Airbnb, Uber Technologies, and Super Micro Computer Have All Been Included in the S&P 500 in the Past Year. This Growth Stock Is on Track to Be Next, According to 1 Wall Street Analyst.

The S&P 500 is arguably the most followed stock index in the world. It's existed in its current form since 1957 and tracks the 500 largest and most profitable publicly traded companies in the United States. Consequently, it's a benchmark for the stock market and the economy.

The obvious implication is that the constituents of this index are some of the biggest and the most influential companies in the world. If they're succeeding or struggling overall, chances are other companies are too.

Here's the thing, though: A list of profitable, important, and publicly traded companies isn't static -- things are constantly changing. And the S&P 500 is constantly updating which companies make the cut. In just the past year, Airbnb, Uber Technologies, and Super Micro Computer were added to the S&P 500 index.

Just think about it: 20 years ago, the idea of sharing a personal residence with travelers was ludicrous. But Airbnb has made a huge, profitable business of it since. It makes sense for Airbnb to be in the S&P 500 now, but no one would have predicted it years ago.

When it comes to Uber and Super Micro Computer, both businesses have improved enough to warrant inclusion. At one time, Uber had questionable profit prospects, but management cut spending and turned the corner. For its part, Super Micro Computer is suddenly at the center of the artificial intelligence (AI) revolution, earning it its own spot.

Investors can't know for sure which company will be next added to the S&P 500. But according to Barclays analyst Ramsey El-Assal, financial technology (fintech) company Block (NYSE: SQ) will likely be added this year. Here's why and here's what investors should do about it.

Why Block could be headed toward S&P 500 inclusion

Block is a fintech company, primarily offering products and services to individuals and businesses. Between fintech services to individuals through its Cash App ecosystem, as well as to businesses through its Square ecosystem, the company has processed over $200 billion in payment volume in the past year -- if you're looking for a consequential company for the S&P 500, this level of volume is worth noting.

Block generates revenue by taking a small percentage from transactions, and by offering many fintech software services. And this can be a very lucrative business.

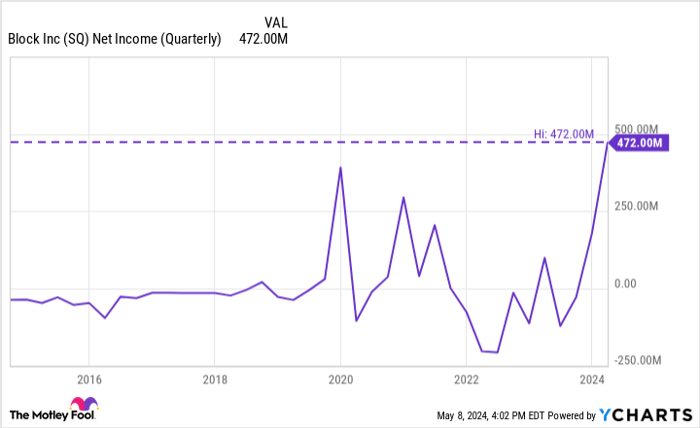

To be clear, the company hasn't been consistently profitable since going public in 2015. But it's a recent point of emphasis, and profits absolutely surged higher in the first quarter of 2024, hitting an all-time quarterly high of $472 million.

SQ Net Income (Quarterly) data by YCharts.

Importantly, Block's Q1 net income boosted total net income over the last 12 months into positive territory. That's another thing that's needed for inclusion into the S&P 500. Therefore, it seems that El-Assal is definitely on the right track regarding his prediction for Block.

What investors should do about it

There's a thing called "the index effect" -- an investing observation that notes that stocks outperform the S&P 500 for a short time when it's announced they're going to be included in the index. The reason for this is that index funds have to buy shares after the announcement, boosting the price because of buying demand.

However, a September 2021 study from S&P Global found that the index effect is increasingly less prominent due to higher overall stock market liquidity. In short, investors shouldn't buy Block stock in anticipation of it being added to the S&P 500. If shares do jump on the announcement, the move will likely be small and short-lived.

However, it's worth noting that those who make decisions for S&P 500 inclusion won't consider Block unless they believe it's set up for long-term success. Therefore, if it does get into the index, it would be a vote of confidence from financial professionals, which counts for something.

Regarding profitability, investors don't want Block to focus on profits at the exclusion of growth. A balance would be nice, and that's exactly what management is hoping to accomplish.

Block is using something called the Rule of 40. Other companies use this metric as well. But companies define the term differently. In Block's case, gross-profit growth combined with its adjusted operating-profit margin needs to equal 40.

For example, if Block's gross profit grows by 20%, then its adjusted operating margin also needs to be 20%. The two numbers combined would equal 40 in this case. It's a way for management to balance growth and profits.

Block isn't there yet -- it's hoping to get achieve its Rule of 40 by 2026. But since introducing the goal, the company has swung from net losses to a record quarterly profit in Q1. That's something exciting for investors today. And this focus might just land it a spot in the S&P 500 this year.

Should you invest $1,000 in Block right now?

Before you buy stock in Block, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Block wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Jon Quast has positions in Airbnb and Block. The Motley Fool has positions in and recommends Airbnb, Block, S&P Global, and Uber Technologies. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.