What a Couple Making $200K Actually Takes Home in Every State

Six figures sure sounds good, and looks even better on paper. That is until you take a look at the taxes. While $200,000 is inarguably a sizable income, that number can be whittled down significantly after you pay taxes — especially depending on the state in which you reside.

Check Out: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Read Next: One Smart Way To Grow Your Retirement Savings in 2024

GOBankingrates drew tax info, for both federal and state tax brackets, from the Tax Foundation’s 2023 data to find out what a married couple takes home after taxes with that grand salary in every state.

Some states where you keep the most of your salary include Alaska, New Hampshire, Tennessee and Washington. States where taxes eat up more of your salary include California, Hawaii and Oregon.

Check out which states are the tax-friendliest to couples making $200,000.

Alabama

Take-home pay married filing jointly: $146,684

Total tax burden married filer: 26.66%

Learn More: IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying

For You: 7 Unusual Ways To Make Extra Money (That Actually Work)

Alaska

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

Read More: Top 7 Countries With Zero Income Tax

Arizona

Take-home pay married filing jointly: $151,872

Total tax burden married filer: 24.06%

Arkansas

Take-home pay married filing jointly: $146,764

Total tax burden married filer: 26.62%

California

Take-home pay married filing jointly: $145,040

Total tax burden married filer: 27.48%

Colorado

Take-home pay married filing jointly: $148,598

Total tax burden married filer: 25.70%

Learn More: Trump-Era Tax Cuts Are Expiring — How Changes Will Impact Retirees

Connecticut

Take-home pay married filing jointly: $146,079

Total tax burden married filer: 26.96%

Delaware

Take-home pay married filing jointly: $144,425

Total tax burden married filer: 27.79%

Florida

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

Georgia

Take-home pay married filing jointly: $145,322

Total tax burden married filer: 27.34%

Check Out: The 7 Worst Things You Can Do If You Owe the IRS

Hawaii

Take-home pay married filing jointly: $141,535

Total tax burden married filer:29.23%

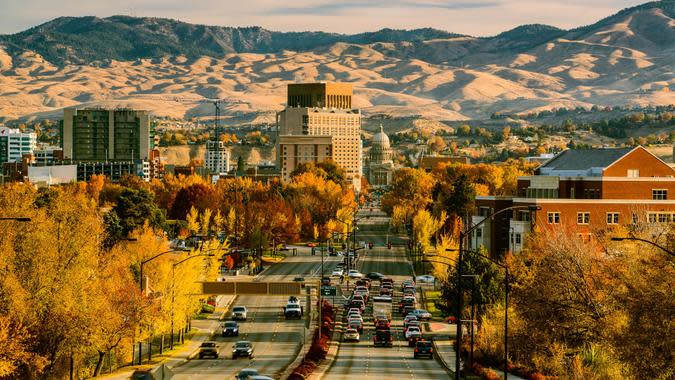

Idaho

Take-home pay married filing jointly: $146,186

Total tax burden married filer: 26.91%

Illinois

Take-home pay married filing jointly: $146,279

Total tax burden married filer: 26.86%

Indiana

Take-home pay married filing jointly: $149,879

Total tax burden married filer: 25.06%

Read Next: A Look at Tax-Filing Options and Costs

Iowa

Take-home pay married filing jointly: $145,207

Total tax burden married filer: 27.40%

Kansas

Take-home pay married filing jointly: $146,150

Total tax burden married filer: 26.93%

Kentucky

Take-home pay married filing jointly: $147,428

Total tax burden married filer: 26.29%

Louisiana

Take-home pay married filing jointly: $148,842

Total tax burden married filer: 25.58%

Learn More: 5 Frugal Habits of Mark Cuban

Maine

Take-home pay married filing jointly: $144,790

Total tax burden married filer: 27.61%

Maryland

Take-home pay married filing jointly: $146,799

Total tax burden married filer: 26.60%

Massachusetts

Take-home pay married filing jointly: $146,179

Total tax burden married filer: 26.91%

Michigan

Take-home pay married filing jointly: $147,679

Total tax burden married filer: 26.16%

Read More: Frugal People Love the 6 to 1 Grocery Shopping Method: Here’s Why It Works

Minnesota

Take-home pay married filing jointly: $145,096

Total tax burden married filer: 27.45%

Mississippi

Take-home pay married filing jointly: $145,096

Total tax burden married filer: 27.45%

Missouri

Take-home pay married filing jointly: $147,820

Total tax burden married filer: 26.09%

Montana

Take-home pay married filing jointly: $144,083

Total tax burden married filer: 27.96%

Trending Now: 5 Unnecessary Bills You Should Stop Paying in 2024

Nebraska

Take-home pay married filing jointly: $145,856

Total tax burden married filer: 27.07%

Nevada

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

New Hampshire

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

New Jersey

Take-home pay married filing jointly: $147,482

Total tax burden married filer: 26.26%

For You: 10 Best Cheap Gym Memberships: Break a Sweat but Not Your Budget

New Mexico

Take-home pay married filing jointly: $148,144

Total tax burden married filer: 25.93%

New York

Take-home pay married filing jointly: $146,282

Total tax burden married filer: 26.86%

North Carolina

Take-home pay married filing jointly: $147,890

Total tax burden married filer: 26.05%

North Dakota

Take-home pay married filing jointly: $153,310

Total tax burden married filer: 23.34%

For You: 10 Expenses Most Likely To Drain Your Checking Account Each Month

Ohio

Take-home pay married filing jointly: $149,906

Total tax burden married filer: 25.05%

Oklahoma

Take-home pay married filing jointly: $147,637

Total tax burden married filer: 26.18%

Oregon

Take-home pay married filing jointly: $139,705

Total tax burden married filer: 30.15%

Pennsylvania

Take-home pay married filing jointly: $150,039

Total tax burden married filer: 24.98%

Be Aware: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Rhode Island

Take-home pay married filing jointly: $148,005

Total tax burden married filer: 26.00%

South Carolina

Take-home pay married filing jointly: $143,836

Total tax burden married filer: 28.08%

South Dakota

Take-home pay married filing jointly: $143,836

Total tax burden married filer: 28.08%

Tennessee

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

Check Out: 13 Cheap Cryptocurrencies With the Highest Potential Upside for You

Texas

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

Utah

Take-home pay married filing jointly: $146,560

Total tax burden married filer: 26.72%

Vermont

Take-home pay married filing jointly: $145,963

Total tax burden married filer: 27.02%

Virginia

Take-home pay married filing jointly: $145,857

Total tax burden married filer: 27.07%

Learn More: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Washington

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

West Virginia

Take-home pay married filing jointly: $144,304

Total tax burden married filer: 27.85%

Wisconsin

Take-home pay married filing jointly: $147,275

Total tax burden married filer: 26.36%

Wyoming

Take-home pay married filing jointly: $156,179

Total tax burden married filer: 21.91%

Methodology: For this study, GOBankingRates found the take home amount from a $200,000 salary in every state. Starting with a $200,000 salary, GOBankingRates found the amount of federal income tax paid and state income tax paid both using an in house calculators and information from Tax Foundation’s 2023 Federal Tax Brackets and Tax Foundation’s State Tax Rates and Brackets. FICA tax was also calculated using information from the IRS.gov – Topic 751. The total taxes paid, effective tax rate, marginal tax rate, and leftover savings are calculated. The taxes were calculated as an individual and a married couple, filing jointly. All the information was collected on and is up to date as of April 3, 2024.

More From GOBankingRates

Dave Ramsey: Why You Shouldn't Buy a New Car/Take Out an Auto Loan This Year

5 Reasons You Should Consider an Annuity For Your Retirement Savings

This article originally appeared on GOBankingRates.com: What a Couple Making $200K Actually Takes Home in Every State