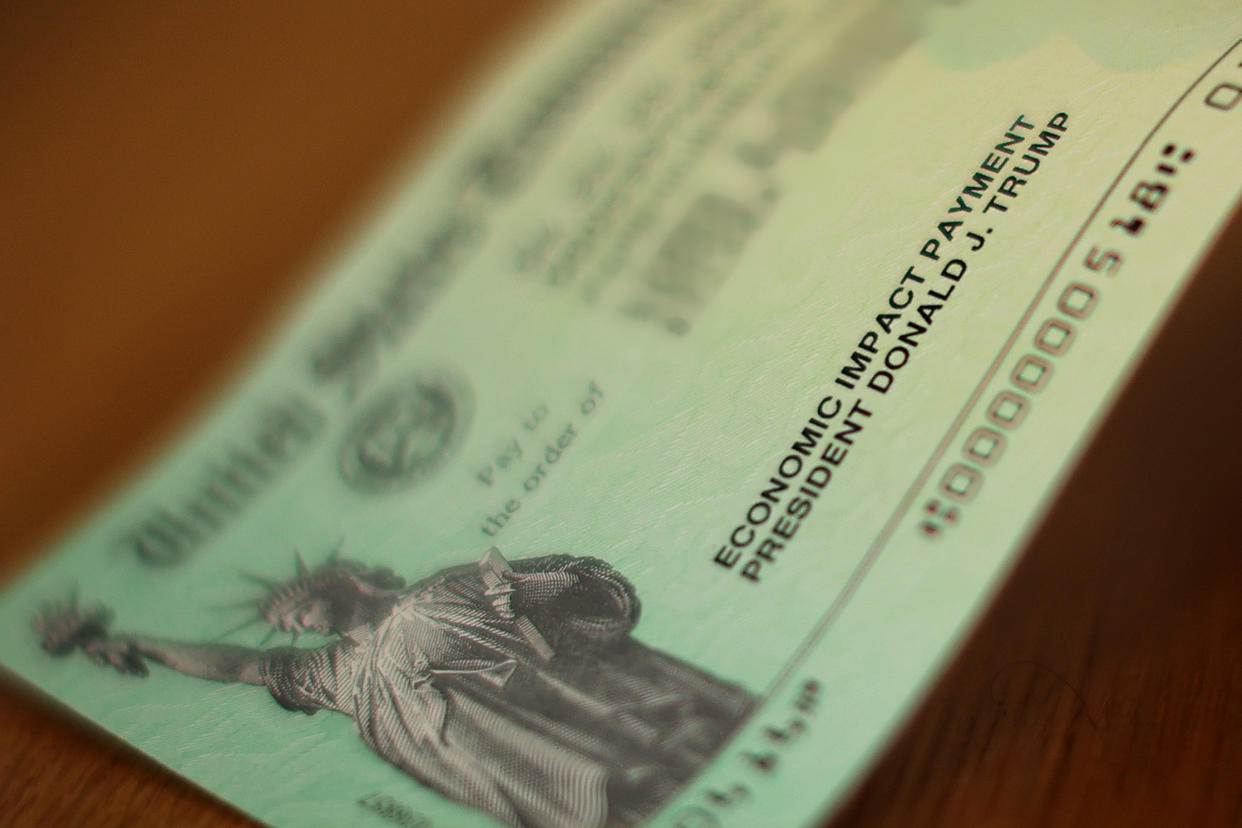

$600 stimulus checks arriving ‘as early as tonight’ while increase to $2,000 stalls in Senate

Stimulus checks will begin arriving “as early as tonight” for eligible Americans, Treasury Secretary Steven Mnuchin tweeted on Tuesday, pointing to the Internal Revenue Service (IRS) ‘Get My Payment’ tool for status updates.

“This second round of payments will be distributed automatically, with no action required for eligible individuals,” the Treasury Department stated on Tuesday. “If additional legislation is enacted to provide for an increased amount, Economic Impact Payments that have been issued will be topped up as quickly as possible.”

The current round of stimulus payments, part of a new $900 billion stimulus deal, should be completed by Jan. 15, according to the bill’s text. Starting on Wednesday, around 10 million are expected to be mailed every week to recipients without direct deposit information on file with the IRS.

The direct payments will be $600 per individual (and $600 for each dependent under 17), with the possible increase the payments to $2,000 currently stalled in the Senate. If the amount of stimulus increased through legislation, additional payments will be issued.

On Monday, the Democratic-controlled House passed the Caring for Americans with Supplemental Help Act (CASH) Act to increase the amount of the direct payments from $600 to $2,000 and expand the additional bonus for dependents from each dependent under 17 to each dependent of any age.

On Tuesday, Senate Majority Leader Mitch McConnell (R-KY) blocked an anonymous consent vote on the standalone $2,000 stimulus check legislation requested by Senate Minority Leader Chuck Schumer (D-NY).

McConnell later introduced a bill that combines both the $2,000 stimulus checks and the repeal of Section 230, a 1996 internet law that protects platform from legal liability arising for user-generated content. Both demands are supported by President Trump but tied together are unlikely to be supported by Democrats who oppose the repeal of Section 230.

“Senator McConnell knows how to make $2,000 survival checks reality and he knows how to kill them,” Schumer said in a statement on Tuesday. “If Sen. McConnell tries loading up the bipartisan House-passed CASH Act with unrelated, partisan provisions that will do absolutely nothing to help struggling families.”

Who gets a stimulus check?

For the second round of stimulus checks, the IRS will mostly use 2019 tax returns to determine eligibility for a direct payment.

Social Security beneficiaries, Disability Insurance beneficiaries, Supplemental Security Income recipients, Railroad Retirement Board beneficiaries, and Veterans Administration beneficiaries all are eligible for the payment even if they didn’t file a 2019 tax return.

Read more: Everything you need to know about the second stimulus payment

Eligible taxpayers who used the IRS Non-Filer tool for the first round of checks will be treated as providing returns and will also receive payments.

The payment will be reduced at a rate of $5 per $100 of additional income over $75,000 for single adults and $150,000 for married couples. Reduced payments will be available for single adults without children who earn between $75,001 and $87,000 and married couples without children who earn between $150,001 and $174,000. The phaseout thresholds change depending on the number of children in the household. A family of four will not receive a check if their income exceeds $198,000.

Deceased people may also receive a payment. Checks will go to all eligible taxpayers who were alive as of Jan. 1, 2020.

Who doesn't get a check?

Those without a Social Security number and nonresident aliens — those who aren’t U.S. citizens or U.S. national and don’t have a green card or have not passed the substantial presence test — are not eligible for the direct payments.

Married taxpayers who file jointly where one spouse has a Social Security Number and one spouse doesn’t will get one $600 payment, in addition to $600 per child with a Social Security Number.

Adult children whose parents claim them as a dependent on their taxes are also ineligible.

How will the government send you the stimulus check?

The IRS will use direct deposit information provided from the taxes filed for 2019.

Americans may be able to use the IRS’ Non-Filers tool to provide information like the first round. But, so far, the IRS has not announced whether that tool will be available this time around.

Read more: Here's what the new coronavirus stimulus deal means for your wallet

The tool was for eligible U.S. citizens or permanent residents who had gross income below $12,200 ($24,400 for married couples) for 2019 and weren’t required to file a 2019 federal tax return.

If you have no direct deposit information on file or if the account provided is now closed, the IRS will mail the stimulus payment.

If you received no payment and you think you’re eligible or you’ve got the wrong amount you’ll be able to claim it on 2020 tax return.

Do you have to pay back the stimulus check?

No, you don’t have to pay it back. It also doesn’t reduce any refund you would otherwise receive.

“No, there is no provision in the law requiring repayment of an Economic Impact Payment,” the IRS website said about the first round of checks.

If you were supposed to get a larger sum based on your 2020 income but got a reduced amount because of your 2019 income, then the government will pay you the difference when you file your taxes for 2020.

If your payment is too high based on your 2020 income, you’re not responsible for paying back the difference.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit