50 Wealth-Building Keys From Elon Musk and the Richest People on Earth

Billionaires can seem like mythical people, with access to capital that mere mortals can only dream of. The truth, however, is that they’re just humans who have figured out more than a few keys to being successful.

Find Out: Shark Tank’ Star Kevin O’Leary: My Morning Habit That Keeps Me From ‘Losing Money 100% of the Time’

Try This: 4 Genius Things All Wealthy People Do With Their Money

There are 2,781 billionaires as of March 2024, according to Forbes, which is 141 more than last year. What can you learn about wealth-building from the uber rich?

GOBankingRates gleaned almost 50 pieces of advice from the 10 richest people in the world, including names you’re probably familiar with, such as Elon Musk and Jeff Bezos, and others you may not know as well, like Mukesh Ambani. Read on to find out what they can teach you about building wealth.

Bernard Arnault

The richest man in the world currently, Bernard Arnault, is CEO of LVMH, quite literally a fashion empire. This includes more than 75 fashion and cosmetic brands, most famously Louis Vuitton and Sephora. His net worth is around $233 billion.

Let Creativity Lead You

Arnault once told Forbes, “What I have fun with is trying to transform creativity into business reality all over the world.”

In his world this means being connected to innovators and designers, but in a larger sense it can look like finding ways to seek inspiration from thought leaders and creatives in your field, industry or passion to help you stay inspired. Money is borne from creative ideas, after all.

Trending: I’m a Financial Advisor: Here’s Why My Rich Clients Identify With the Middle Class

Have Patience

In reflecting on his many years in business, Arnault acknowledged that he was impatient in his early years. He sold a make-up business that he’d owned for only five years when it wasn’t working, when he should have kept it.

“What I have taken from this is that when you have business that’s not performing well, it’s important to better understand the business and be patient. It can take years in this universe of creative brands to make something work. Now that business is doing well.”

He went on to say that in business, “the most important thing is to position yourself for long-term and not be too impatient.”

Uphold a Standard of Excellence

In his role overseeing LVMH, Arnault has held very high standards of quality for his company’s products. While you may not be a CEO of a global conglomerate, holding your work and those who work with you to high quality standards positions you to be engaged in the kind of work or business that attracts money and attention.

Execution Is More Important Than a Good Idea

Arnault told Forbes that while great ideas are a key to success, the truth is “the idea is just 20%. Execution is 80%.”

He pointed to many early startups where the ideas are “[G]reat at the beginning. But there were others with that same idea. Why is Facebook the phenomenal success it is today? It’s because of the execution, and that’s the key. I would say to a young person trying to work in a startup, have ideas, but be persistent and execute well.”

Don’t Focus on Money

While money may be the end goal of hard work or a great idea, Arnault encouraged people not to just focus on the money. Hard work and long term vision are keys to success.

He told Forbes, “Money is just a consequence. I always say to my team, don’t worry too much about profitability. If you do your job well, the profitability will come.”

When reflecting on one of his companies, Louis Vuitton, the number one luxury brand in the world, he said, “What I am interested in is how we can make it as admired and successful in ten years as it is today. It’s not how much we’re going to make next year.”

Elon Musk

Elon Musk is the headline-making co-founder of six companies, including Tesla, SpaceX and the Boring Company. His net worth is around $195 billion. Here is some of his advice about running a business and building wealth.

For You: Net Worth for US Families: How To Tell if You’re Poor, Middle Class, Upper Middle Class or Rich

Be Open to Feedback

Though the Tesla CEO has not been notoriously good at taking criticism about himself or his companies, Musk is on record as having said, “Take as much feedback from as many people as you can about whatever idea you have.”

In particular, he referred to critical feedback, adding, “Ask them what’s wrong. You often have to draw it out in a nuanced way to figure out what’s wrong.”

Of course, feedback is how we grow, and can help us make better decisions about our finances. Even Musk wouldn’t be a billionaire if he hadn’t listened to feedback along the way.

Help Others

While most of us learn as children to care about others, Musk has taken this philosophy into his businesses, building companies like Tesla and SpaceX with a sustainable or alternative future in mind — for the betterment of humankind.

On a 2021 episode of the Lex Fridman Podcast, Musk said, “Do things that are useful to your fellow human beings, to the world. It’s hard to be useful. Very hard.”

While this might not seem like an obvious way to build wealth, doing for others is one of the ways that many entrepreneurs build their businesses, by identifying and solving problems.

Read a Lot

In that same Fridman interview, Musk gave the advice, “I would encourage people to read a lot of books. Try to ingest as much information as you can, and try to also develop a good general knowledge so you at least have a rough lay of the land of the knowledge landscape.”

Many finance experts recommend the same advice, suggesting that if there’s something you don’t know, go out and learn about it. Empower yourself with knowledge.

Be Persistent

Musk has had his share of failures as well as successes, and yet that has not stopped him very often. “Persistence is very important. You should not give up unless you are forced to give up.”

Whether learning about finances, trying out an investing strategy, or trying to find the best avenue for wealth building, persistence is required to get rich.

Be Aware: Toilet Paper to Discontinued Items: 7 Ways Shrinkflation Has Come to Costco

Invest in Products You Love

Investing can feel a bit mysterious if you’re new to it. Musk has a simple strategy, which he shared in a 2023 Tesla earnings call. “Identify companies whose products you love. Does it seem like they’ll continue to make great products? Buy that stock and hold it. That’s it. You will win,” he said.

He added, “The reason companies exist is to make goods and services, ideally great goods and services. That’s why you should buy stock in a company that makes good products. It’s common sense, actually.”

Jeff Bezos

Jeff Bezos is the founder of the e-commerce retailer, Amazon. His net worth is an estimated $194 billion. Here are some of his top financial tips.

Diversify Your Portfolio

Bezos’ fortune not only comes from the sheer profits that Amazon has wrought him, but from a diverse investment portfolio. In fact, the vast bulk of his wealth comes from his investments, and in companies where he invested seed funding or venture capital.

Anyone can check out his investments at BezosExpeditions.com to see how to invest like a billionaire. Of course, your investments will likely be much more modest.

Be Willing To Take Risks

Wealth-building doesn’t come by playing it safe, and Bezos knows this. He told his Amazon shareholders in a letter, “If you know in advance that it’s going to work, it’s not an experiment.”

He’s not too proud to admit that many of his successes came from experimentation, and even failures.

Take Advantage of Your Gifts

In 2017, Bezos gave a speech at The Museum of Flight to celebrate their Apollo space exhibit, in which he emphasized how important it is to not only overcome adversity but lean into your talents.

“You get certain gifts in life, and you want to take advantage of those,” he said. “My advice on adversity and success [is] to be proud not of your gifts, but of your hard work and your choices.”

Find Out: How Far a $100,000 Salary Goes in America’s 50 Largest Cities

Work Hard To Be Successful

Of course, talent alone is not enough to be successful at building wealth or any other endeavor. Bezos told CNBC, “When you have a gift and then you work hard, you’re really going to leverage that gift.” He added, “When you do [your work] well, it will lead to your success.”

Be (or Become) Adaptable

While Bezos has not necessarily said aloud that adaptability is key, his actions — and Amazon’s — say that in spades.

Amazon has been nothing but, starting out as an online bookstore and transforming into a global e-commerce and cloud computing company known the world over.

Mark Zuckerberg

Mark Zuckerberg started Facebook in 2004, at just 19 years old, as a place for students to connect names with faces. His net worth is an estimated $177 billion. Here are his keys to financial success.

Stay Frugal, No Matter Your Income

With so much wealth, Zuckerberg could easily wear designer suits and drive a fancy car. Instead, he embodies frugality with his signature wardrobe of the gray T-shirt and jeans. He’s also known to drive a simple Acura instead of a flashy sports car.

Invest in the Future

While billionaires are in the position to donate big money to big initiatives, they remind us that even in small amounts, we can all invest in the future.

Zuckerberg and his wife Priscilla Chan founded the Chan Zuckerberg Initiative in 2015, making a pledge to give 99% of their shares in Facebook to tackle some of the biggest issues of the day, from disease to education. All of us can invest in these endeavors with what extra money we have.

While this may not help you build personal wealth, you can invest in helping those less fortunate than you, which is good for society as a whole.

Check Out: Here’s What the US Minimum Wage Was the Year You Were Born

Think Beyond Your Individual Purpose

Zuckerberg has doubled down on this idea about thinking beyond just your own individual purpose. He told Harvard’s 366th graduating class, “Today I want to talk about purpose. But I’m not here to give you the standard commencement about finding your purpose. We’re millennials. We’ll try to do that instinctively.”

However, he suggested that one must think bigger than the self to make any kind of meaningful change. “Instead, I’m here to tell you finding your purpose isn’t enough. The challenge for our generation is creating a world where everyone has a sense of purpose,” he said.

Don’t Just Think — Act

In that same Harvard address, Zuckerberg suggested that both change and success don’t happen just by thinking about them. They take action.

“I know, you’re probably thinking: I don’t know how to build a dam, or get a million people involved in anything. But let me tell you a secret: no one does when they begin. Ideas don’t come out fully formed. They only become clear as you work on them. You just have to get started,” he said.

Work To Fix Inequality

If you’re noticing a theme amongst Zuckeberg’s words of wisdom, it’s that while individual pursuits of wealth and success are good, we should all be working for equality.

“We should explore ideas like universal basic income to give everyone a cushion to try new things. We’re going to change jobs many times, so we need affordable child care to get to work and healthcare that aren’t tied to one company,” he said.

Larry Ellison

Larry Ellison is the chairman, chief technology officer and co-founder of the software company Oracle. His net worth is around $141 billion. Here’s what he says it takes to get rich.

Find Your Limits

In a YouTube compilation video of Ellison’s talks over the years, he said that life is a series of acts of discovery in order to discover your limits. If you don’t test and push them, how will you know where they are?

Whether this applies to your limits for risk tolerance in investing, or how willing you are to take a chance as an entrepreneur, it hasn’t steered Ellison wrong.

Explore More: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

Think for Yourself

Ellison is a man who looks beyond the conventional, into gray areas where new ideas and sometimes even scary risks lead to great things. In a phrase, be like Ellison and learn to think for yourself, trust your instincts, and don’t just follow the crowd when it comes to your own personal success or wealth-building. If you see a good opportunity that feels right, jump on it.

Learn To Translate Good Ideas

In that same YouTube compilation, Ellison referenced the way people have accused Apple co-founder Steve Jobs of stealing the idea for the Macintosh computer from Xerox’s Alto computer. Ellison said that while they may have looked like the same idea up front, there were so many things that had to be done to turn it into the Macintosh that Xerox had not done. He said Steve could translate good ideas into finished brilliant products.

While most of you may not be building a company that sells products, by adding your own labor, sweat and vision to something, you can turn it into a success for yourself.

Make Tough but Necessary Choices

Ellison said that sometimes you have to make tough choices that are right for you, your business or your finances, but may seem painful at the moment. He referred to the time he had to lay off his entire management team at one point in order to drive Oracle in the right direction. It was painful, but necessary, he said.

He called it “the most difficult thing I had to do in business.”

Keep Moving the Goal Posts

Wealth-building does not happen passively at first. It takes aggressive strategizing and planning.

Ellison reported that every time he’d get near to a goal, he’d move the goal posts out further to challenge himself. He said that you can always do more to push yourself toward greater things.

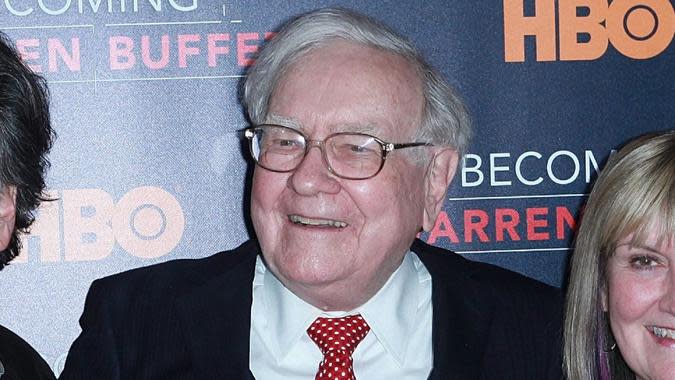

Warren Buffett

The “Oracle of Omaha,” Warren Buffett, the co-chairman of the investing company Berkshire Hathway, is not only known for his investing savvy, but his frugal lifestyle. His net worth is approximately $133 billion. Here’s what he advises about money.

Find Out: How Much Does the Average Middle-Class Person Have in Savings?

Don’t Rely on Handouts

Buffett, like Zuckerburg, is known for living a modest and frugal life despite being one of the ten richest billionaires in the world. He extends this philosophy to his children and other family members.

ABC News reported that Buffett told his own daughter, who asked for a $41,000 loan to renovate her kitchen, to get her loan the same way everyone else does: through a bank.

The sooner you learn to build a strong financial foundation and not look for bailouts or handouts, the sooner you’ll find financial stability.

It’s Better To Work for Money Than Inherit It

Despite being a billionaire, Buffett has long been outspoken about inequity, and is known for stating, “You should leave your children enough so they can do anything, but not enough so they can do nothing.”

He has told his shareholders that he believes working for money is the more noble pursuit than inheriting it. He also believes that people with money to spare should donate to charitable causes.

Be Like Bertie (Buffett’s Sister)

In Buffett’s very recently published 2024 shareholder letter, Buffett describes his wise sister Bertie as the ideal investor. “She is sensible — very sensible — instinctively knowing that pundits should always be ignored,” he said.

She may not be numbers smart, but Bertie has good instincts because she doesn’t listen to hot new friends like NFTs or flash-in-the-pan stocks, Buffet said. He urged people to not be easily moved by trends and flashy financial promises, which often benefit others, but not you.

Pay Yourself First

Buffett (and many other finance experts) often say you should pay yourself first. What this translates to is, “Do not save what is left after spending, but spend what is left after saving.”

Adopt a Savings Mindset

In Berkshire Hathaway’s 2023 shareholder letter, Buffett urged people to take a savings mindset from the get-go, and not to rely upon transfers of wealth.

“A common belief is that people choose to save when young, expecting thereby to maintain their living standards after retirement,” he wrote. “Any assets that remain at death, this theory says, will usually be left to their families or, possibly, to friends and philanthropy.”

“Our experience has differed,” he wrote. “We believe Berkshire’s individual holders largely to be of the once-a-saver, always-a-saver variety.”

Up Next: Here’s How Much You Need To Earn To Be ‘Rich’ in Every State

Bill Gates

Bill Gates, the founder of Microsoft, has also diversified his assets into numerous other holdings, including waste disposal firm Republic Services and tractor maker Deere & Co. His net worth is a reported $128 billion.

Optimism Can Change the World

Optimism is not just a sunny attitude toward life, argued Bill Gates at a 2014 commencement address at Stanford University. It is a life-changing way of looking at everything from business to life, and should be part of any strategy, even wealth-building.

He explained how his trips to severely impoverished countries, where people die of common illnesses, motivated many of his pursuits at Microsoft.

“Melinda and I have described some devastating scenes. But we want to make the strongest case we can for the power of optimism. Even in dire situations, optimism can fuel innovation and lead to new tools to eliminate suffering,” he said.

Invest in Education

It’s no surprise that Gates believes strongly in education, given that he and his ex-wife, Melinda, invested heavily in education through their foundation.

In a Reddit “Ask Me Anything” thread, he answered the question of “What is your best personal financial advice for people who make under $100,000 a year?” with, “Invest in your education.” [X] [x]

Be Wary of Cryptocurrencies

In a 2022 Reddit “Ask Me Anything,” people asked Bill about his thoughts on cryptocurrencies as a wealth-building tool.

His answer: “I don’t own any. I like investing in things that have valuable output. The value of companies is based on how they make great products. The value of crypto is just what some other person decides someone else will pay for it so not adding to society like other investments.”

Let Mistakes Be Your Teacher

Gates is often cited as saying, “It’s fine to celebrate success, but it is more important to heed the lessons of failure.”

He’s not alone in this advice, as failure is inevitable in life and business, but it doesn’t have to be ultimate. Instead, it can be a way to grow and learn. In building wealth, just try to keep the financial size of your failures to a minimum.

Check Your Change: 6 Rare Coins That Will Spike in Value in 2024

Set Goals and Chart Progress

Setting and measuring financial goals is essential to achieving them, experts explain. Gates underscored this in the annual letter from the Bill and Melinda Gates Foundation in 2013.

“In the past year I have been struck again and again by how important measurement is to improving the human condition.” He went on to add, “You can achieve amazing progress if you set a clear goal and find a measure that will drive progress toward that goal.”

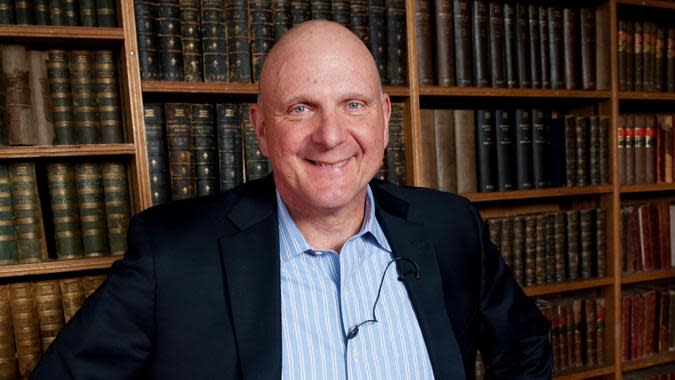

Steve Ballmer

Steve Ballmer was the CEO of Microsoft from 2000 to 2014. He is the current owner of the Los Angeles Clippers and co-founder of Ballmer Group. His net worth is around $121 billion. Here are some of his top financial tips.

Have Long Vision

Ballmer helmed Microsoft during a time when competitors like Apple and Google provided significant competition, yet he managed to keep the company in great shape and ahead of the game due to his ability to look into the future.

“If the CEO doesn’t see the playing field, nobody else can,” Ballmer told Fortune.com. “The team may need to see it too, but the CEO really needs to be able to see the entire competitive space.”

Planning for your own wealth requires thinking beyond the moment.

Don’t Fear Change

Building wealth often requires change — whether that’s a new investment strategy, product or timeline. Ballmer understands this.

“The playing field is always changing,” he told Fortune not long before he left Microsoft.

He must have meant literally, as he went on to purchase the L.A. Clippers, signing superstar players and launching a new brand focused on sports and entertainment teams and venues.

Admit What You Don’t Know

For many people, wealth-building starts out as a new territory where there’s more that you don’t know than answers. Rather than try to act smart, this is one area where you really want to admit what you don’t know so you can seek the experts to help you learn.

Ballmer is one who took this advice to heart. “I’ve grown, and when you grow, you say, ‘Wow, I didn’t know what I didn’t know,'” Balmer told Fortune.

Good To Know: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Embrace Change

CEOs like Ballmer understand one principal probably above all others: change is inevitable, you might as well embrace it.

For him, this looked like several different pivots over the years, steering the company into directions that were true to its brand but still kept it on top of the competition.

Mukesh Ambani

Mukesh Ambani is the chairman of Reliance Industries, which has its hands in petrochemicals, oil and gas, telecom, retail and financial services. His net worth is $116 billion.

Have an Entrepreneurial Attitude

When Ambani was just starting his then quite small company Reliance, just out of Stanford University, his father reportedly told him, “I am not going to tell you anything. If you are an entrepreneur, you will figure out what you want to do.”

This taught Ambani the importance of an entrepreneurial mindset, which means not waiting for instruction, but being proactive, taking risks and being innovative.

Learn More: 6 Money Moves To Make When Your 401(k) Hits $1 Million

Solve Problems You Care About

Much of Ambani’s advice is geared toward entrepreneurs and business people, but there are lessons for the average person to extrapolate.

At the 2017 NASSCOM conference, an annual technology conference, Ambani suggested that if you’re going to build a business, seek to solve problems that you’re passionate to solve. He suggested that entrepreneurs should look to solve problems that have a wider social impact versus just personal financial gain.

Failure Is Inevitable, but Stay Hopeful

Not unlike Bill Gates’ earlier comments on optimism, Ambani has also learned that staying optimistic is a key trait on the path to any pursuit.

Wealth-building can be frustrating, slow and involve failure. In Ambani’s talk at the NASSCOM conference, he urged people not to get frustrated by failure, and to stay hopeful.

Assemble an A-Team

Rarely does success of any kind happen alone. If you’re hoping to build wealth, you’re likely building off the wisdom of those who went before you.

Indeed, Ambani suggested that anyone who hopes to have wild success needs to assemble an “A-team.”

For you this could simply mean hiring a financial planner, or shadowing an investing whiz to see how they do it. Whatever it looks like, bringing in supportive players in your journey can be essential.

Stay Positive

It’s no surprise by now that billionaires have cornered the market on a certain attitude that helps in their success.

Like Gates and others, Ambani told attendees at the conference, “The entrepreneur is an optimist. There are a lot of cynics and people who think negatively. Glass half full, never half empty.”

Adopting that glass-half-full approach can help you to be proactive and positive in your pursuit of wealth-building rather than getting easily frustrated or discouraged.

For You: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Larry Page

Larry Page is a co-founder of Alphabet, the parent company of Google. He stepped down as CEO in 2019, but is still a board member and has a controlling share in the company. His net worth is a reported $114 billion.

Dream Big

Don’t let naysayers tell you that any idea you want to invest in or fund is too big. Consider dreaming big like Larry Page.

According to Forbes, Page has invested his own money to fund two “secretive startup companies” that are allegedly building flying cars. While this reality may be a long way off, it’s clear that Page knows how to dream big — and invest his money in those dreams.

Invest in Sustainability

Page is also well known for his advocacy and investment in clean energy. According to Forbes, he also walks the walk by powering his home with geothermal energy and fuel cells.

The more people who invest in these technologies, the more likely they will eventually add value to a portfolio as well as to society.

Be Able To Pivot

Being able to see change coming and pivot your approach is a key in successful wealth-building.

Page helped Google adapt to new ways of advertising and marketing in the early 2000s. Because of his innovations, Google was able to stay relevant. The result of this was Google ads, which bring in high revenue for the company.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 50 Wealth-Building Keys From Elon Musk and the Richest People on Earth