21 Budgeting Tips for College Students

Budgeting can be difficult for anyone, and college students are no exception. With the countless opportunities and new experiences at most universities, it might be tempting to indulge yourself and rely on your parents as a financial safety net. But if you can learn to manage your money at this stage in life, your chances of living a more financially stable and free life in the future are pretty high.

See Our List: 100 Most Influential Money Experts

Looking To Diversify in a Bear Market? Consider These 6 Alternative Investments

Although you might not make a lot of money in college, you’ll likely want to experience everything it has to offer. But you don’t want to go broke doing it all, only to find yourself having to pay off a massive amount of student loan debt.

Find out some creative ways to pay for college.

1. Use an App

As a college student, you’ve got a thousand things happening on a daily basis and, often, each day is different. A lack of structure can keep you from being on top of managing your spending and can spell disaster for your budget. Fortunately, there are a number of free budgeting apps to help.

Try a money management app like GoodBudget or CreditKarma which took over some features from the popular personal finance app Mint, and find the best budgeting app for you. Chances are, after consistently using one of these helpful budgeting tools for just a month, you’ll find new ways to save.

Live Richer Podcast: How To Get Rid of Your Student Loan Debt

2. Build In a Financial Cushion

Be prepared for unexpected expenses by building up a bit of savings that you can rely on. Once you have your budget, build in a 10% cushion, said Kendal Perez, a blogger for Hassle-Free Savings. “If a roommate unexpectedly moves out or your car requires an unexpected repair, this cushion can help reduce the stress and cost of these events,” she said.

Check out: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

3. Invest Your Spare Change

Saving your spare change has gone digital with investing apps like Acorns. You link your credit or debit card and when you make a purchase, Acorns rounds up the amount to the nearest dollar and makes the change available for you to invest. Not only will you be saving money, but you’ll also have the opportunity to grow it because your spare change is invested in stocks and bonds. It doesn’t take a math major to know that spare change and interest can really add up.

4. Start Paying Off Student Loans

Americans owe more than $1.7 trillion in student loans. It’s never too early to start paying off loans, especially interest, which can add up quickly. If you are on track to accumulate debt, Perez suggested it’s a good idea to start paying down your debt immediately — not to wait until after graduation — and to start incorporating payments into your current budget, no matter how small. “Even if you’re just paying off interest, getting into the habit of making regular payments to your student loans will help you pay them off faster,” Perez said.

5. Use Cash for Fun

Perez suggested determining how much you can spend on discretionary expenses such as dining out and social events, then withdrawing that amount in cash, whether it’s for the week or month.

“Commit to only using cash on these discretionary expenses and cut yourself off once it’s gone,” Perez said. “This strategy should help you make more thoughtful spending decisions since you want to get the most out of your cash.”

Read Next: How Much Does the Average Middle-Class Person Have in Savings?

6. Double or Triple Your Credit Card Payments

If you’ve run up credit card debt, one of the smartest money-saving moves you can make is paying that high-interest debt off, said Perez. She suggested including double or even triple payments in your budget. It might be tough, but you’ll thank yourself later. “You’re already (saddled) with student loan debt; don’t compound the issue with credit card debt,” said Perez.

Budget early for additional credit card payments so you don’t have to wait until later in the month to see if you can afford it. Once you have your credit card balances paid off, practice mindful spending so you don’t rack up high balances again.

7. Use Coupons

Coupons might not sound cool, but paying full retail prices is fiscally foolish. Coupons are available for just about everything if you search hard enough, said Kerry Sherin, SEO and PR manager at VirtualRealityRental.co. “Saving that extra 20% could mean the difference between a meal out with your friends or eating ramen alone in your dorm room,” she said.

Consider using free and credible coupon and deal sites like Coupons.com and Krazy Coupon Lady to find deals. Also, take advantage of coupons and offers from your favorite retailers and plan your necessary shopping trips around these deals.

8. Use Your Student ID or Student Email

Your student ID can get you some valuable student discounts on more than just movie tickets. For instance, with a valid student email address, you can sign up for Prime Student on Amazon and receive free shipping on millions of eligible items, exclusive college deals and promotions.

Other great deals can be found on everything from computer software and FedEx shipping to newspapers, food, clothing and much more, according to Sherin. “The bottom line is you should always ask if a student discount is available,” Sherin said.

Learn More: Here’s How Much You Need To Earn To Be ‘Rich’ in Every State

9. Don’t Overbuy at the Grocery Store

Almost 40% of the U.S. food supply is wasted each year which adds up to 325 pounds per person according to Recycle track Systems. For a college student, wasting food is a budget bomb and a shame. To be part of the solution and save some money in the process, buy only the groceries you absolutely need.

“Buying too many groceries can hit your wallet hard,” Sherin said. “Try setting a weekly grocery budget or stick to food items that have longer shelf lives.”

10. Look For Free Events

Colleges and universities are known for having many free events, so save money by taking advantage of them, advised Sherin. “While hitting up the local bar or nightclub might sound more appealing than a free campus event, you will spend more money out on the town,” said Sherin. Campus events are also a great way to meet new friends, Sherin said.

Whether it’s a concert, exhibition, or workshop, these provide entertainment and networking opportunities without cost. Look beyond campus events as well to see if the local community has any free entertainment or festivals to attend.

11. Take Classes at a Community College

Whether you’re supplementing your four-year university education — and possibly shaving some time off your college career by graduating earlier than scheduled — or attending a local college as a substitute for a four-year university, you can save a substantial amount of money by taking courses at a community college.

“Oftentimes, universities and colleges have agreements with other local community colleges to have classes that can transfer between each other,” Sherin said. “If it makes sense for your schedule and your wallet, see what’s available at the other school.”

Read More: 6 Rare Coins That Will Spike in Value in 2024

12. Get a Cash-Back Credit Card

Use this tip with caution: Getting a cash-back credit card can be a good financial move — as long as you are responsible. “Be sure you can manage debt responsibly before signing up for any credit card,” said Sherin.

It’s best to keep your credit card balance below 30% of your credit limit. So if you have a $1,000 limit, your balance should never exceed $300. Make it a habit to repay your credit card balance in full each month so you can maximize your cash back rewards.

“If you know you can be responsible with a credit card, apply for one that offers cash-back incentives,” Sherin said. “This way, you can earn money on the purchases you make every day.” A number of rewards credit cards are available, and some offer extra cash-back rewards depending on what financial institution you bank with.

13. Shop at the Dollar Store

The dollar store might not be the coolest place to shop, but it’s often the cheapest — learn dollar-store strategies. For essentials like school supplies, toiletries, and non-perishable foods, the dollar store can be a gold mine. Sourcing items here can dramatically reduce your monthly spending.

“If you know you are going to be shopping for things you are going to throw away — like trash bags, sandwich bags or paper towels — pick something inexpensive at your local dollar store,” Sherin said.

14. Borrow as Little as Possible

If you have to use student loans to pay for your education, try to borrow as little as possible, advised Steve Repak, a certified financial planner and author of “6 Week Money Challenge: For Your Personal Finances.”

“Unlike credit card debt, student loan debt can almost never be discharged in bankruptcy, so it is extremely important to put a plan together to get (student loans) paid off as soon as possible,” Repak said. The first move toward that is having a low balance to begin with.

Consider applying for grants and scholarships to help lower your tuition costs and fill out your FAFSA each year to see if you get approved for federal grants.

Check It Out: 10 of the Most Valuable Pennies

15. Get Good Grades

Although there are many reasons to earn the best grades that you can, perhaps one of the biggest incentives is that good grades can also pay off financially, said Ed Gjertsen II, CFP, vice president of Mack Investment Securities Inc.

“Good to great grades can go a long way in schools offering merit-based scholarships,” Gjertsen said. “While athletic scholarships may attract most of the attention, getting good grades can open financial opportunities.” Aside from financial opportunities, earning good grades can score you other perks such as good-student discounts on auto insurance, which can be particularly high for young adults.

16. Live Below Your Means

Even though living the frugal life might not be the most fun in college, it will help you in the long run to financial freedom. To do this, CPA and columnist for Inc., Paul Sundin, recommends that you try to save 10% of your income.

Another popular budgeting method is the 50-30-20 rule — this rule, popularized by Sen. Elizabeth Warren, breaks down your finances in a manageable way. According to the rule, you spend 50% of your income for needs, 30% for wants and 20% to go toward savings and debt.

To keep your living costs low, consider getting roommates and spliting the monthly bills. You can also select off-campus housing which may be cheaper and opt for a basic apartment without a lot of bells and whistles like fancy upgrades such as a pool or clubhouse. Use public transportation if it’s available to cut down on gas and purchase new items when they’re on sale.

17. Learn How To Cook

Although many blogs have famously challenged the idea that cooking is cheaper than eating out, Perez said that if you do it right, you can cook delicious — and likely, healthier — meals compared with what you can get if you eat out.

In addition, cooking your own meals puts money back into your pocket. For instance, if you usually spend $15 on lunch every weekday, you can potentially save $300 per month. There are several free resources to help you learn how to cook quick, affordable, and delicious meals whether it’s recipes to pin on Pinterest or YouTube videos that serve as a guide.

Trending Now: Here’s the Salary Needed to Actually Take Home $100K in Every State

18. Work

Whether it’s a summer job or a part-time gig during the school year, working is a surefire way to help yourself stay within budget. “As much fun as it is laying by the pool, visiting local hotspots and touring the summer music scene, saving up your money during the summer can help you build your nest egg for the school year,” said Sherin. Working also does double duty: You can’t spend money while earning it.

But be sure to save a portion of the money you’re earning, such as 10%, to serve as a cash cushion when you need it.

19. Consolidate Your Streaming Platforms

With so many TV streaming options available ranging from Netflix and Hulu to Peacock, Max and Disney Plus, it’s easy to subscribe to multiple services that can add up quickly. Instead, choose one or two and stick with them – you’ll still have plenty of content to keep you entertained and you can always cancel a service before adding a new one if you’d like to swtich things up.

Another option is to share services with friends. The monthly price will be a little higher to add more user profiles and screens to your plan, but you can divvy up the cost so you may end up spending less overall.

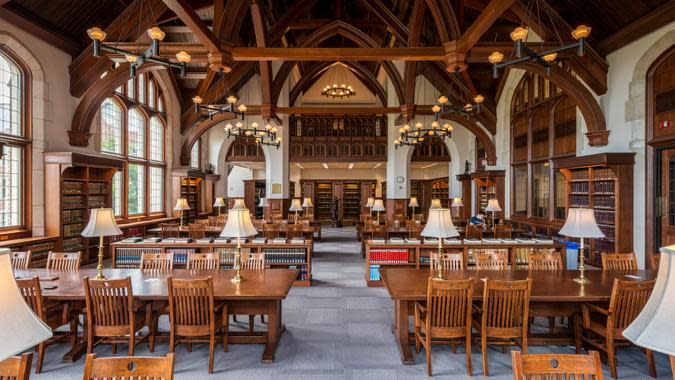

20. Make Use of Your School’s Amenities

Your tuition fees often include access to campus resources, such as the library, writing center, and career services. Take advantage of these amenities instead of paying for external services. Your school may also provide free access to a gym or health center, nutrition coaching, legal expert advice, and academic support services that you can utilize to save money.

21. Become a Resident Advisor

If you’re an upperclassman, consider becoming a resident adviser. An RA provides peer-to-peer advice for fellow, younger or newer students in dorms and residence halls. As an RA, you’ll help build a sense of community, answer students’ questions and more. Being an RA can pay off in a lot of ways: It looks good on your resume, it gives you real-world managing experience, and many universities compensate you with free room and board or other perks.

More From GOBankingRates

Taylor Bell contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: 21 Budgeting Tips for College Students