3 things you may have missed in markets amid weak economic data

This is The Takeaway from today's Morning Brief, which you can receive in your inbox every Monday to Friday by 6:30 a.m. ET along with:

The chart of the day

What we're watching

What we're reading

Economic data releases and earnings

What doesn't kill you only makes you stronger. Or so investors hope.

This week brought a host of misses on closely watched economic data — from the ADP employment report and ISM manufacturing data to JOLTs (the job openings report). Sure, with a 236,000 increase in March, the non-farm payrolls beat estimates slightly. But the figure was below the year-to-date average increase of 344,000 — so it also sort of tapped into the gloomier data mood.

The subsequent vibe on Wall Street is that the economy may be hitting a soft patch after the March banking turmoil and after yet another interest rate hike from the Federal Reserve.

"Risk-off sentiment has continued to grow in markets thanks to another round of weak data that’s added to fears about a potential U.S. recession," Deutsche Bank strategist Jim Reid warned.

The Dow Jones Industrial Average (^DJI), Nasdaq Composite (^IXIC), and S&P 500 (^GSPC) all saw buyer's fatigue in the wake of the data letdowns.

What didn't lack interest? Safe-haven trades such as gold, the Utilities Select Sector SPDR Fund, and the Consumer Staples Select Sector SPDR Fund. Oddly enough, speculative AI names like BigBear.ai (BBAI) and SoundHound (SOUN) caught bids (here's what pros told me about this move).

Amid all this activity, here are three things you may have missed this week.

1. The New York Auto Show is in town

With the auto show in town, Yahoo Finance was working the scene all week to report on the latest and greatest in everything mobility.

GM's (GM) CFO Paul Jacobson told me over lunch that there are no plans to turn a car's cockpit into one giant subscription service. That's reassuring considering some automakers have pondered charging subscriptions for heated seats.

And yes, Tesla came up at lunch — mostly from the view of GM looking to take a bite out of the EV leader's rich profit margins in the category.

Meanwhile, Yahoo Finance's Dave Briggs found three hot trends in autos you need to know about; here's Briggs from the auto show floor. Shout out to our friends at our sister publication Autoblog — I really enjoyed checking out these pics on new vehicle models.

2. Brace for bad chip earnings

An old boss once told me to always be on the lookout for trends. In the spirit of that, I am tossing a red flag onto the field for the approaching earnings season in the semiconductor industry.

With U.S. markets closed on Friday, Samsung (005930.KS) did its best to sneak in an under-the-radar major warning on its business. The chip giant said it would make a "meaningful" cut to its production amid still bloated inventory levels that are weighing on prices.

This is the same bearish tone markets heard from fellow chip-maker Micron (MU) when it reported earnings a few weeks ago.

None of this is a good setup for chip-maker earnings that begin trickling in later this month. I would argue it doesn't augur well for results from PC makers such as HP Inc. and Dell, either.

Even an upgrade on Intel (INTC) on Monday didn't strike me as a "screaming buy" call on the stock.

"We have been decidedly negative on Intel's prospects for quite some time, a stance clearly justified by the company's utter collapse as a weakening market and poor decisions shaved billions off the top line, burned billions in cash, and crashed the stock price by almost 50% since CEO Pat Gelsinger arrived," Bernstein analyst Stacy Rasgon wrote. "But while things still look bad, tactically we believe the medium-term set-up is, finally, improving a bit, as the company's issues are known, and numbers (for the first time in a while) may be low enough to stand."

3. McDonald's is having a moment

Believe me, after spending years covering the restaurant industry as a consumer reporter, a highly paid communications person at McDonald's (MCD) wants nothing more in life than to see their beloved fast food brand mentioned favorably somewhere in media land.

Since I am in a positive mood after my birthday, I have a morsel of happiness for folks at McDonald's (and their investors) to chew on.

Two calls on McDonald's from a report by longtime restaurant analyst Andy Barish at Jefferies caught our attention:

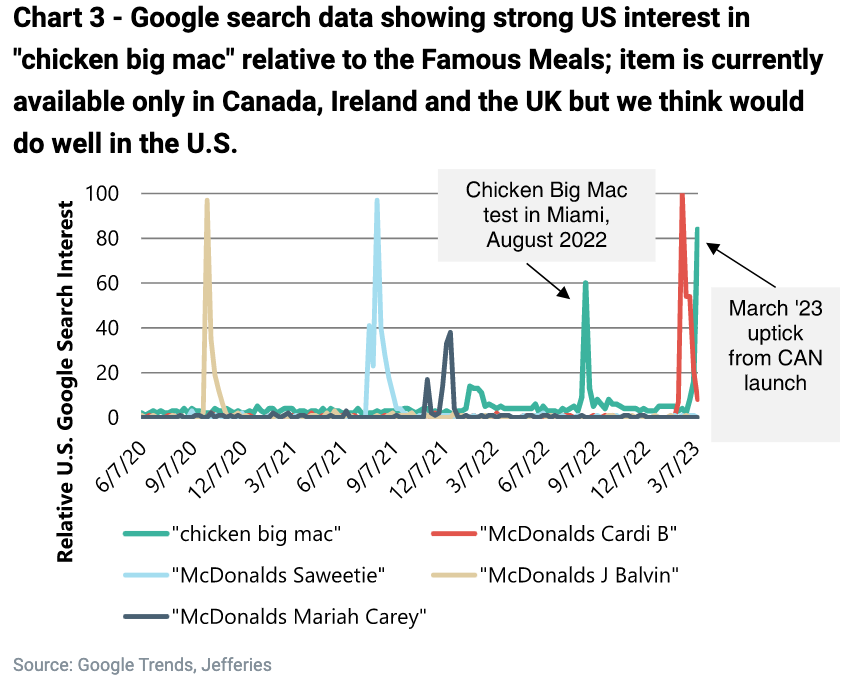

"We continue to be encouraged by the Famous Meals platform as evidence of MCD's powerful brand and marketing relevancy, not to mention the same-store sales upticks and opportunity for digital engagement with loyalty & mobile app usage, particularly among younger customers," Barish wrote. "While we concede there is a limit to how many times they organize current menu items into a combo with a celebrity name attached and still expect big consumer buzz/sales results, Google search data indicates the recent Cardi B & Offset Meal starting on Valentine's Day saw a similar level of attention as the successful J Balvin and Saweetie meals from Oct '20 and Aug '21, respectively, and only lagged the Travis Scott and BTS Meals (which had average tickets 50% lower or more given the Cardi B & Offset Meal is targeted for 2 people, and the BTS Meal likely benefited from a larger and younger worldwide fanbase)."

And then this:

"Google search data (below) also shows “chicken big mac” is trending well in the U.S. even though it isn't available here...yet," the analyst added. "This product is running as a limited-time offering in Canada, Ireland, and the UK. An August ’22 test in select Miami stores also generated a high level of Google search interest relative to MCD’s popular 'Famous Meal' LTO platform. Should the Chicken Big Mac come to U.S. stores, especially as chicken breast prices moderate, we think it would see high demand."

Another nugget: McDonald's shares are up 7.3% year to date, outperforming the Dow Jones Industrial Average's 1% gain.

Brian Sozzi is Yahoo Finance's Executive Editor. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Tips on the banking crisis or anything else? Email brian.sozzi@yahoofinance.com

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance