Amazon CEO Andy Jassy warns about 'short-term headwinds' for AWS business

The Amazon Web Services (AWS) business that Amazon (AMZN) CEO Andy Jassy used to run is starting to suck wind as the economy downshifts and competition from Microsoft and others in the cloud intensifies.

"Despite growing 29% year-over-year (“YoY”) in 2022 on a $62B [billion] revenue base, AWS faces short-term headwinds right now as companies are being more cautious in spending given the challenging, current macroeconomic conditions," Jassy acknowledged in his second annual shareholder letter on Thursday.

Jassy, who assumed the CEO mantle from billionaire founder Jeff Bezos in July 2021, is also dealing with layoffs and overall slowing growth elsewhere.

"While these short-term headwinds soften our growth rate, we like a lot of the fundamentals that we’re seeing in AWS," Jassy added in the letter to shareholders. "Our new customer pipeline is robust, as are our active migrations."

Stabilizing the AWS business is mission critical in the minds of Wall Street.

"Slowing cloud demand remains a key concern as businesses shift focus from accelerating cloud migration to optimizing cloud costs," Jefferies analyst Brent Thill wrote in a client note earlier this week. "AWS estimates continue to contract, with consensus implying year over year growth troughs in 2Q23. Given AWS comprises the vast majority of Amazon's operating income, a stabilization in cloud is crucial for shares to outperform."

Thill's analysis shows 2023 sales estimates for AWS continue to decline, with projections currently 12% lower than they were in February 2022 and 5% lower compared to the start of the year. Operating margin estimates for AWS are alarmingly falling faster, Thill noted, with AWS operating margin estimates for 2023 slashed by 27% compared to where they were in February 2022.

Thill cut his 2023 AWS operating margin estimate by 3.5% in the new note. The analyst doesn't see operating margins improving for AWS until 2024.

Other stats on AWS to consider from Thill's analysis:

Consensus estimates imply that the AWS growth rate will bottom in the second quarter of 2023.

AWS year-over-year net sales growth has decelerated for four straight quarters.

AWS backlog growth has decelerated for three straight quarters.

AWS's operating margin remains under pressure since peaking at 35% in the first quarter of 2022, with the fourth-quarter 2022 AWS operating margin of 24.4% representing the lowest level since the second quarter of 2017.

Thill contends the slowdown in AWS is the primary reason Amazon's stock has badly underperformed tech rivals over the past year.

Amazon stock has shed 35% in the past year, lagging slight drops in cloud rivals Microsoft (MSFT) and Salesforce (CRM).

And Amazon stock has dropped 44% since Jassy took over as CEO, compared to a 6% decline for the S&P 500 during that time.

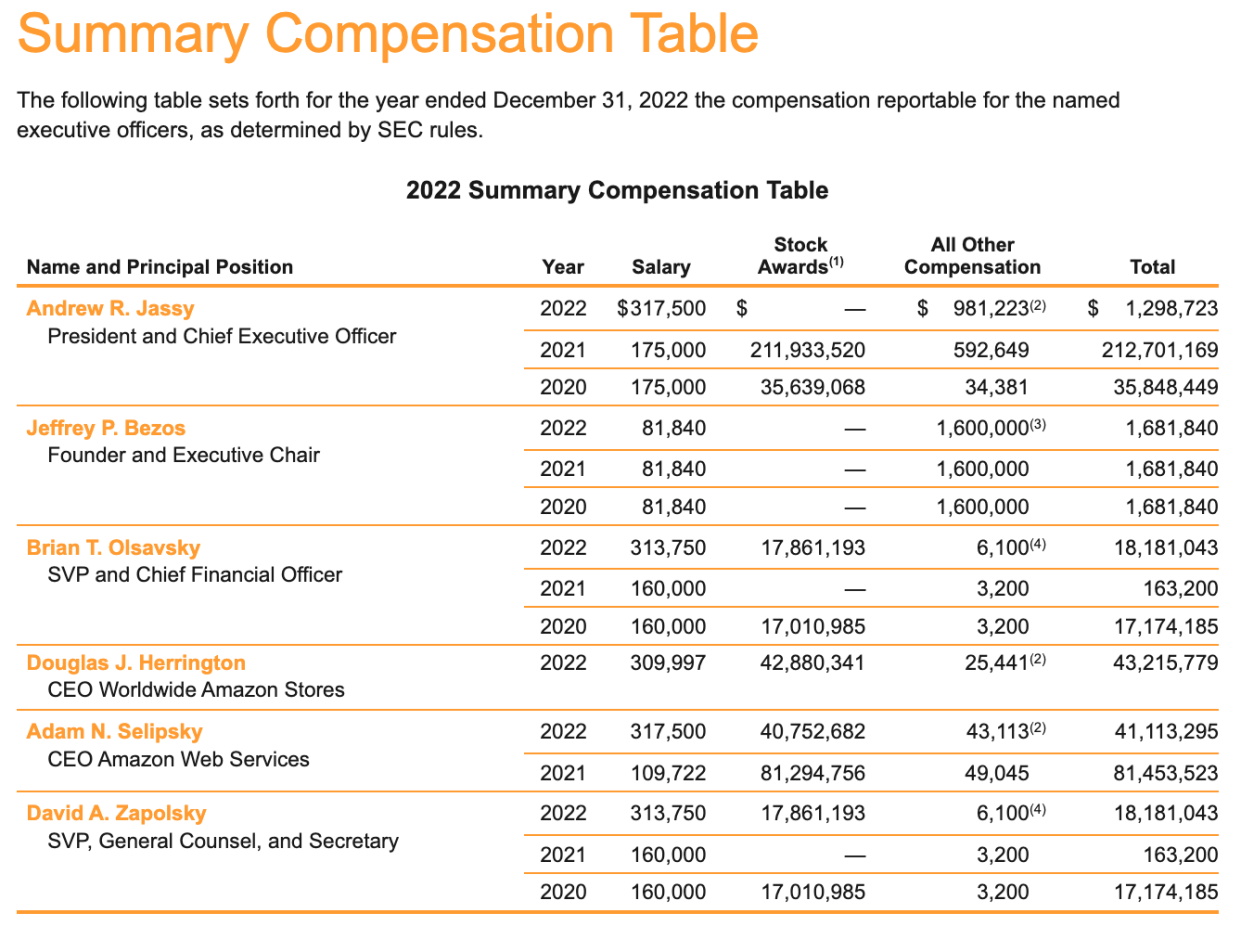

Jassy, meanwhile, has hauled in about $250 million in total compensation, according to the company's proxy statement also filed today.

Brian Sozzi is Yahoo Finance's Executive Editor. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations or anything else? Email brian.sozzi@yahoofinance.com

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance