Decline in Oil Could Cost OPEC $257 Billion in 2015

Falling oil prices are giving a huge boost to the U.S. economy just in time for the holidays, and the reprieve from high gas prices doesn't look like it will stop anytime soon. But elsewhere around the world, the drop in oil might not be looked upon so kindly.

Most of OPEC's 12 member countries rely on oil as a major source of revenue, not only supporting their domestic economies but also balancing national budgets. The amount of potential revenue they've lost as crude oil prices have fallen is staggering.

OPEC's Mounting Revenue Losses

If you're a country like Saudi Arabia, Kuwait or Iraq, which rely on oil as a major revenue source, the drop in oil prices can impact your country dramatically. The U.S. Energy Information Administration just estimated that next year's OPEC oil export revenue (excluding Iran) will drop an incredible $257 billion to $446 billion. That's off its peak of nearly $900 billion in 2012.

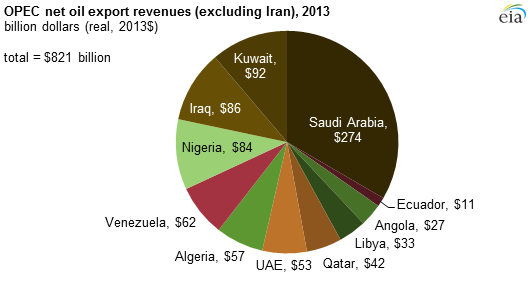

The chart above shows the scale of OPEC's potential revenue drop and the chart below shows who has the most at stake. Interestingly, Saudi Arabia is leading the charge against cutting OPEC's production, which is keeping oil prices low, despite having the most money at stake. The reason may be a long-term need for greater market share in the oil market.

The Only Way for OPEC to Fix the Problem

OPEC is really stuck between a rock and a hard place when it comes to oil prices. If it cuts production, this could raise prices temporarily, but producers in the U.S. and around the world would go back to drilling as they've done in the last few years, and long-term, OPEC would lose market share and power.

The other option is to stay the course and try to get U.S. shale producers, Russia, and other marginal producers to give up drilling new wells, maintaining OPEC's market share long-term. This is short-term pain for a long-term gain, but not all OPEC suppliers can withstand low oil prices for long.

Venezuela, Iraq, and Ecuador rely on high oil revenues to fund their governments, and low oil prices could increase instability in those regions. All three were running fiscal deficits in 2013, so 2015 will be a terrible year if prices stay low. Fiscal deficits can increase borrowing costs and lead to inflation, among other negative side effects, some of which we've already seen in Venezuela.

OPEC Has a Lot to Lose

The biggest problem for OPEC is that most of its members are reliant on oil for revenue to keep their countries afloat. They haven't diversified into becoming industrialized nations, which could ease the pain of lower oil prices.

In fact, the U.S. actually has more at stake with oil prices on an absolute basis. It's the largest oil supplier in the world, recently overtaking Saudi Arabia and Russia. But the U.S. economy is very diverse and flexible, so while oil's plunge will be felt in states like North Dakota and Texas, it won't send the economy into a tailspin.

In the U.S., money will shift from one part of the economy to another, but OPEC's $257 billion in potential lost revenues in 2015 alone is staggering, and shows just what the oil cartel is facing if they don't cut production. That's what being reliant on oil can cost you, and when the boom times are over they can end quickly -- which OPEC is finding out the hard way.

Travis Hoium is a Motley Fool contributor. Try any of our Foolish newsletter services free for 30 days. What will the new year bring for your portfolio? Check out our free report on one great stock to buy for 2015 and beyond.