What you actually take home from a $200K salary in every state

If you earn a $200,000 salary, you're in the top 10% of earners in the United States. Of course, all of that won't show up in your bank account. Taxes will take a big bite out of your take-home pay. Since state income taxes can vary wildly depending on where you live, the percentage of that $200,000 you get to actually put in your pocket changes from state to state.

Do You Have a Money Question? Ask an Expert

More: With a Recession Looming, Make These 3 Retirement Moves To Stay On Track

GOBankingRates pulled federal and state tax data from the Tax Foundation's 2023 data and calculated using an in-house paycheck calculator to see which states offered the highest take-home pay rates. GOBankingRates also looked at the Federal Insurance Contributions Act tax, sourced from the Social Security Administration. Some states take out bigger chunks than others, so it's important to know exactly how much take-home pay you can expect in every state if you're grossing $200,000.

Alabama

Take-home pay: $150,479

Alabama's state income tax rate is moderate, meaning you'll keep a little over $150,000 on your salary of $200,000. It also offers the lowest property taxes in the country.

Alaska

Take-home pay: $159,465

If you want to keep a big chunk of your $200,000 salary, consider living in Alaska. With no state income tax, Alaskans earning $200,000 can expect to bring home $159,465, among the highest take-home rates in the nation. The state also ranks as the most tax-friendly state for retirees.Take Our Poll: Are You Concerned About the Safety of Your Money in Your Bank Accounts?

Arizona

Take-home pay: $140,562

Residents in the Valley of the Sun enjoy a graduated state income tax system that helps keep overall tax rates low. The top state income tax rate is 4.50%. The state also offers decent standard deductions and personal exemptions to taxpayers.

Arkansas

Take-home pay: $148,799

Even though Arkansas residents earn less than the average American income overall, those who take home a high salary face a steep state income tax rate of 5.50%.

California

Take-home pay: $144,309

True to its reputation as a high-tax state, California slaps a high tax rate of 9.3% on both single and joint filers earning $200,000 in the Golden State.

Colorado

Take-home pay: $150,954

Colorado residents earning $200,000 can expect to take home a good amount from their paychecks. Workers in the Centennial State pay a flat 4.55% income tax on all of their taxable income, regardless of the amount.

Connecticut

Take-home pay: $148,415

Although Connecticut has a high top-end state income tax rate of 6.50% for the highest earning residents. Residents earning $200,000 still face a 6.5% or 6% rate, respectively, which is enough to bring the take-home pay down to slightly below the national average.

Delaware

Take-home pay: $147,496

Delaware's graduated state income tax rate jumps up quickly, peaking out at 6.6% for both single and joint filers. This large tax bite is enough to drag Delaware down to the bottom-third when it comes to ranking take-home pay.

Florida

Take-home pay: $159,465

The Sunshine State takes the crown when it comes to take-home pay, with residents earning $200,000 keeping a whopping $159,465, tops in the nation. Although the state has to share this title with eight others, it's not likely to lose its ranking as long as it remains free of state income tax.

Georgia

Take-home pay: $148,448

High earners in Georgia don't get to keep as much of their pay as the average American due to the rapidly graduated state tax schedule. Georgians making $200,000 are bi-monthly taking home a net paycheck of $5,709.54.

Hawaii

Take-home pay: $143,306

Living in paradise carries a high cost. In addition to paying more for basic commodities from food to fuel, residents of the great state of Hawaii face the second-highest tax rate in the country at 11 percent. Workers earning $200,000 pay the full 10% rate if they are single filers, while the rate is a still-high 8.25% for joint filers.

Idaho

Take-home pay: $148,616

Due to the high state tax rates, Idaho residents earning top salaries get to keep less of it than the average American. The state tax rate is 5.8%. However, Idaho residents still take home nearly $150,000.

Illinois

Take-home pay: $149,565

If you're a high earner in Illinois, your take-home pay will be pretty decent. Illinois's state income tax rate is a flat 4.95%, regardless of income, which isn't particularly onerous overall.

Indiana

Take-home pay: $153,165

Indiana has a moderate flat tax of just 3.15% on all residents, regardless of income. High earners pulling down $200,000 per year can expect to take home a hefty $153,165. Indianans will see a bi-monthly net paycheck of $5,890.96.

Iowa

Take-home pay: $148,112

Iowa residents also see a decent amount of their income after taxes. Unfortunately, high earners bear the brunt of one of the higher state tax rates in the country; both single and joint filers pay 6.00% of their income.

Kansas

Take-home pay: $148,722

If you're driving cross-country, Kansas is just about in the middle of the road — and the same is true when it comes to its total tax rate for high earners. The state's tax rate is 5.7%.

Kentucky

Take-home pay: $150,590

The land of bluegrass, thoroughbreds and bourbon carries some above-average tax rates. Graduated state tax income rates hit 4.5%, regardless of filing status. The total tax burden of state and federal taxes amounts to 24.71%.

Louisiana

Take-home pay: $151,546

High-income workers in the Bayou State take home a bit more than other states. A moderate top state income tax rate of 4.25% applies to single filers and joint filers alike. The total tax burden of state and federal taxes is $48,454 or 24.23%.

Maine

Take-home pay: $146,527

A relatively high state income tax deduction isn't enough to offset Maine's high tax rates when it comes to take-home pay. Maine residents pay 4.25% whether filing single or jointly. The total tax burden of state and federal taxes is $53,473 or 26.74%

Maryland

Take-home pay: $149,584

Taxpayers might burst out the state song of "Maryland, My Maryland" when they first see their tax bill from the state. Residents earning $200,000 take home nearly $150,000 after taxes. The total tax burden of state and federal taxes is $50,416 or 25.21%

Massachusetts

Take-home pay: $149,465

Massachusetts has a reputation as being a high-tax state, but the take-home pay for a $200,000 earner is similar to many other states. A flat state income tax rate of 5% applies to all incomes, meaning every dollar of a $200,000 earner's income is fair game.

Michigan

Take-home pay: $150,965

High-income Michigan residents take home more of their pay than the average American thanks to a flat 4.25% state income tax rate. The total tax burden of state and federal taxes is $49,035 or 24.52%.

Minnesota

Take-home pay: $145,836

Minnesotans are among the fittest Americans according to numerous studies, and their take-home checks are a bit lean as well. Residents earning $200,000 take home a bit less pay than other states due to a higher tax rate here, of 9.85%. The total tax burden of state and federal taxes is $54,164 or 27.08%

Mississippi

Take-home pay: $150,080

Residents in Mississippi can take home more of their $200,000 than some other states. The total tax burden of state and federal taxes is $49,920 or 24.96%. The result is more than $150,000.

Missouri

Take-home pay: $149,737

Residents of the Show-Me State might want to shout, "Show me the money" when looking at their take-home pay rates. For $200,000 earners, the net take-home pay of $149,737 is a bit less than other states. The state's top income tax rate is 5.30%. The total tax burden of state and federal taxes is $50,263 or 25.13%.

Montana

Take-home pay: $146,862

Montana income tax is a fairly steep 6.75%, netting residents less than other states. Those fortunate enough to earn $200,000 will have to fork over a significant chunk of that income to the state government, resulting in a well below-average net take-home pay. The total tax burden of state and federal taxes is $53,138 or 26.57%.

Nebraska

Take-home pay: $147,559

There's nothing middle-America about Nebraska's tax rates, which hit 6.64%. Taxes are enough to drag down the take-home pay for a $200,000 earner to the bottom quarter of the country. The total tax burden of state and federal taxes is $52,441 or 26.22%.

Nevada

Take-home pay: $159,465

As one of the few states without an income tax, Nevada residents earning $200,000 take home the highest net pay in the country, tied with eight other states. The total tax burden of state and federal taxes is $40,535 or 20.27%.

New Hampshire

Take-home pay: $159,465

New Hampshire charges a 5% tax rate on interest and dividend income, but all other income is tax-free. As a result, New Hampshire is one of the nine states that has the highest take-home pay on an income of $200,000, at $159,465. The total tax burden of state and federal taxes is $40,535 or 20.27%.

New Jersey

Take-home pay: $148,849

New Jersey has lower overall tax rates than its famous neighbor, New York, but not by much. In fact, New Jersey's top state income tax rate of 6.37% is actually higher than New York's. However, tax rates in the lower brackets are not as high, bringing the state's overall tax liability down a notch. Things are not as rosy for property owners, as the state is saddled with the highest property taxes in the nation.

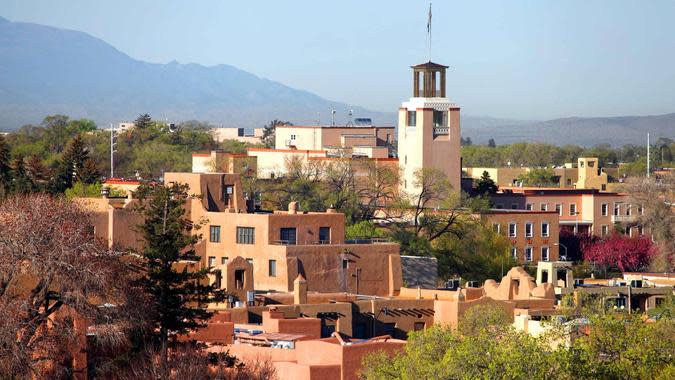

New Mexico

Take-home pay: $150,579

New Mexico has a fairly low state income tax rate, which peaks at 4.9%. Take-home pay for high earners in New Mexico is about average. The total tax burden of state and federal taxes is $49,421 or 24.71%.

New York

Take-home pay: $148,001

New York is notorious for having high state and local income taxes, and the rumor isn't that far from reality. New York ranks among the lowest on this list when it comes to take-home pay for those earning at least $200,000. The state's top tax rate is 6.25%.

North Carolina

Take-home pay: $150,571

State taxes are straightforward in North Carolina. A flat rate of 4.75% applies to all incomes. This means that someone earning $200,000 in North Carolina must pay tax at that rate on all of their income.

North Dakota

Take-home pay: $155,826

Of the 41 states that have a state income tax, North Dakota ranks No. 1 on the list when it comes to net take-home pay for $200,000 earners. With a slowly graduated, low-rate tax system that only tops out at 2.27%, state tax obligations remain low even for the highest earners.

Ohio

Take-home pay: $153,120

Take-home pay is in the top-third in Ohio for top earners, where a $200,000 earner can expect to take home over $153,000. Ohioans earning $200,000 will be in the 3.99% state income tax bracket.

Oklahoma

Take-home pay: $150,455

Oklahoma's graduated state income tax schedule reaches its top rate of 4.75% relatively quickly. Standard deductions and personal exemptions help take some of the bite out of that rate, resulting in an about-average net take-home pay for $200,000 earners. The total tax burden of state and federal taxes is $49,545 or 24.77%.

Oregon

Take-home pay: $141,599

Perhaps surprisingly, Oregon residents earning $200,000 have the lowest take-home pay amount in the nation. A combination of low deductions and personal exemptions, along with a high tax rate, are enough to do the trick. Its top rate is a very high 9.90%.

Pennsylvania

Take-home pay: $153,325

Residents of the Keystone State are right on the nose when it comes to take-home pay for $200,000 earners. Take-home pay in the state is among the highest on this list. A flat tax rate of 3.07% helps keep net take-home pay very close to average. The total tax burden of state and federal taxes is $46,675 or 23.34%.

Rhode Island

Take-home pay: $150,647

The state's high tax rates bring down net take-home pay below some other East Coast states. Residents earning $200,000 face a tax rate of 5.99%, whether filing singly or jointly. The total tax burden of state and federal taxes is $49,353 or 24.68%.

South Carolina

Take-home pay: $146,916

South Carolina has a fairly high standard deduction, but its graduated tax system rises quickly to a 7% rate for both single and joint filers. The end result is a net take-home pay for $200,000 earners that is among the others on the list.

South Dakota

Take-home pay: $145,962

South Dakota is one of the nine lucky states that doesn't have a state income tax. As a result, it's tied for the top spot in terms of take-home pay for a $200,000 earner. Unlike some other states, there's no separate tax on dividends or interest in South Dakota, making it a true panacea when it comes to state taxation. The total tax burden of state and federal taxes is $40,535 or 20.27%.

Tennessee

Take-home pay: $159,465

Tennessee does have a 3% flat tax on interest and dividend income, but for those earning $200,000 in salary or wages, the state is a tax haven. With no state income tax, high earners keep more of what they earn.

Texas

Take-home pay: $159,465

The Lone Star State reigns supreme when it comes to state income tax, since it has none. Just like its eight compatriots on this list, no state income tax equates to higher take-home pay. Texas residents earning $200,000 can expect the highest net take-home pay in the country.

Utah

Take-home pay: $149,603

Utah makes it simple when it comes to state income tax. Under the state's flat tax system, 4.95% of every dollar is handed over to the state treasurer, with no regard for income level or filing status. The net result is that a $200,000 earner in Utah can expect to take home just slightly less than other states.

Vermont

Take-home pay: $147,070

Vermont is one of the most highly taxed states in the nation, with a tax rate of 7.60%. The total tax burden of state and federal taxes is $52,930 or 26.47%.

Virginia

Take-home pay: $148,481

Virginia's state income tax rate is 5.75% regardless of filing status. The net result for $200,000 earners is a well below-average take-home pay rate. The total tax burden of state and federal taxes is $51,519 or 25.76%.

Washington

Take-home pay: $159,465

Washington is one of the nine states in the country without a state income tax. The end result is predictable — Washington is in a nine-way tie for the highest net take-home pay for a $200,000 earner.

West Virginia

Take-home pay: $147,590

West Virginia has one of the lowest per-capita incomes in the country, but that doesn't stop the state from having one aggressive tax structure. Incomes for both single and joint filers are taxed at the top rate of 6.5%, and there is no standard deduction to reduce the taxable amount.

Wisconsin

Take-home pay: $149,797

Wisconsin residents earning $200,000 face a high rate of 5.30% is enough to drag down the state's net take-home pay figure. The state's relatively high standard deduction is of no help to high earners, as it phases out to zero long before the $200,000 income level.

Wyoming

Take-home pay: $159,465

Wyoming is famous for its wide-open plains, its sense of individuality and the freedom it gives to its resident taxpayers. With no state income tax, those earning $200,000 are free to keep a whopping $159,465, the best take-home rate in the nation (which it shares with eight other states). Wyoming is also one of the best states in the nation for retirees.More From GOBankingRates11 Grocery Items To Buy at Dollar Tree

Got a Question About Money? Ask an Expert

Maximize your savings with these 3 expert tips

Take Our Poll: How Do You File Your Taxes?

John Csiszar contributed to the reporting for this article.Methodology: In order to find what a $200k salary really looks like in every state, GOBankingRates sourced both the federal and state tax brackets from the Tax Foundation's 2023 data. GOBankingRates used an in-house income tax calculator to find both the effective and marginal tax rate on income of $200,000 in every state. GOBankingRates also found the Federal Insurance Contributions Act tax with its rate sourced from the Social Security Administration. These calculations were done for a person filing their taxes as a single person and for a married couple filing jointly. GOBankingRates found the total income taxes paid, total tax burden, total take home pay, total gross bi-weekly paycheck, the after-income tax bi-weekly paycheck for each state and the total amount taken out of each bi-weekly paycheck due to taxes. All data was collected on and up to date as of February 1, 2023.

This article originally appeared on GOBankingRates.com: What You Actually Take Home From a $200,000 Salary in Every State