AI is still driving Big Tech earnings

This article was first featured in Yahoo Finance Tech, a weekly newsletter highlighting our original content on the industry. Get it sent directly to your inbox every Wednesday. Subscribe.

Tech earnings season is winding down, and if there’s one takeaway from the results so far, it’s that the AI craze is still driving the narrative for the industry’s biggest companies.

The CEOs of Microsoft (MSFT), Google (GOOG, GOOGL), Meta (META), Amazon (AMZN), and Intel (INTC) each mentioned AI during their company’s earnings calls a number of times. Microsoft’s Satya Nadella pointed to AI’s impact on its various business and consumer products.

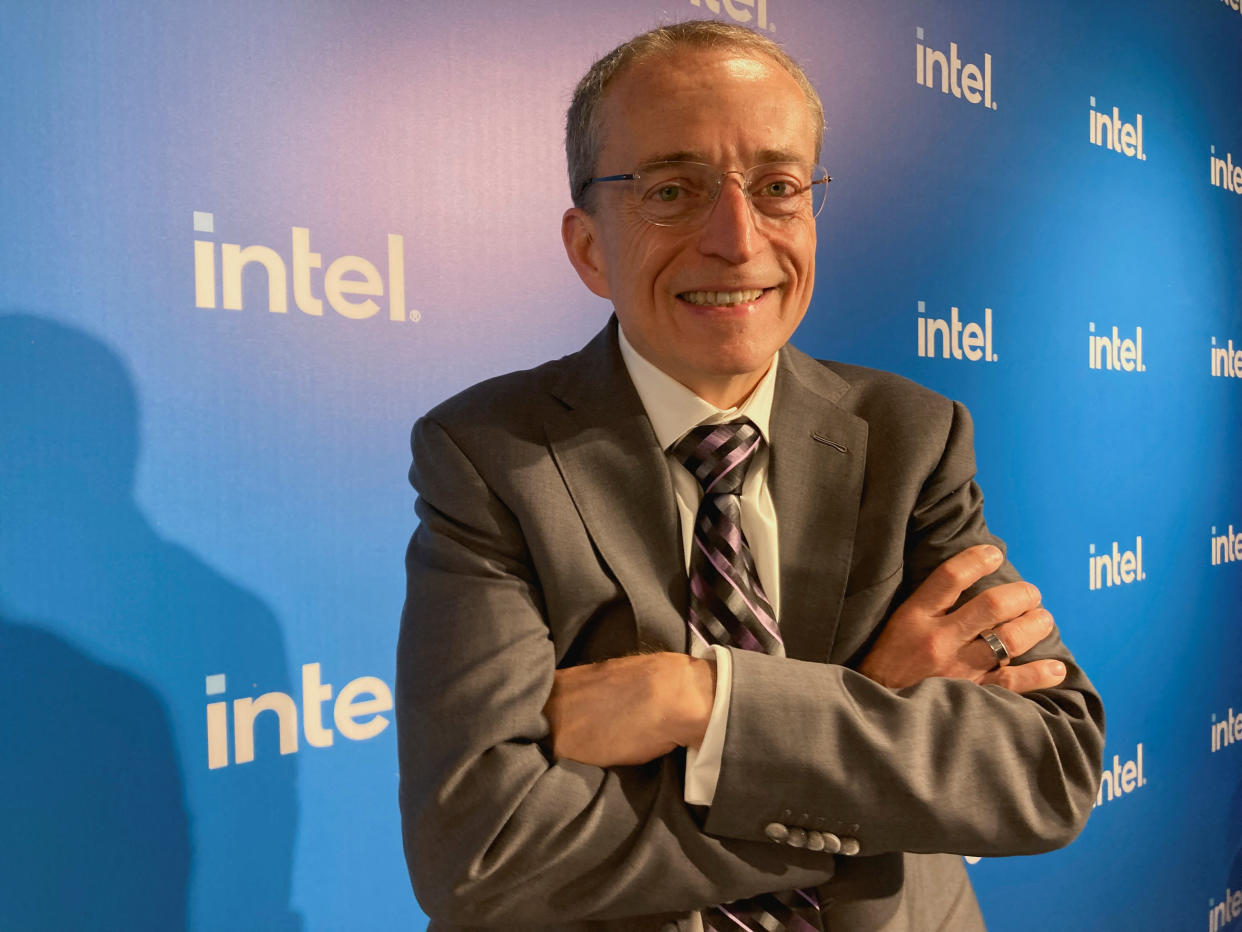

Google’s Sundar Pichai and Meta’s Mark Zuckerberg talked up the technology’s potential for serving up ads. Amazon’s Andy Jassy called out the company’s work on generative AI for Amazon Web Services. And Intel’s Pat Gelsinger spoke to how AI will drive future growth.

The one outlier? Apple. CEO Tim Cook only brought up AI when Deutsche Bank analyst Sidney Ho asked about how Apple is taking advantage of the technology. Cook said Apple is baking the tech into all of its products.

Yes, despite what’s been a chaotic earnings season that’s seen uneven results from Microsoft and Apple, AI is all anyone can seemingly still talk about.

Microsoft is all business

While Microsoft beat analysts’ estimates on the top and bottom lines for its fiscal fourth quarter, jitters about a slowdown in its Azure and other cloud growth segments have eaten into the company’s share price in recent days. Still, during Microsoft’s earnings call, Nadella kept the focus on how the company’s grand AI plans are coming to fruition.

The CEO ran through a slew of wins for the company’s AI investments, including adding 100 new customers every day in the quarter to its Azure OpenAI service and that 27,000 organizations have signed up for its GitHub Copilot for Business.

Nadella also made sure to mention the uptake in its Microsoft 365 Copilot software. Pricing for the product, which the company announced in the quarter, is set at $30 per user per month, a pricey option that should help pad Microsoft’s bottom line.

“We are now rolling out Microsoft 365 Copilot to 600 paid customers through our early access program, and feedback from organizations like Emirates NBD, General Motors, Goodyear, and Lumen is that it’s a game changer for employee productivity,” he said.

Microsoft’s AI investments are a major part of its future plans. It’s pouring billions into the technology, including a multiyear multibillion deal with ChatGPT developer OpenAI. And Nadella and company are clearly keen on making sure Wall Street sees its progress.

Google and Meta push AI for ads

Pichai didn’t offer as many concrete numbers as his counterpart at Microsoft, but the CEO did focus on how Google’s generative AI products will benefit its ad business.

Importantly, Pichai made sure to mention how the company is testing ad placement and formatting in its Search Generative Experience (SGE) app. An experimental version of Google Search powered by the company’s generative AI technology, SGE could be the future of the company’s all-important Search product. And ensuring the offering can display the kinds of ads in the areas of the page advertisers want is crucial to the product’s success.

“We have more than 20 years of experience serving ads relevant to users’ commercial queries and SGE enhances our ability to do this even better,” Pichai said. “We are testing and evolving placements and formats and giving advertisers tools to take advantage of generative AI.”

Meta’s Zuckerberg also dug into AI’s impact on the social media empire’s ad business, saying the technology is driving results through its automated ad tools.

“Almost all our advertisers are using at least one of our AI-driven products,” he said. “We've also deployed Meta Lattice, a new model architecture that learns to predict an ad's performance across a variety of datasets and optimization goals.”

Both Pichai and Zuckerberg also hit on how their companies are using AI to develop and build out enterprise products, but it’s clear from the fact that they mentioned their ad businesses first that the technology’s impact on advertising is top of mind for their firms.

Amazon and Intel push potential

While Microsoft, Google, and Meta pushed concrete examples of how AI is driving growth, Amazon CEO Andy Jassy and Intel CEO Pat Gelsinger seemed to focus more on how AI is a growth opportunity ahead for their various products.

Jassy spoke to how Amazon’s AWS, AI chips and inferences, and Bedrock platform are bringing AI to its enterprise offerings. And while he said that customers are using its AI products, much of his commentary revolved around future capabilities.

“Inside Amazon, every one of our teams is working on building generative AI applications that reinvent and enhance their customers' experience,” he told investors on the company’s earnings call.

Gelsinger, meanwhile, explained that while Intel’s server business is still facing weakness, AI will eventually pay off for the chip maker.

“Longer term, we see AI as TAM expansive to server CPUs, and more importantly, we see our accelerated product portfolio is well positioned to gain share in 2024 and beyond,” he told investors and analysts.

From the nature of the chatter during earnings season, it’s clear that Big Tech’s AI boom is still in full effect. And while there’s discussion as to whether the bubble has, or is about to, burst, the industry’s biggest companies are still touting the current and potential benefits the technology is and could bring to their bottom lines.

Now we just have to see if it all actually pays off.

Daniel Howley is the tech editor at Yahoo Finance. Follow him @DanielHowley.

Click here for the latest technology business news, reviews, and useful articles on tech and gadgets

Read the latest financial and business news from Yahoo Finance