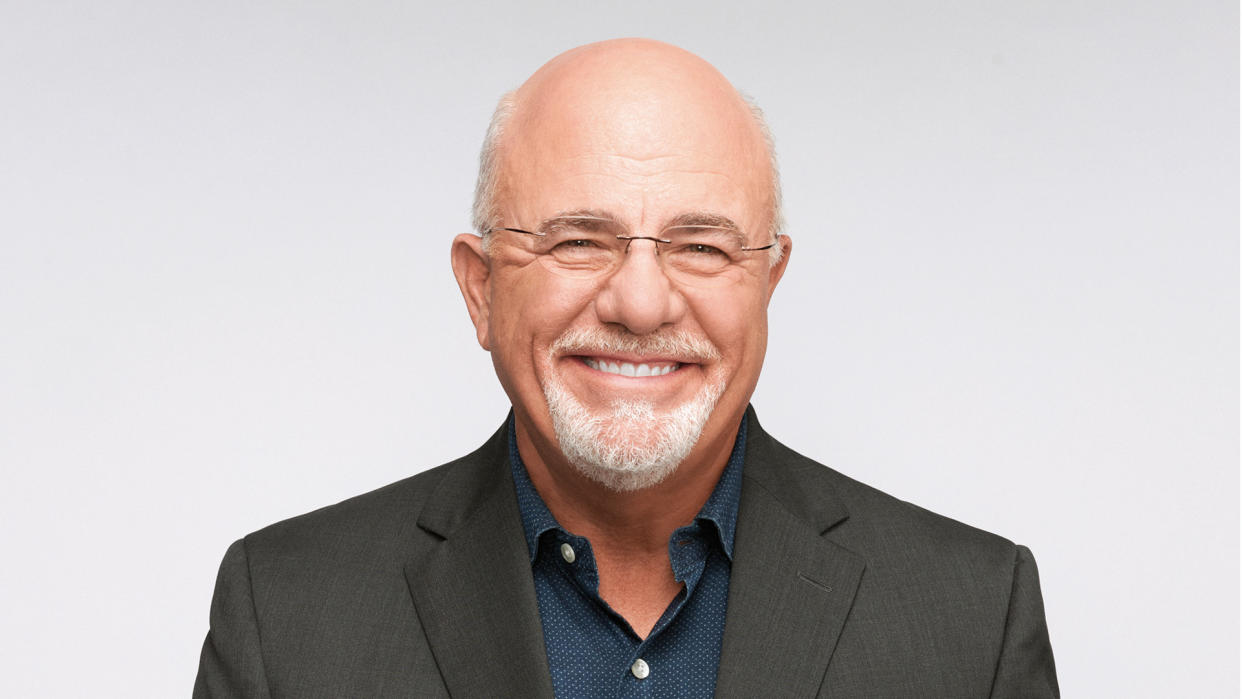

90% of Those Who Followed Dave Ramsey’s 7 Baby Steps Stopped Living Paycheck-to-Paycheck — So Can You

Inflation, soaring rates and the resumption of student loans have taken a toll on many Americans’ wallets, forcing many of them to live paycheck-to-paycheck.

See: 9 Frugal Habits Dave Ramsey Swears By

Experts: Make These 7 Money Resolutions If You Want To Become Rich on an Average Salary

Yet, 90% of individuals who followed Dave Ramsey’s 7 Baby Steps, “a step-by-step financial plan that bucks the ‘normal’ culture’s toxic approach to money and leads to long-term financial success,” said they can overcome their money challenges. Meanwhile, only 59% of general Americans say the same, according to a recent Ramsey Solutions study.

What’s more, the study found that 84% of people who followed this financial plan describe themselves as intentional when it comes to money, compared to only 48% of the general population. While almost half of Americans — 43% — are having trouble paying their bills, only 20% of Baby Steppers are experiencing the same difficulty.

According to Ramsey Solutions, following the plan also provides peace of mind, as 43% of the general population said their personal finances have had a negative impact on their mental health, compared to only 31% of those who follow the plan. Meanwhile, 74% of Baby Steppers believe they can become a millionaire, compared to only 33% of the general population.

“Personal finance is 80% behavior and only 20% head knowledge,” Ramsey said in a press release. “People don’t need more facts and figures when it comes to money. They need something deeper. Something more personal. And we’ve got rock-solid confidence in the principles we’ll share with America during this livestream. More than 10 million people have already used our plan to get out of debt and build wealth. Why shouldn’t you be next?”

What Does the Plan Entail?

Ramsey’s plan is money management aimed at helping people get out of debt, save money and build wealth by following seven steps:

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3-6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.

On Jan. 11, Ramsey, along with his co-hosts, will hold a free livestream event called “Break the Cycle: Stop Living Paycheck to Paycheck,” which will address ways to create financial breathing room by using a budget; keys to unlocking lasting behavior changes with money; the impact financial stress has on our mental health; as well as the mindsets that keep people stuck in poor money management habits.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 90% of Those Who Followed Dave Ramsey’s 7 Baby Steps Stopped Living Paycheck-to-Paycheck — So Can You