $1.5 trillion this year, up from $1.3 trillion last year. Biden’s “reduction” comes from the fact that the deficit was $3.1 trillion in 2020, because of huge amounts of COVID relief, so his deficits are lower by comparison to that hugely anomalous baseline. But Biden is gliding over the fact the deficits are likely only to get progressively worse. He’d address the problem by raising taxes on businesses and the wealthy, but the votes aren't there to do it. Even when Democrats controlled the House and Senate during Biden’s first two years, they couldn’t raise those taxes.

You could reasonably argue that the US credit rating should be even lower than it is. Moody’s still rates the United States AAA, and at the AA+ rating Fitch and S&P assign, the US still seems to be doing way better than other advanced nations. The United Kingdom and France, for instance, both have smaller debt loads than the United States, yet their credit ratings are lower. Japan has the highest debt burden of any advanced economy, and its credit rating, as expected, is several steps below America’s. That's America's special status inoculating it from internal sabotage.

The United States still has ample capacity to respond if or when there is a full-blown debt crisis. The government’s power to tax is effectively unlimited, and it could slash spending if needed, as well. Those measures could easily cause a recession, and perhaps a deep one, if there’s already some kind of financial crisis that requires such stringent measures. But Uncle Sam would have no choice, if the alternative were actual nonpayment of US debt, which would have calamitous repercussions.

As virtually all analyses of America’s mounting debt load point out, the real problem isn’t the financials; it’s cowardly policymaking and the weaponization of debt politics. Instead of acting outraged and insulted by Fitch’s sober assessment, a proper steward of America’s finances would be alarmed. Apparently everybody sees the problem except those who are causing it.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance