9 Smart Tax Moves To Make Before the End of the Year

While Americans are brainstorming ways to have a cheerful holiday, they might not be thinking about the pleasures of saving money on taxes. But with a little planning, your tax savings can help pay for the extra shopping you did on Black Friday and throughout the holiday season.

Here It Is: Our 2022 Small Business Spotlight

Read More: If Your Credit Score Is Under 740, Make These 4 Moves Now

Read on for tax tips that will help you score big when you file your tax return in the spring.

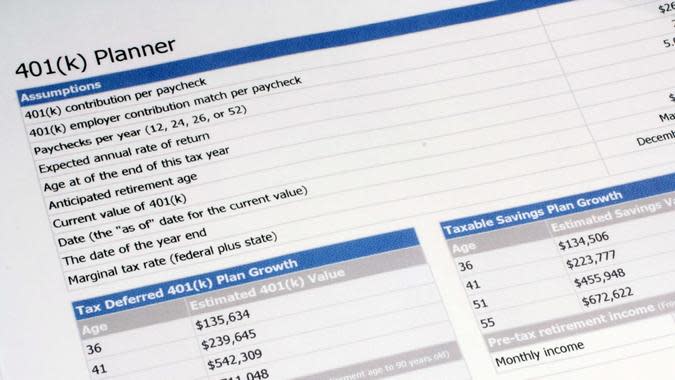

Maximize Retirement Account Contributions

The easiest way to lower your tax bill and set yourself up for a more prosperous retirement is to max out your contributions to your retirement plan. You can increase your 401(k) account contributions through the end of the year by changing your contribution rates with your employer. Check your employer's matching contribution level to grow your nest egg even more.

You might also be able to reduce your taxes by contributing to a traditional IRA account as a last-minute tax deduction. However, if you or your spouse are covered by an employer plan, like a 401(k) or 403(b), you might not be eligible to deduct your contributions if you make too much money.

For the 2021 tax year, the maximum you can contribute throughout the year to a traditional IRA is $6,000 ($7,000 if you're 50 or older), whereas 401(k) plans cap at $19,500. The catch-up contribution limit for those over 50 is $6,500.

Take Our Poll: Are You Struggling To Keep Up With Your Utility Bills?

Convert to a Roth

If you find yourself in a lower income tax bracket than you expect to be in future years, consider converting some of your traditional IRA savings to a Roth IRA. When you convert, the conversion amount is taxed at your marginal tax rate -- the incremental rate applied to your last dollar of income. That lower tax rate will apply to the converted income.

For example, say you lost your job in March and didn't find a new one until November, and your taxable income is much lower this year so you're only paying a marginal tax rate of 12% instead of 22%. If you convert a portion of your traditional IRA to a Roth IRA, you can pay taxes on the conversion at the lower rate and enjoy tax-free qualified distributions in retirement.

But before you make changes, remember to include unemployment benefits you received -- including any $600 weekly Federal Pandemic Unemployment Compensation payments -- in your federal taxable income. Also, note that the IRS might require you to make estimated tax payments the year you convert to a Roth IRA, prior to filing your 2021 tax return.

Lump Medical Expenses in One Year

Medical expenses can be challenging to deduct because not only do you have to itemize your deductions, but you are also limited to deducting only the portion of your medical expenses that exceed 7.5% of your gross adjusted income.

But you can increase your deduction if you strategically schedule procedures and payment dates. Expenses are deductible in the year you pay for them, so if you've already paid substantial bills, try to pay for as much as possible before the end of the year to maximize your deduction.

It should go without saying that you shouldn't let tax considerations make important medical decisions for you, but if you have flexibility, you can take advantage to lower your tax bill.

Don't Forget About HSA Contributions

If you have a high-deductible health insurance plan, you can contribute money to your health savings account to reduce your tax bill.

"HSAs are a great savings tool because they offer a 'triple tax advantage,'" said Marcy Keckler, senior vice president of financial advice strategy at Ameriprise Financial. "The money you contribute goes in pre-tax, the money in the account grows tax-free and when you take out money for qualified medical expenses, it is withdrawn tax-free."

"You can use the money in your account at any time to cover current medical costs," she continued. "And those payments are essentially made on a discounted basis because you are avoiding current year income taxes. If you don't need the funds now, the long-term benefits can be even more powerful if you invest in your HSA savings. You can use the money in the account to pay for future healthcare expenses before and during retirement. There are some restrictions on HSA contributions for those who may also be covered by Medicare, but you can continue to make withdrawals."

For 2021, you're allowed to contribute a maximum of $3,600 if you are covered by an individual plan or $7,200 for a family plan. If you're 55 or over, the contribution limit is bumped up by $1,000.

Make Your January Mortgage Payment Early

Mortgage interest is deductible in the year that you pay it rather than the year that the interest accrued. Often, monthly mortgage payments are made a few days into each month to cover the previous month.

For example, the interest that accrues on your mortgage in June doesn't get paid until you make your monthly payment in early July. Usually, that doesn't affect your taxes.

The exception comes at the end of the year. For example, if you pay December's accrued interest on Dec. 31, you get to claim that interest on your taxes for the current year. If you don't pay it until early January, you can't claim it on your taxes until the following year.

Make a Charitable Contribution

Under normal IRS rules, you can deduct charitable giving up to 60% of your adjusted gross income as long as you itemize your deductions. The CARES Act suspended that limit, for cash contributions only, through the end of 2021, so you can deduct up to 100% of your AGI this year. Even if you don't itemize in 2021, you can still deduct $300 ($600 for married individuals filing jointly) in contributions to a nonprofit organization.

If you really want to maximize your tax breaks, contribute appreciated securities to charity. These contributions aren't included in the CARES ACT rule suspension, so they're limited to 30% of your AGI. But you can deduct the fair market value of the stock, not just what you paid for it. If the gains on the stock would have counted as long-term capital gains had you sold the stock, donating it instead saves you from having to pay taxes on those gains.

"In this current environment of markets soaring to historical highs, there is an incentive from a tax perspective to donate appreciated stocks you own to charity," Keckler said. "That's because you can avoid paying capital gains taxes on appreciated stocks that you've owned for a least a year by gifting them to a qualifying charity. Not only will you make a positive impact on a cause you care about, but you can also avoid paying a tax bill -- which in some cases could be hefty -- on stocks that have increased in value."

However, you must give to an actual charity. You can't deduct gifts you make to other people, no matter how needy they are, and you can't deduct the value of the time you spend volunteering.

Sell Investments With Losses

If you have some investments that haven't performed as well as you hoped, consider selling them before the end of the year so you can claim a loss on your taxes, otherwise known as tax-loss harvesting.

"No one likes to lose money on investments, but a loss doesn't have to be all bad news," Keckler said. "In most cases, you can use investment losses to offset any realized capital gains and then use any remaining losses up to $3,000 to offset ordinary income. Remaining losses can be carried over to subsequent years, to offset capital gains in those years. However, bear in mind the 'wash-sale' rule if you sell or trade a security at a loss. This rule defers the capital loss on securities they sold at a loss if they buy 'substantially identical' securities within 30 days before or after the sale."

If you repurchase the same securities within 30 days of the sale, the IRS will consider it a "wash sale" and disallow the deduction.

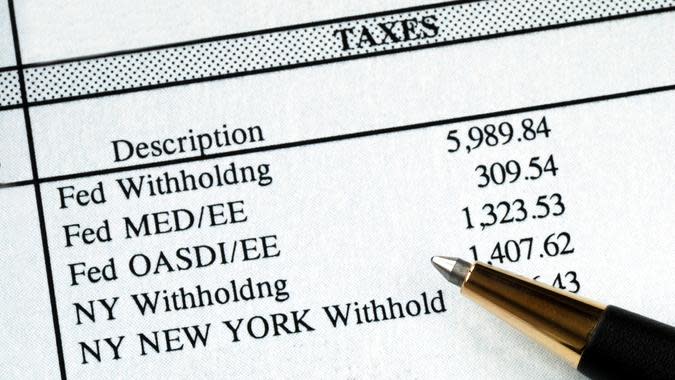

Increase Tax Withholding If You Expect To Owe

For most people, taxes withheld from paychecks are sufficient to pay what they owe when they file their tax returns, or at least to avoid under-withholding penalties. However, if you had income that wasn't subject to withholding, such as income from selling stocks or a home, you might come up short.

As long as you owe less than $1,000, or have withholding equal to at least 90% of what you owe this year -- or 100% of what you owed the prior year -- you're safe.

But if you're not going to make one of those "safe harbors," ask your employer to withhold extra on your last few paychecks. That money is treated as being withheld throughout the year, which can reduce or eliminate underpayment penalties and interest.

Look Ahead to Possible Impacts of Child Tax Credit Payments

This article originally appeared on GOBankingRates.com: 9 Smart Tax Moves To Make Before the End of the Year