6 Times Warren Buffett, Jim Cramer and Other Experts Were Right About the Stock Market

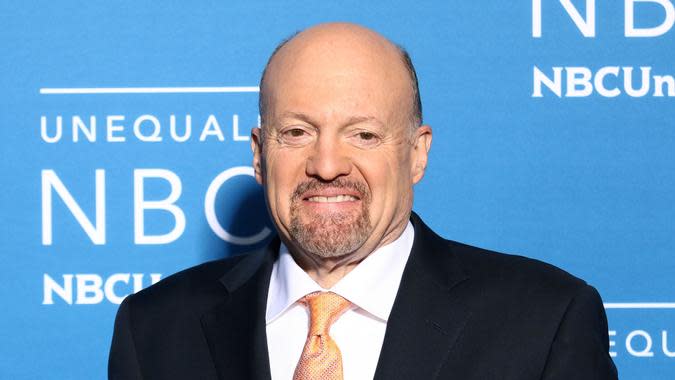

Public figures in the world of finance are easy targets when they make bad market calls. As commentators like Jim Cramer and billionaires like Warren Buffett are frequently quoted in the press, their missteps are publicly available for all to see.

See Our List: 100 Most Influential Money Experts

Small Business Spotlight 2022: Nominate Your Favorite Small Biz by July 25

What gets often overlooked,. however, are the number of times that these experts make correct market calls. Here are just a few of the times that Cramer, Buffett and other well-known experts have made profitable calls in stocks or the market overall.

Warren Buffett: Goldman Sachs Will Not Fall

In late summer 2008, the financial world was melting down. Lehman Brothers, an investment bank that had been founded in 1844, failed almost overnight, and Bear Stearns was right on its heels before getting bought out by JPMorgan Chase at just $2 per share.

Goldman Sachs, which itself was founded in 1869, saw its stock cut in half, on its way to further losses. But Warren Buffett saw not calamity but opportunity. The billionaire invested $5 billion into the company, which provided him with high-dividend preferred shares along with warrants to buy $5 billion common shares at $115.

When Buffett sold out in 2013, he walked away with a cool $3.2 billion in profits.

Check Out: 6 Alternative Investments To Consider for Diversification in 2022

Jim Cramer: Buy Apple

Apple is the largest company in America, and is seemingly owned by every investor and portfolio manager in existence. Some pundits go so far as to say, "as goes Apple, so goes the market," and over the past few years, they have been largely correct.

But way back in 2010, buying Apple wasn't the easy trade that it seems to be in the 2020s. Jim Cramer was among the first to wholeheartedly endorse the stock, calling it a "buy what you know" company.

According to Cramer, "it has the best company, best product, best consumer loyalty that I've ever seen." Cramer has been richly rewarded for his decision to buy and hold the stock, which has returned over 1,000% since he bought it.

Robert Shiller: Two Major Bubbles Will Burst

Yale economist Robert Shiller is one of the most-quoted financial experts in the world, and with good reason. While not all of his predictions have come to fruition, some of his biggest market calls have predicted major setbacks in financial assets.

Among his most noteworthy include the bursting of the internet bubble in 2000 and the housing market collapse in 2007. Avoiding either of these financial disasters, let alone both of them, could have saved investors large amounts of money. In 2013, Shiller earned the Nobel Prize for economics, in part due to his decades of accurate economic forecasting.

Jim Cramer: Buy NVIDIA

In the case of NVIDIA, Cramer cites the power of coupling a good business with an excellent CEO. According to Cramer, NVIDIA founder and CEO Jensen Huang has done a great job of positioning the company to benefit from strong economic trends, breaking ground "in the way that Intel used to break ground."

While the company is now well-known for its leadership in everything from artificial intelligence and gaming to machine learning and automobile parts, Cramer was all over the company as early as 2017, taking profits in 2018 before piling back in after a strong selloff in March 2019.

Warren Buffett: Bank of America Will Be of Great Value

Just like Buffett made a great call on Goldman Sachs at the start of the late 2000s meltdown, he also made one on Bank of America as the recovery was beginning to take root. By 2011, Bank of America had fallen below $7 per share, as it was still suffering the effects of the subprime mortgage meltdown. But just as he invested $5 billion into Goldman Sachs in 2008, Buffett forked over an additional $5 billion into B of A in 2011.

The deal was somewhat similar to the Goldman Sachs deal, offering Buffett high-paying preferred stocks shares along with warrants to buy 700 million Bank of America shares at $7.14 each. As Buffett noted in his annual investment letter to shareholders, "Our warrants to buy 700 million Bank of America shares will likely be of great value before they expire."

When he exercised those warrants in 2012, Buffett earned $12 billion.

Bill Ackman: General Growth Properties

Billionaire hedge fund manager Bill Ackman epitomizes the idea that even great analysts and managers can have both major successes and major failures. Although Ackman has been in the news recently with his failed investments in Valeant Pharmaceuticals and Herbalife, his track record of successes is equally enviable.

One of his greatest calls was investing in General Growth Properties when the mall operator was nearly bankrupt. A $60 million investment from his hedge fund Pershing Investments in 2009 led to a whopping $1.6 billion profit.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 6 Times Warren Buffett, Jim Cramer and Other Experts Were Right About the Stock Market