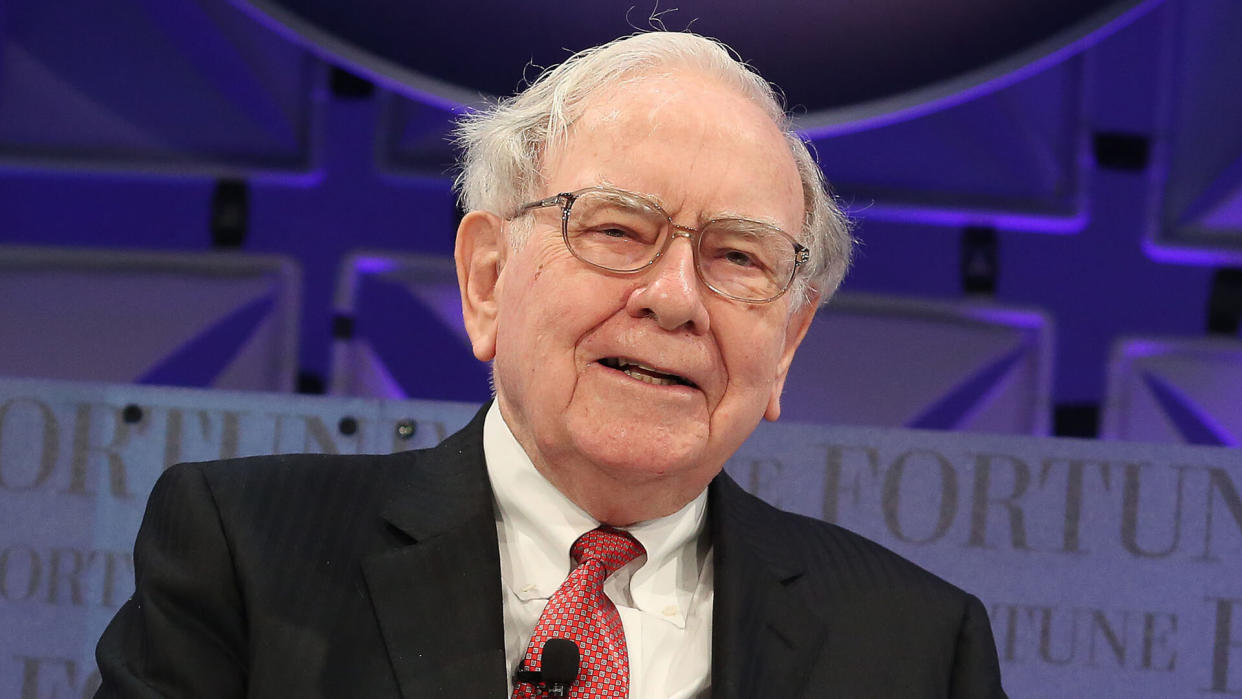

5 Lessons You Can Learn From Warren Buffett To Build Your Wealth

Warren Buffett is as famous for his folksy wisdom as he is for being the billionaire CEO of Berkshire Hathaway. One of the reasons that Buffett is often quoted in the financial press is that he’s able to dispense great investment advice for the masses in easy-to-understand language. Buffett actually seems to have disdain for high-fee financial advisors, suggesting many times that investors should avoid paying fees and that most would be better off buying index funds instead of developing complex strategies. Here’s some pithy investment wisdom straight from Buffett’s mouth regarding lessons you can learn to build your wealth.

See: Why Stealth Wealth Is the Best Way To Handle Your Money

Find Out: How To Guard Your Wealth From a Potential Banking Crisis With Gold

Buy a Low-Cost Index Fund

Index funds may seem “boring” to some investors, particularly those who seek outsized returns. After all, by definition, owning an index fund will only give you an “average” return, and you won’t outperform the stock market. But the reality is that most traders who try to beat the market on their own fail. In fact, most money managers do as well. Buffett has often touted the value of an S&P 500 index fund, going so far as to make a wager with money manager Ted Seides in 2007 that his hand-chosen group of hedge funds couldn’t outperform the S&P 500. Buffett won the bet handily.

As Buffett told Vanguard founder Jack Bogle in his book “The Little Book of Common Sense Investing,” “A low-cost index fund is the most sensible equity investment for the great majority of investors. By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.”

Take Our Poll: Would You Move for a Job That Paid You a $10,000 Signing Bonus?

Buy Quality Companies

In his 2022 letter to shareholders, Buffett stressed that investors should be buying quality companies rather than chasing stocks. In other words, Buffett emphasized that investors should look at stocks not just as numbers that bounce up and down and that you can trade in and out of; rather, look at the business behind the stock and determine if it has the qualities for long-term success. Specifically, Buffett said in his shareholder letter that one of the keys to the success of Berkshire Hathaway is choosing only “investments in businesses with both long-lasting favorable economic characteristics and trustworthy managers.”

Avoid Diversification

One of the cornerstones of financial advice over the past century has been that investors should diversify their portfolios to reduce risk. After all, the theory says, you don’t want one bad stock to blow up your entire portfolio. But billionaire Warren Buffett sees it differently. According to Buffett, if you do your research — as you should as an investor risking real-world money — then diversification is simply “protection against ignorance.” As Buffett famously stated in the 1996 Berkshire Hathaway annual meeting, “…we think diversification is – as practiced generally – makes very little sense for anyone that knows what they’re doing.”

While this may sound jarring at first glance, the principle behind it is sound. If you really do your homework and know the companies you are investing in, adding additional investments simply for diversification purposes will actually dilute the returns of the solid companies you have chosen.

Invest In America When Others Are Panicking

Perhaps Buffett’s most famous line about generating long-term wealth is that investors should “be fearful when others are greedy, and greedy when others are fearful.” The notion behind this quote is that when others are fearful, prices drop to bargain levels, offering opportunity for patient, long-term investors — particularly in American companies.

Buffett has long espoused his belief in the American economy and recommends always buying when things look bleak. In his 2021 letter to shareholders, Buffett wrote, “In its brief 232 years of existence … there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

Invest In Yourself

Although Buffett is famous for buying long-term winning stocks, he actually believes that the best investment you can make is in yourself. At the 2022 Berkshire Hathaway annual meeting, a member of the audience asked Mr. Buffett to recommend a single best stock for the current market environment. In typical Buffett style, he responded, “Well, I’ll tell you something even better than that one stock…the best thing you can do is to be exceptionally good at something….whatever it may be, whatever abilities you have can’t be taken away from you….So, the best investment by far is anything that develops yourself.”

In this exchange, Buffett was trying to make the point that regardless of if there’s inflation, a recession or even an economic depression, people will always seek out those who are excellent at what they do. This can lead to long-term economic success, even in tough times when stocks may be losing value.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 5 Lessons You Can Learn From Warren Buffett To Build Your Wealth