6 Best Places in New York for a Couple To Live Only on Social Security

New York is often considered one of the most expensive states to live in America. And it's certainly true that areas like Manhattan carry a cost of living well above the national average.

But it's equally true that there are plenty of places in New York that are actually both great places to live and quite affordable. In fact, a couple living off an average Social Security check of $1,623 each -- or $3,246 combined -- can comfortably cover their basic expenses in at least six New York cities, all of which have high standards of living.

Discover: 10 Best Florida Cities To Retire on $2,500 a Month

Learn: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

To determine the best places in New York for a couple to live only on Social Security, GOBankingRates acquired data from a wide range of sources, including the Bureau of Labor Statistics, the U.S. Department of Housing and Urban Development, the Social Security Administration and the U.S. Census Bureau. Livability scores were derived from AreaVibes.

Data revealed that the average monthly cost of groceries in the United States per person was $411.83, while monthly healthcare expenses tallied $431.42 on average. To generate the final rankings, the average cost of a one-bedroom apartment rental was factored in, as was the livability score of each city. The percentage of the population that was 65 or older, when compared with the national average of 16%, was also considered.

6. Middletown

Monthly costs: $2,950

Middletown is a great case in point that shows how far Social Security checks can actually stretch. The city doesn't boast particularly affordable living -- in fact, grocery costs are about 2.2% above the national average, while healthcare runs a whopping 16% above average. But the city's relatively modest $1,107 average rent for a one-bedroom apartment is enough to bring the total expected monthly expenditures within reach of a couple retiring on an average combined Social Security benefit of $3,246.

Take Our Poll: What's the Table Time Limit on a $400 Restaurant Meal?

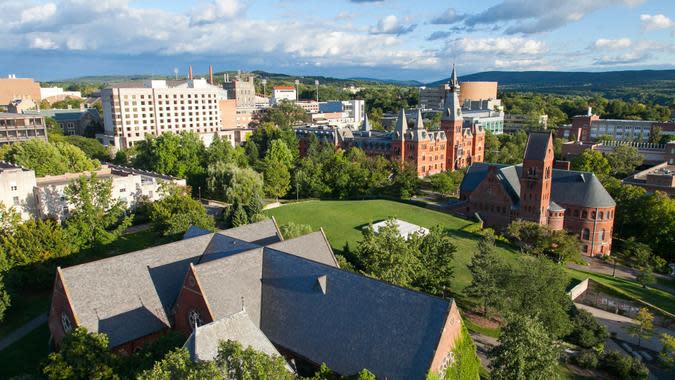

5. Ithaca

Monthly costs: $2,900

Ithaca's healthcare and grocery costs are actually a decent amount above the national averages, by 5.6% and 4.6%. But the total expected monthly average cost for a couple in Ithaca is just a few hundred dollars below what two Social Security earners can be expected to pull down. The average one-bedroom apartment rents for $1,127 in Ithaca, not the cheapest around but low enough to help keep total average costs within reason.

4. Kingston

Monthly costs: $2,855

Kingston has above-average healthcare and grocery costs, but an average one-bedroom monthly rent of $1,060 helps keep the combination of all of these expenses at just $2,855 for a couple. That's well below the average income for a couple living off Social Security. Toss in a livability score of 69, and it's no wonder that a very high 20% of Kingston residents are 65 and older.

3. Glens Falls

Monthly costs: $2,512

Seniors seek out Glens Falls in droves due in large part to its high quality of life. A very high 21% of its residents are 65 and older, well above the national average of 16%, and its excellent livability score of 74 is also well above average. With one-bedroom rents averaging just $850 per month, and grocery and healthcare costs also below average, a couple living on Social Security should be able to cover those costs and have more than $700 left over for other expenses.

2. Cheektowaga

Monthly costs: $2,461

Cheektowaga may be a mouthful, but it's one of the best places to live in all of New York, with a livability score of 82. A big part of that comes from the low cost of living in Cheektowaga, where a one-bedroom apartment costs just $812 per month on average, and total costs -- including housing, groceries and healthcare -- reach just $2,461. This could free up hundreds per month in the budget of a couple living just on Social Security.

1. Rome

Monthly costs: $2,342

The top city in New York for couples living on Social Security checks is Rome. Not to be confused with the Eternal City in Italy, New York's Rome is a mecca for those looking to live in a very livable city on a low budget. All-in, healthcare, groceries and one-bedroom apartment rent in Rome average well below the $3,246 an average couple brings home from Social Security. Rent in Rome is particularly low, at just $680 per month for the average one-bedroom apartment, while livability still remains high with a score of 71. About 19% of the population of Rome is 65 and older, above the 16% average for America as a whole.

Methodology: GOBankingRates determined the best places in New York State for a couple to live on only their Social Security checks based on (1) the average monthly benefit for retired workers ($1,623.10), sourced from the Social Security Administration, and doubled; and (2) FY 2022 New York State Fair Market Rent for a one-bedroom apartment, as sourced from U.S. Department of Housing and Urban Development. GOBankingRates then used Sperling's Best to find the cost of living index for each listed city, looking at (3) grocery and (4) healthcare index scores. Next, GOBankingRates used data from the Bureau of Labor Statistics 2020 Consumer Expenditure Survey to find the annual expenditure amount for both grocery ("food at home") and healthcare costs for people age 65 and older in order to find how much a person 65 and over would spend on groceries and healthcare in each city on a monthly basis. GOBankingRates then added monthly housing, grocery and healthcare costs together. In order for a city to be qualified for the study, its (5) population had to be 10% or more over the age of 65, according to the U.S. Census Bureau, and (6) have a livability score of 65 or above, sourced from AreaVibes. All data was collected on and up to date as of Aug. 11, 2022.

More From GOBankingRates

Food Stamps Schedule: When Can I Anticipate September 2022 SNAP Payments?

Check Out Readers' Favorite Small Businesses in Our 2022 Small Business Spotlight

This Credit Score Mistake Could Be Costing Millions Of Americans

This article originally appeared on GOBankingRates.com: 6 Best Places in New York for a Couple To Live Only on Social Security