Is the Nasdaq Due For a Huge Drop?

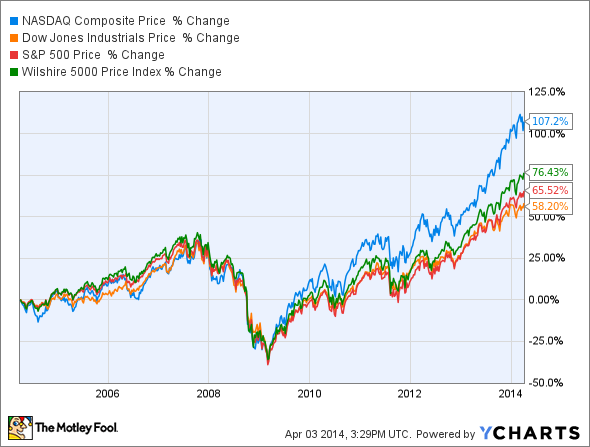

The Nasdaq Composite has absolutely crushed the broader market for a long, long time. It doesn't matter if you compare it to the Dow Jones Industrial Average blue-chip index or the wider net of the S&P 500 , or even the total market tracker of the Wilshire 5000 index -- the Nasdaq is stomping them all.

It doesn't even matter much how you set the parameters of your analysis. The Nasdaq more than doubled the Dow's returns over the past year:

... trounced the blue-chip tracker by 54% over five years ...

... and doubled in a decade while the Dow only gained 58%. The S&P 500 tracks close to the Dow here at a 65.5% gain:

However, most of the tech-heavy Nasdaq's gains came over the last four years. Take that period out of the equation, and the six years between 2004 and 2010 delivered a far closer four-way race:

Some market watchers would say that the Nasdaq surge must end -- and badly. In this view, the index is due, or maybe overdue, for a massive correction. To get back in line with the long-term performances of the Dow and the S&P 500, the Nasdaq might need to shed about half of its value.

This argument makes sense at first blush. After all, why would one segment of the stock market soar so high above the other tickers? There must be something fundamentally wrong here, and tech stocks are always overheated anyway!

Right?

But then you're ignoring the fact that the Nasdaq index actually is a fundamentally different beast than the other major market trackers.

Nasdaq is a far more international index than its closest cousins.The Nasdaq Composite Index tracks every stock listed on the Nasdaq Stock Market. That's 2,812 tickers today. Of these companies, 673, or 24%, are headquartered outside U.S. borders. By comparison, only 4% of the S&P 500 companies are based abroad, and none of the 30 Dow Jones stocks.

Collecting every Nasdaq stock in one index is a much simpler and less subjective process than the hand-picked nature of the S&P 500 and the Dow. There's a selection bias built into those two indices, and the Dow's smaller tracking portfolio magnifies the bias.

And, of course, the tech industry is overrepresented on the Nasdaq. People may be created equal, but that's not true for companies, stocks, or market sectors. If the tech industry is outperforming other sectors in real-world business terms, it's only fair to see the associated market index skyrocket as well.

All three of these fundamental differences can move the Nasdaq in a different direction than its peers. And at least two of the three contrasts seem to work in the Nasdaq's favor.

America's gross domestic product rarely outgrows India or China, or even Europe as a whole. So having a larger proportion of index components anchored to faster-growing economies abroad should be a genuine performance booster.

As for industry differences, the U.S. information technology sector grew revenue by 8.3% a year over the last five years. Meanwhile, adjusted earnings increased 12.5% a year, and cash from operations gained 13.1% annually.

By contrast, the industrial sector delivered just 3.3% revenue growth, 7.6% earnings growth, and 4.9% higher cash flows a year. Utilities -- another underrepresented sector on the Nasdaq -- delivered 10.3% of annual cash flow growth in spite of shrinking earnings and revenues.

I think it's pretty clear that technology businesses are performing better than your average market sector, giving the Nasdaq another respectable tailwind.

The big takeaway

So, with all of these factors in mind, is the Nasdaq index due for a big correction?

I don't think so. I believe that the tech-heavy Nasdaq will instead continue to outperform other stock market indices in the long run.

My personal portfolio reflects this attitude in a big way, with over 80% of holdings loosely belonging in the tech sector.

Every investor is different, and your needs might not match mine. But if you're relatively young, not scared of some short-term risk in exchange for potentially huge long-term gains, and generally agree with my analysis of the Nasdaq index, you might want to take a closer look at Nasdaq stocks as well.

There's a lot to love here.

3 stocks poised to help you retire rich

Diving into the best market sector is just the start of a successful investing strategy. It's no secret that investors tend to be impatient with the market, but the best investment strategy is to buy shares in solid businesses and keep them for the long term. In the special free report "3 Stocks That Will Help You Retire Rich," The Motley Fool shares investment ideas and strategies that could help you build wealth for years to come. Click here to grab your free copy today.

The article Is the Nasdaq Due For a Huge Drop? originally appeared on Fool.com.

Anders Bylund has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.