'Will they be able to take our home?': This Houston couple got tricked into a contract — to pay up to $67K — for 'free' solar panels. Here are 3 legit ways to get cash back for going green

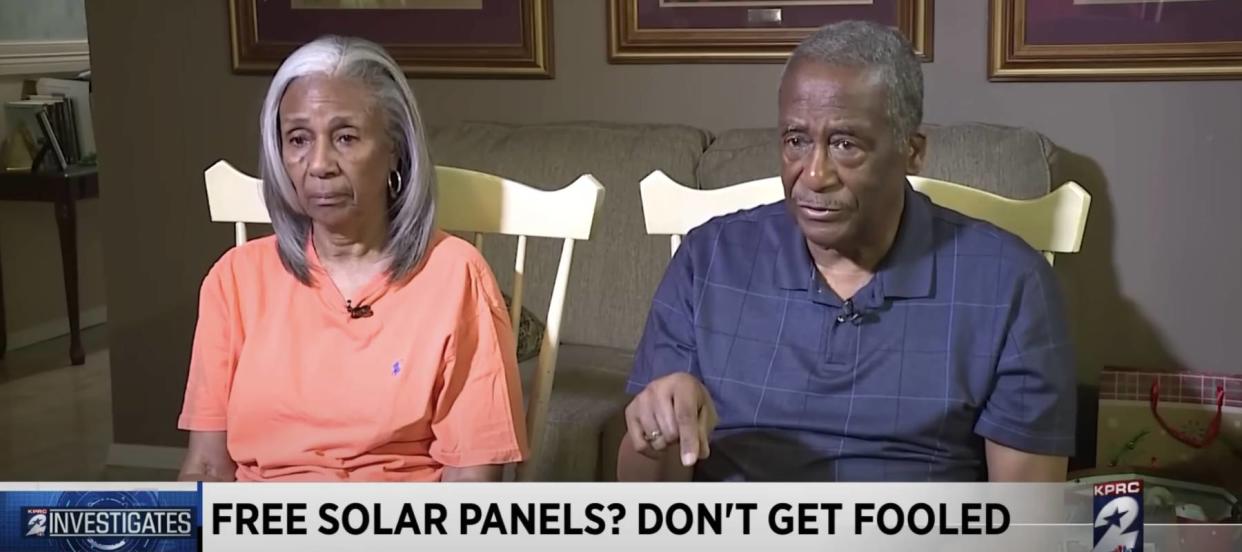

When a deal sounds too good to be true, it very well may be. Bernard and Tasa Mosley, a retired couple from Houston, Texas, learned that lesson the hard way when they fell for a scam offering free solar panels.

The budget-conscious pair told KPRC 2 investigative reporter Amy Davis that they were first approached by two door-to-door salespeople in December 2022. Bernard, then 82, recalled saying “no, thank you” because they didn’t have the money to buy solar panels. But the salespeople convinced the Mosleys with a lie, telling them a government grant would cover the cost.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

Enticed by the idea of lowering their energy bills, the Mosleys signed a one-page contract that day, the salespeople left (without leaving a copy of the contract) and within a few weeks, crews installed the solar panels on the couple’s roof.

Soon afterward, bills from Sunrun, a San Francisco-based solar energy company, started arriving. When the Mosleys asked to see a copy of their Sunrun contract, they were shocked to receive a 40-page document signed with Tasa’s electronic signature.

The contract said the Mosleys could pay $38,411 in full for their new solar panels or pay monthly over 25 years — at the end of which, they would have paid a total of $67,129.56 and Bernard would be 107-years-old.

“The first thing I thought was, ‘Oh my god, they’re sending us these bills. What happens if we don’t pay these bills?’” said the 75-year-old Tasa. “Will they be able to take our home?”

With the help of Davis, the couple managed to resolve their issue with Sunrun — including removal of the solar panels and voiding the contract — and now Bernard has a warning for others:

“I hope other people will see this and know that they need to be very very careful about purchasing anything, much less the solar systems.”

Legitimate solar programs

The Mosleys are by no means alone in falling prey to solar scams — with dishonest salespeople taking advantage of Americans’ rising interest in solar technology’s cost-saving and carbon-cutting potential.

As explained by the Department of Energy (DOE) on a web page warning about solar scams: “The federal government does not offer any programs for free home solar panel installations, nor does the government require companies to grant solar panels for free to customers.”

The DOE does, however, offer several programs to help consumers lower the cost of solar projects for their homes.

For instance, you may be eligible to receive a 30% federal tax credit if you have installed or will install a solar system between 2022 and 2032, which the government says could reduce the cost of installation by an average of more than $7,500.

The DOE says homeowners can also finance rooftop solar projects through lease or loan arrangements and could get additional money back through programs offered by their state.

With so much misinformation out there — as the Mosleys discovered — the DOE says: “It is important to not sign any contract until you are able to make a well-informed decision. Homeowners can refer to guidance from our solar office to explore options and eligibility for programs.”

In addition to solar tax credits, here are two other legitimate ways you can earn money back from the government for having a green thumb.

Read more: Generating 'passive income' through real estate is the biggest myth in investing — but here's 1 surefire way to do it with as little as $10

Buy an electric vehicle

One of the most-talked-about ways to cut down on one’s carbon footprint is to ditch any gas-guzzling vehicle for a cleaner, electric alternative.

Electric vehicles (EVs) have become increasingly accessible for Americans thanks to federal tax credits introduced in the Inflation Reduction Act (IRA).

In 2023, motorists are able to claim up to $7,500 in credits for purchasing an EV that meets certain conditions.

Your eligibility for the credit will depend on several factors, including the vehicle's MSRP (Manufacturer's Suggested Retail Price), its final assembly location, battery components and your modified adjusted gross income.

If that’s not incentive enough, you can also get a tax credit if you install an electric car charger at home. You can claim a credit equal to 30% of the cost — up to a maximum of $1,000.

Install a heat pump

President Joe Biden’s IRA has introduced several financial incentives to get homeowners to make more energy-efficient upgrades to their dwellings. Some of the biggest tax credits and rebates are for heat pumps, which can be anywhere from two and a half times to four times more efficient than electric baseboard heaters.

From 2023 through the end of 2032, homeowners will be eligible for a 30% federal tax credit on the total cost of buying and installing a qualified heat pump, up to a maximum of $2,000.

The High-Efficiency Electric Home Rebate Act — part of the IRA — can also help you offset the cost of purchasing a heat pump, depending on your income. You could be eligible for up to $1,750 for a heat pump water heater and $8,000 for a heat pump for space heating if your household income is less than 150% of your state’s median income.

What to read next

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Don't let high car insurance rates drain your bank account — find how you can pay as little as $29 a month

Millions of Americans are in massive debt in the face of rising costs. Here's how to get your head above water ASAP

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.