5 States Where Social Security Cuts Wouldn’t Matter to You

The United States is home to about 62 million adults of retirement age, and the vast majority get Social Security benefits. More than 53.1 million Americans received retirement checks as of February 2024, according to the Social Security Administration. If Social Security benefits ever get cut — as some politicians have suggested — it would have a huge negative impact on many seniors, but not all of them.

Read Next: Cutting Expenses in Retirement — 6 Home Items to Stop Buying

Check Out: One Smart Way To Grow Your Retirement Savings in 2024

Americans in some cities and states rely much more heavily on Social Security benefits than in others. Seniors who live in states with low costs of living, low taxes and cheap housing have an easier time planning for retirement and are in a much better position to weather Social Security cuts.

For now, benefit cuts are not a major worry. Although some politicians have proposed cutting Social Security benefits to help prop up the program as it heads toward a funding shortfall, they are in a tiny minority. Most politicians — including President Joe Biden and ex-President Donald Trump — publicly oppose cutting benefits.

Even so, the idea of cutting Social Security to put the program on sturdier financial footing has been around a long time and is not likely to disappear anytime soon.

If benefits ever are cut, here are five states where it would matter the least based on previous GOBankingRates research that looked at the following categories: states with the lowest tax rates; states where your Social Security check goes the furthest; and states where you can afford to buy a home on Social Security income. None of the states below tax Social Security benefits, either.

Arkansas

As of June 2023, the average home value in Arkansas was $199,284, making it one of only three states where you could buy a typical home for less than $200,000. Arkansas also ranks high in terms of how many necessities you can purchase on a single Social Security check.

Discover More: Here’s What the Average Social Security Payment Will Be in 15 Years

Find Out: 10 Things You Must Buy on Amazon While on a Retirement Budget

Florida

There’s a reason so many retirees flock to Florida. The Sunshine State doesn’t impose taxes on income or Social Security benefits, its property tax rate is about average and its sales tax rate is fairly low vs. other states.

Be Aware: 6 Things Retirees Shouldn’t Spend Big Money on While Traveling Abroad

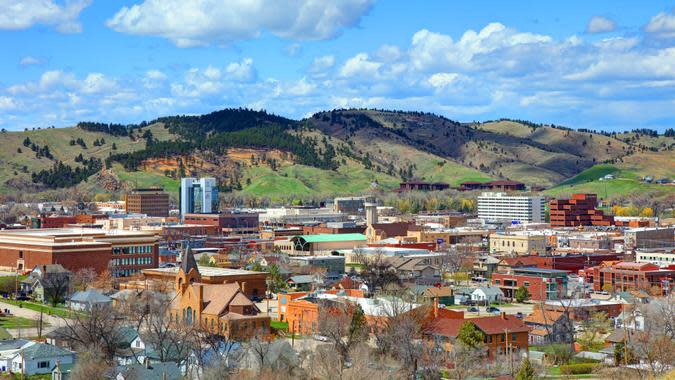

North Dakota

North Dakota ranks among the states with the lowest taxes, with an income tax rate of only 1.1% for residents 65 and older. Your Social Security check also goes a long way in North Dakota compared with other states.

South Dakota

South Dakota has no state income tax, so retirees don’t have to worry about any of their retirement benefits being taxed. And like its neighbor to the north, South Dakota is a state were Social Security checks can pay for a lot of necessities.

Wyoming

Wyoming is another state that does not levy state income taxes. In addition, your Social Security check will go a long way here compared with the rest of the country, and property taxes are low.

More From GOBankingRates

Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

The Biggest Mistake People Make With Their Tax Refund -- And How to Avoid It

This article originally appeared on GOBankingRates.com: 5 States Where Social Security Cuts Wouldn’t Matter to You